T-Mobile’s licensed spectrum, while

maintaining LTE sessions.

“LTE-U allows wireless providers

to deliver mobile data traffic using un-

licensed spectrum while sharing the

road, so to speak, with Wi-Fi,” said FCC

Chairman Ajit Pai.

Some will quickly point out that

smartphones and other computing

devices have been able to use Wi-Fi

in the past, so some degree of virtu-

alization already has become com-

monplace. What is new, with LTE-U, is

that the network and devices will treat

some specific blocks of Wi-Fi spec-

trum as though they are part of the

capacity the phones can use when on

the mobile network.

Think of the concept of “convergence”

as the difference, even if virtualization also

is a feature of smartphone use of Wi-Fi.

In the past, devices could use either

Wi-Fi or the mobile network, or both, in

turn. With LTE-U, devices simply use all

the authorized capacity as one seam-

less resource. In other words, both

mobile licensed spectrum assets and

unlicensed Wi-Fi assets are virtually

parts of one network.

Nor are virtualized mobile access

networks the only ways virtualiza-

tion will occur. A similar virtualized

method of “creating” and managing

discrete core networks also will be

fundamental for future mobile and

fixed networks.

Based on core network virtualiza-

tion of several types, the new thinking

is that core networks built on network

functions virtualization (NFV) will under-

pin the more-flexible applications and

use cases 5G will enable.

Some potential applications – such

as connected car and autonomous

vehicles – will require very-low-latency

from the network, beyond that provided

by 2G, 3G or 4G. Other apps might

require lots of bandwidth, as for vision

capabilities (traffic cameras, vehicle

cameras, visual security apps, medical

diagnosis). Many other sensor apps,

on the other hand, will not use much

bandwidth at all (kilobits per second,

infrequently), and might be located in

hard-to-reach places.

Virtualizing the network helps be-

cause it will be possible to affordably

and quickly create specialized sub-

networks that have the precise sets of

features needed by the different apps,

users and industries.

Network slicing is a fundamen-

tal building block of the coming 5G

network, and essentially offers the

hope of a flexible network that can be

reconfigured in many ways, to “tune”

the sub-network for the specific re-

quirements of application, device and

network support cases. If latency, but

not bandwidth, is the requirement, a

network slice can be created to sort

that requirement set.

If the requirement is low latency

and visual bandwidth, a different slice

can be provisioned, while if moderate

latency and moderate bandwidth are

the requirements, that can be sup-

ported as well. Likewise, it should be

possible to tune the network over time,

to support demand “hot spots” during a

given day, for example.

Only a virtualized network will

be flexible enough, and controllable

enough, to support network slicing.

So whether at the level of mobile

phone access to core network trans-

port and features, virtualization is

becoming an architectural principle

following the earlier virtualization of

apps and services from physical layer

access and transport.

Now, that trend is spreading to more

parts of the business and will help reshape

business models. The only issue is

“how” the changes will be seen.

o

Source: RAD-INFO INC

Examples of Decli

Source: US Telecom; Well F

Source: Nokia Networks

The Market Seg

Inhibitors to Cloud

Primary Technical Factors Drive Upgrade to 5G

Average Wireless Price per MB

Wi-Fi

Wi-Fi 5GHz

Channel 149

DL

LTE-U 5GHz,

Channel 136, DL

Lic DL

Lic UL

LTE-U

Source: Grandmetric

5G Network

Source: Qualcomm

New Spectrum Sharing Paradigms–Opportunity to Innovate

IoT Sensors

IoT related

business

Internet/Content

Traffic/

Automobile

Mobile Data

Mission Critical

IoT

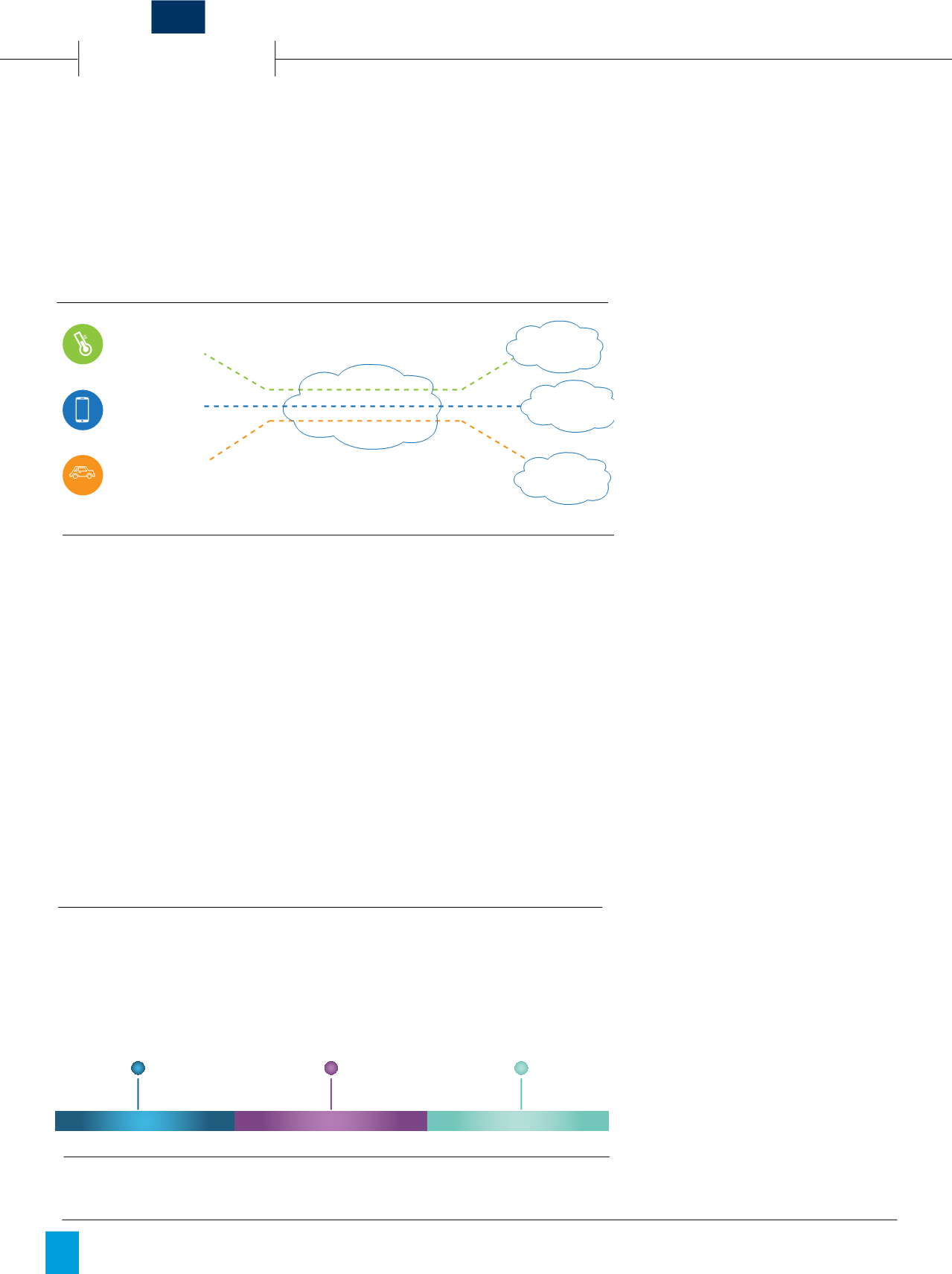

Can enable mo efficient utilization of, and access to, scarce resources

Exc usive use

Example 2.1 GHz

New shared spectrum paradigms

Example 2.3 GHz Europe/3.5 GHz USA

Shared use

Example 2.4 GHz global/5 GHz global

Lic nsed

spectrum

Shared

spectrum

Unlicensed

spectrum

Ultra-low latency

Ultra-high bandwidth

throughput

Increase network capacity

Enabling massive

machine-typecommunication

Ultra-high network

availability

Lower energy consumption

Technical Factors

88%

79%

75%

75%

58%

29%

1-4 e

4-10 e

11-20

21-

51-

$0.08

$0.06

$

$1,515,000

$0.04

$0.02

$0.00

Cl ud T chnologie

Source: BCG

-47

41%

25%

11%

23%

Today

Network

IT infrastructu

ANNUAL IT SPENDING O

Source: Qualcomm

UCaaS Seats Installed with

Source: Synergy; Broadsoft; courtesy RAD

Source: RAD-INFO INC

Examples of Decling Broadb

Source: US Telecom; Well Fargo: Merrill Lyn

Source: Nokia Networks

LTE-U Leve ages Wi-Fi Spectrum

The Market Segments, Pic

Opens up 150 MHz spectrum while incumbents are still using it

Primary Technical Factors Drive Upgrade to 5G

Average Wireless Price per MB

Incumbents are protected

from interference from

PAL and GAA

Tier 1

Incumbents

Tier 2

Priority Acces

Licenses (PAL)

Tier 3

General Authorized

Access (GAA)

PAL has priority over GAA

licensed via auction, 10 MHz

blocks, up to 7 licenses

GAA can use any spectrum

not used, yields to PAL and

incumbents

3550

3600

3650

3700 MHz

Navy radar

FSS RX

WISPs

PAL

GAA

Wi-Fi

Wi-Fi 5GHz

Channel 149

DL

LTE-U 5GHz,

Channel 136, DL

Lic DL

Lic UL

LTE-U

Source: Grandmetric

5G Network

Source: Qualcomm

New Spectrum Sharing Paradigms–Opportunity to Innovate

IoT Sensors

IoT related

business

Internet/Content

Traffic/

Automobile

Mobile Data

Mission Critical

IoT

Can enable more efficient utilization of, and access to, scarce resources

Exclusive use

Example 2.1 GHz

New shared spectrum paradigms

Example 2.3 GHz Europe/3.5 GHz USA

Shared use

Example 2.4 GHz global/5 GHz global

Licensed

spectrum

Shared

spectrum

Unlicensed

spectrum

BroadSoft

Cisco

Metaswitch

RingCentral

8 x 8

Genband

Mitel

ShoreTel

Microsoft

0 2 4 6 8

Q1 16

Q3 16

1-4 employees

4-10 employees

11-20 employees

21-50 emp

51-99 emp

<1

<250 e

$0.08

$0.06

$9.03 per Mbp

$0.07

per MB

2010

$1,515,000

$802

$0.04

$0.02

$0.00

Cloud Technologies Offer Hu

-47%

4

2

1

1

41%

25%

11%

23%

ANNUAL IT SPENDING OF A MEDIUM-

Virtual Realities

Channel

Vision

|

March - April, 2017

16