But, there are alternatives for

those that need to use a lot of data.

Sprint’s prepaid international roaming

plans, for instance, offer 3G speeds at

reasonable day rates: $15 for a one-

day pass and 100MB of data; $25 for

200MB over seven days; or $50 for

500MB for 14 days.

Sprint’s not alone in zeroing in

on international roaming as a dif-

ferentiator. T-Mobile has rolled out

an “un-carrier” offering of no an-

nual contracts, overages or interna-

tional roaming fees for enterprise

users, available via its channel

partner program.

The company recently launched Un-Carrier 9.0, or

Un-Carrier for Business, in which it promises a “radically

new level of transparency, simplicity and value – and

upending how business buys wireless.”

The carrier said that the average American business

can save more than $5,100 on 20 lines over two years.

“We’re going to do for businesses what we’ve already

been doing for consumers,” said John Legere, T-Mobile’s

president and CEO. “Eliminate pain points and force

change. The majority of U.S. businesses – a full 99.7

percent – have less than 500 employees and don’t have

the money or resources to waste debating, negotiating

and deciphering the carriers’ hidden pricing.”

Google’s Project Fi, its mobile virtual network op-

erator (MVNO) play, also aims to shake up the roaming

world. For one, the service, when launched, will allow

users to pay only for the data they use, anywhere in

the world.

IDC analysts Brian Haven and Carrie MacGillivray

wrote in a research note that Google is banking on in-

dustry disruption, enabling seamless handoff between

cellular and “a million free, open Wi-Fi hotspots,” even

though at launch, Google is offering just one device.

“Project Fi could be concerning for all mobile opera-

tors – in particular AT&T and Verizon,” they wrote. “Google

represents the third platform in its truest sense, and is

infringing on the mobile operators’ turf by riding on bor-

rowed (read: wholesaled) access. With this offering, Google

is essentially relegating the cellular network to a pipeline

for which to deliver its product, similar to what OTT [over-

the-top] providers like Netflix and HBO Go have done to

traditional broadband providers. If Google can achieve

some meaningful scale, it could significantly disrupt the

market, and this business model could emerge as an alter-

native to the way that consumers traditionally subscribe

to wireless service. The question is whether or not Google

will try to achieve this scale – as scale is limited by the one

device offered, Google Nexus 6.”

Gene Munster, a financial analyst with Piper Jaffray,

put it more simply: Google’s Project Fi is an effort to

“motivate other wireless providers to provide cheap

wireless service that will basically make it easier for us

to consume more data.” And data (and the advertising

that comes with it) is after all the business that Google

is really in.

Again though, channel partners putting together

wireless strategies for their customers would do well to

examine the fine print.

“The main thing that strikes me is that it’s not espe-

cially cheap,” said Dean Bubley of Disruptive Analysis.

“Yes, $20 per month is a good headline price for U.S.

consumers who have a major-operator plan today, but

$10 per GB isn’t really that good a deal, unless you’re

a mostly Wi-Fi user who just needs a bit of cellular data

for maps and emails when you’re out and about.”

International, though, could be its ticket. Google

said that it will offer wireless roaming in 120-plus coun-

tries without charging roaming fees. It will cost $20 a

month for unlimited talk/text around the world and $10

per 1GB of global data – because thanks to a deal with

Hong Kong-based Hutchison Whampoa, U.S. customers

will be able to travel across international markets for

free. The arrangement includes roaming on Hutchison’s

three operations in the United Kingdom, Ireland, Italy

and other markets around the world.

“If this is going to be a unique software/hardware ori-

ented experience, Google could take a stab at improving

the experience for users when calling internationally or

when traveling,” Lowenstein said.

There’s also the old-fashioned way to avoid roaming

fees: buy a local SIM card in the country you’re travel-

ing to. Agents can often strike bulk wholesale deals

with overseas distributors in popular markets such as

the UK or Mexico. Users simply swap out their SIM

cards inside the device. As Lowenstein pointed out,

this can be confusing for end users. But, agents can

help users determine whether CDMA or GSM is the

compatible way to go.

Of course, for those businesspeople traveling to a

number of countries on a regular basis, the home car-

rier’s roaming plan may actually be the optimal choice.

Again, a channel partner has an opportunity here to

play a consultative role.

INTERNATIONAL AGENTs

SECTION

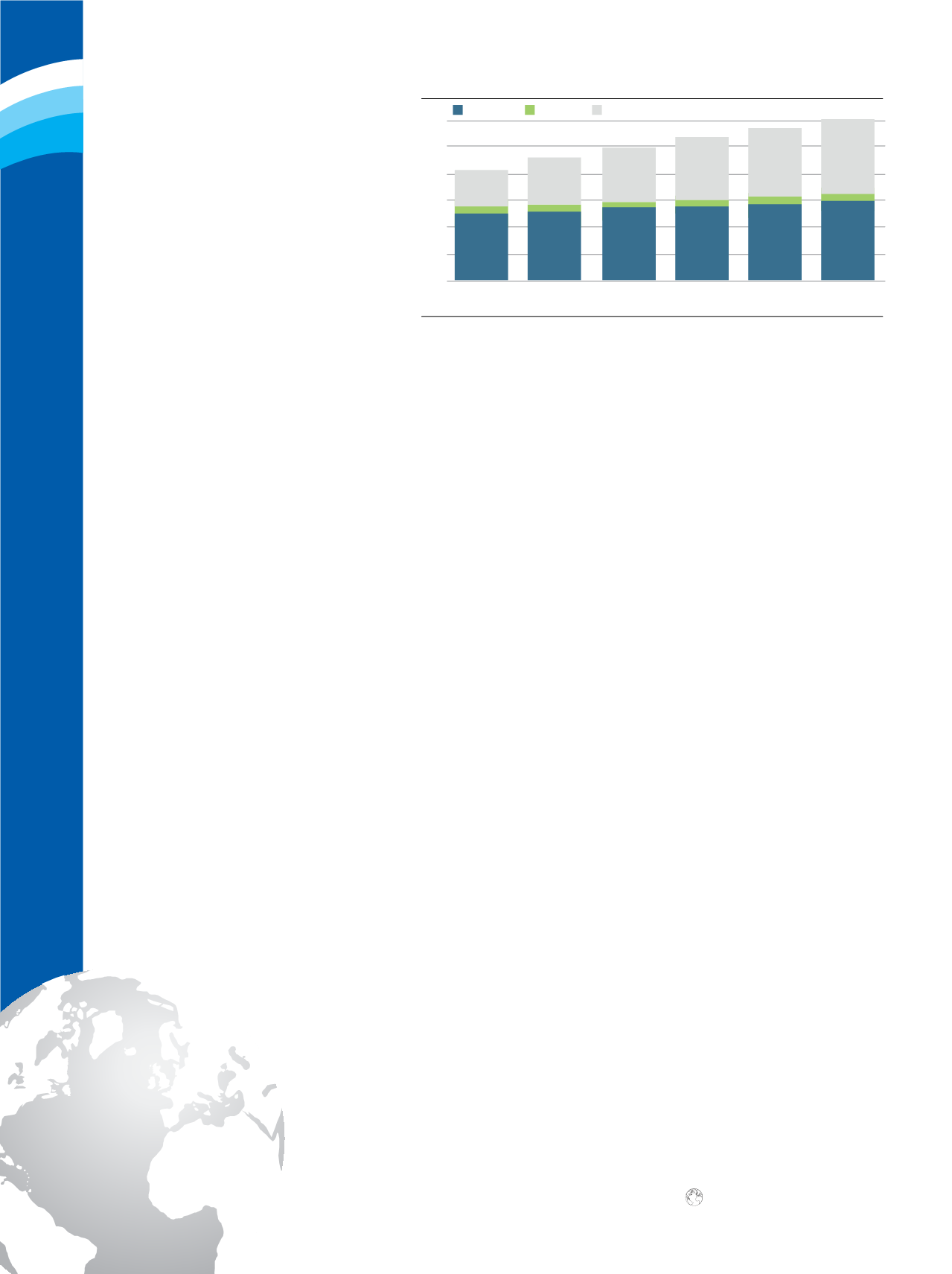

Source: Informa Telecoms and Media, 2013

Global Roaming Revenues, 2011-2016

41.9

46.2

50.1

53.6 56.9

59.9

2011

2012

2013

2014

2015

2016

60

50

40

30

20

10

0

Revenue (US$ bil.)

Voice

SMS Data

20

Channel

Vision

|

May - June 2015