EMERGENT

to BCG. The firm found that the 10

most valuable use cases include

the ability to use sensors to predict

when machinery will need to be re-

paired, self-optimizing production,

automated inventory management,

remote patient monitoring, smart

meters, track and trace, connected

cards, distributed generation and

storage, fleet management and de-

mand response.

Networks are shifting to accom-

modate this. For instance, technol-

ogy in transport is shifting from

legacy systems to scalable LAN and

WLAN IP solutions, and the market

is starting to see the rise of hard-

ened network components that can

support the transition to Intelligent

Transportation Systems.

Scenting this opportunity, ALE,

operating under the Alcatel-Lucent

Enterprise brand, recently an-

nounced the appointment of Lisa

Simpson as vice president of chan-

nel sales and distribution strategy in

North America. Simpson will be re-

sponsible for driving revenue growth

in the channel by expanding the

company’s North American reseller

and distributor base, and developing

new opportunities to support part-

ners in key vertical markets, in par-

ticular in education and transport.

“Lisa’s appointment reinforces

our commitment to business growth

through the channel and support for

our customers in North America’s

vertical markets,” said Charles Mat-

thews, senior vice president for

North America at ALE. “In this new

position, Lisa will use her skills and

experience to grow sustainable reve-

nue for ALE through the channel and

develop a collaborative knowledge-

sharing environment where ALE

and its partners can meet the digital

transformation needs of customers.”

Mobile Carrier Plays

Not to be outdone, mobile car-

riers are embracing the industrial

opportunity as well, thanks to new

standards work in LTE. This too will

open up new revenue avenues for

channel partners.

With rollouts expected to start in

the late 2017/early 2018 time frame,

full advanced LTE implementations

are expected by 2022 in most mar-

kets, with 5G standards starting to

shake out about then.

5G, which will encompass

multiple networks, including LTE,

small cells, and Wi-Fi and other

unlicensed spectrum technolo-

gies, will provide 1,000 times the

current available capacity, with

links capable of offering a fiber-

like 1Gbps throughput. This is a

dream for supporting the industrial

internet, but the logistics have a

long way to go: This vision will

require 10 times the cell sites that

exist today, and 10 times the spec-

trum, making for a big expansion

of operators’ spectral holdings

in both licensed and unlicensed

frequencies (and a great deal of

future regulatory debate). Getting

there will also take at least a 10X

improvement in spectral efficiency

thanks to better radio interfaces

and core networks.

Suffice it to say that achieving the

5G vision will require a significant re-

architecting and densification of the

network as we know it today.

But there’s the next genera-

tion of LTE standards, beginning

with release 13, that will offer an

initial path to an entirely new value

proposition for mobile operators and

channel partners alike, well ahead

of 5G becoming a reality.

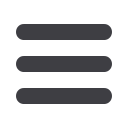

Estimated Global loT Device Installed Base

Source: Business Insider

Overall Skills Gap

How import

cloud strat

and public

How will yo

over the ne

Source: CompTIA, survey of

Source: Business Insider

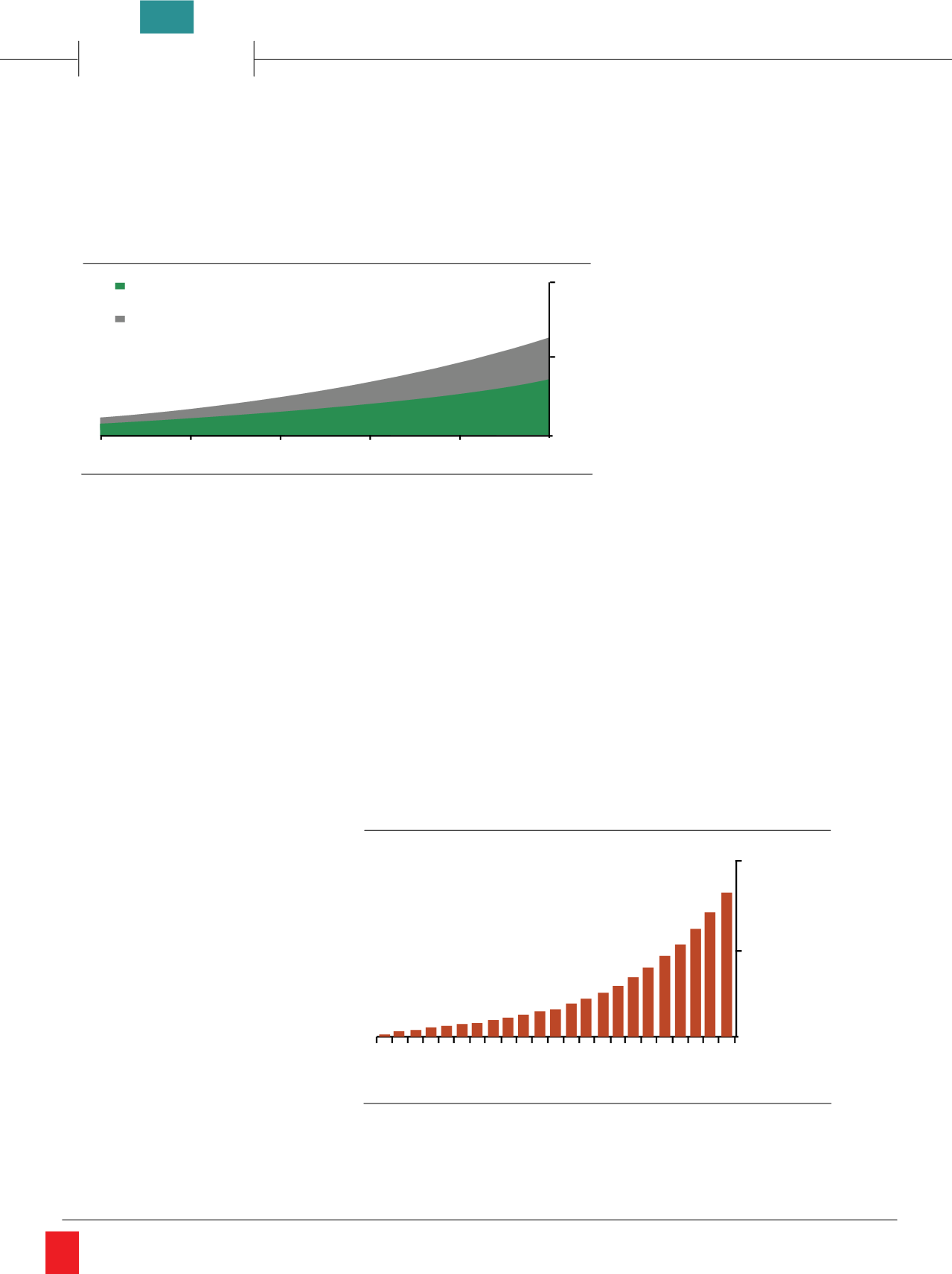

Agricultural Companies Are Using Sensors to Collect Data

for Precision Farming

Estimated Amount of Data Generated by the Average

Connected Farm

5G Upgrade Drivers: Us Cases, per Mobile Service Providers

Enterprise loT Devices

Government loT Devices

Installed Devices (Billions)

2015E

2016E

2017E

2018E

2019E

2020E

30

15

0

2034E

2032E

2030E

2028E

2026E

2024E

2022E

2020E

2018E

2016E

2014E

5,000,000

2,500,000

0

Data Points Generated Per Day

loT

HD and UHD video services

Fast r broadband internet

Real time gaming

AR/VR

Tactile low latency touch and steer

Factory automation

Medical emergency situations

Autonomous driving

79%

75%

71%

63%

58%

58%

58%

50%

33%

Use Cases

Nearly half believe the ski

13%

33%

Growing

significantly

Growing

moderately c

21%

25%

35%

What perce

Estimated Global loT Device Installed Base

Source: Business Insider

Source: Business Insider

Agricultural Companies Are Using Sensors to Collect Data

for Precision Farming

Estimated Amount of Data Generated by the Average

Connected Farm

5G Upgrade Drivers: Use Cases, per Mobile Service Providers

Enterprise loT Devices

Government loT Devices

Installed Devices (Billions)

2015E

2016E

2017E

2018E

2019E

2020E

30

15

0

2034E

2032E

2030E

2028E

2026E

2024E

2022E

2020E

2018E

2016E

2014E

5,000,000

2,500,000

0

Data Points Generated Per Day

Channel

Vision

|

July - August, 2017

14