has value, not necessarily the “things”

(decoders, light bulbs and fixtures).

So one way to look at potential

TaaS development in telecom is to

see increasing management of appli-

ances and fixtures necessary to add

more value to the core “communica-

tions” value.

The other way to look at poten-

tial TaaS opportunities is to see that

most of the created value eventually

will come from analytics made pos-

sible by the big data gathered by the

sensor network and using the com-

munications services. Likewise, in the

“Internet of humans” space, at least a

few mobile service providers will ex-

periment with “mobility as a service,”

where “supplying handsets” becomes

a feature of a communications service

for business customers.

That is another example suggesting

that, if and when TaaS develops, early

traction might come where analytics

drive the new business value, enabled

by a managed offer bundling the sen-

sor network, the communications and

the analytics platform.

Later on, those sorts of

bundled offers might seem

quaint. But in the early go-

ing, it all might seem familiar

enough to ease adoption.

Businesses have an under-

standing of what intercon-

nects, value added resellers

and managed service provid-

ers do. Businesses under-

stand the value of communi-

cations, cloud computing and

business intelligence created

from mountains of raw opera-

tional data.

Mix it all together and you

wind up with TaaS, where it is

not the sensors but the analyt-

ics or the management that

drives the most value.

If you look at today’s con-

sumer Internet ecosystem, or

the business computing eco-

system, to the extent that “val-

ue” correlates with “revenue,”

then most of the revenue will

come from the content (consumer eco-

system) or the applications segment of

the business IT ecosystem.

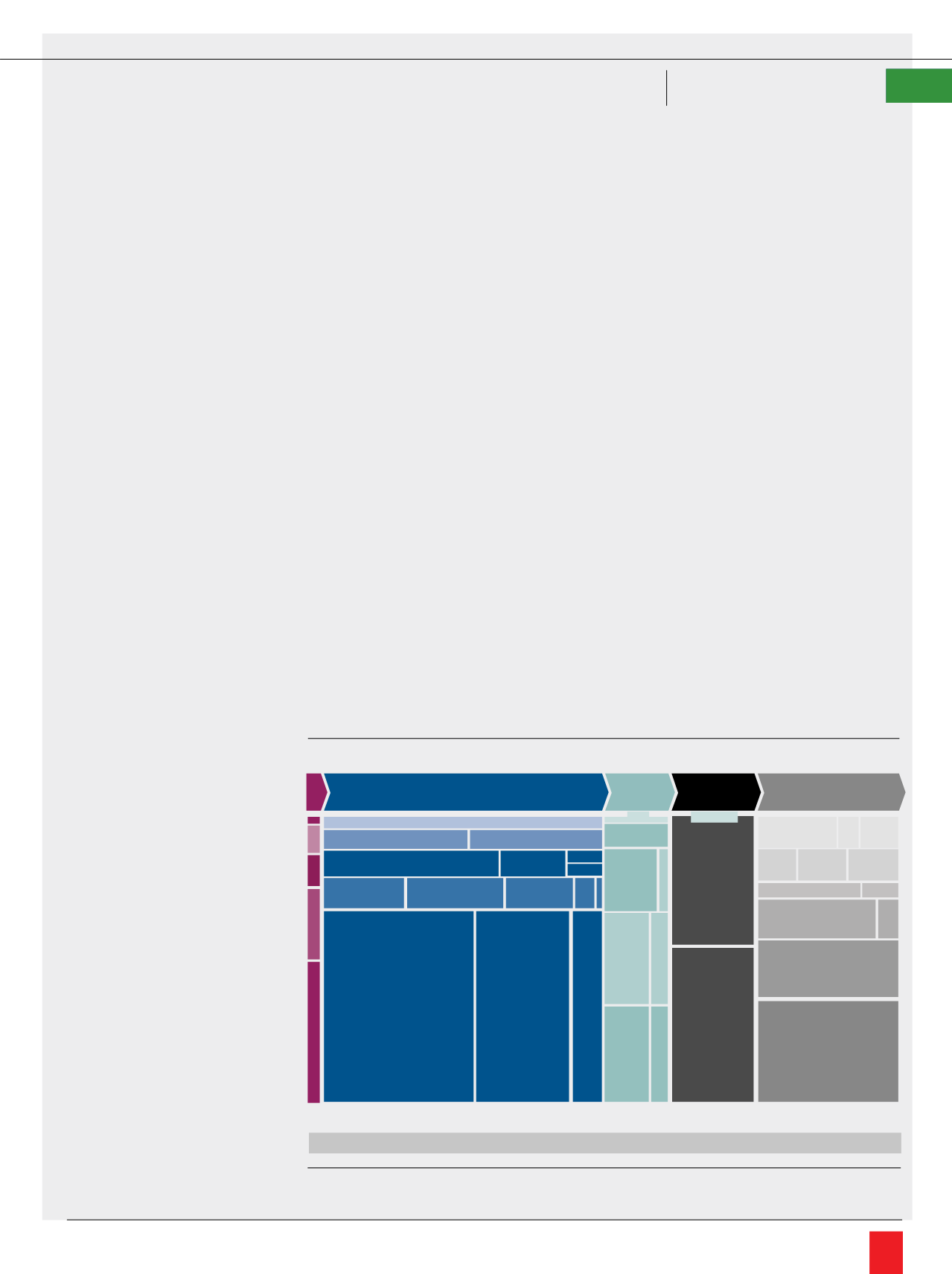

In 2015, for example, the GSMA

estimated the mobile ecosystem at

about $3.5 trillion. About 47 percent

of that was earned by content or

app providers. About 2 percent was

earned by content rights holders.

Roughly 23 percent was earned by

device, other hardware, operating

systems and other software.

Connectivity services represented

about 17 percent of ecosystem reve-

nue, according to GSMA, but other es-

timates assume higher percentages at-

tributable to access providers (perhaps

30 percent in the United Kingdom, as

much as 48 percent in Spain).

TaaS, then, would be part of the ap-

plications market segment, where the

IoT function is functionally a substitute

for 58 percent of the IoT revenue op-

portunity, assuming the Internet eco-

system provides an indicator.

In other words, TaaS should de-

velop as did other XaaS services:

applications, platforms and infrastruc-

ture, with a significant access services

component. It will be easiest for most

access providers to sell connectivity,

as presently is the case.

But as proven to be the case

for leading telecom providers in the

consumer segment of the business,

owning at least some of the applica-

tions delivered over the “dumb pipe” is

the fundamental strategy for dealing

with “commodity” products and reve-

nue streams. In similar fashion, at least

some tier-one access providers will

become owners of TaaS applications,

if not so much providers of platforms

or computing infrastructure, as distinct

from access services.

So sales opportunities for telecom

channel partners are likely to hinge on

the degree to which their underlying

suppliers achieve significant “hori-

zontal” roles in TaaS. In other words,

if app and service providers primarily

target general-purpose TaaS

(Sales- force.comas an example, or hosted

voice, rather than vertical apps target-

ed at industry verticals), the channel

opportunity will be greater.

at your service: Xaas

Source: TeleGeography

Source: Techaisle

Millennials in US Small Businesses (1-99 employ es)

Source: GSMA

Mobile Ecosystem Market Size by Segment and Category

30%

20%

10%

0%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Private Sha

41%

Employees

(weighted data)

35%

IT Decision

Makers

29%

Owners/CEOs/

Presidents

ONLINE SERVICES

OTHER E-SERVICE

OTHER E-SERVICE

SEARCH

PUBLISHING

B

2

C E-RETAIL

B

2

C E-RETAIL

E-TRAVEL

GAMING CAMPING

VIDEO

OTHER E-SERVICE

CONNECTIVITY USER INTERFACE

ENABLING

TECHNOLOGY

AND SERVICES

SOCIAL AND

COMMUNITY

PAYMENT

PLATFORMS

TOTAL MARKET = $3,463 BILLION

OPERATING

SYSTEMS

APP

STORES

MUSIC

SECURITY

AND

SOFTWARE

CONSOLES

TABLETS

SMART TVs

PCs

SMARTPHONES

STBs

AND

DMRs

WEARABLES

OTHER

SMART

ITEMS

OTHER

HARDWARE

FIXED

MOBILE

ADVERTISING

SERVICES

CORE NETWORK

AND INTERCHANGE

DESIGN AND

DEVELOPMENT

WEB HOSTING

AD AGENCIES

CONTENT DELIVERY

AND OPTIMIZATION

IP COMMS

M

2

M

SATELLITE

B2B

COMMS

CR

MUSIC

SPORTS

VIDEO

PUBLISHING

GAMING

64(2%)

1,637(47%)

373 (11%)

577 (17%)

813 (23%)

$ billion, % of total market, 2015

May - June, 2017

|

Channel

Vision

33