22

THE CHANNEL MANAGER’S

PLAYBOOK

What’s happening, in short, is that technology ob-

jectives are becoming more business focused. At least

that is the way things are viewed by 57 percent of busi-

ness units and 48 percent of IT professionals surveyed

by the channel association. Traditionally, IT has been

viewed mostly as operational, where IT is responsible

for keeping business systems up and running. “IT has

always played a support role – the ultimate objective

has always been to support the needs of the business,”

CompTIA researchers explain. But the view of enter-

prise technology is changing in the cloud/mobile era

to a more strategic role. “Rather than simply enabling

goals that the business has already chosen, technology

is tightly integrated with the goals.” In other words, says

CompTIA, the proper use of technology is often required

to aggressively move business goals forward.

In turn, non-IT departments are increasingly involved

in IT planning and purchasing processes.

According to business unit respondents, that in-

cludes 59 percent of finance departments, 47 percent

of marketing departments and 45 percent of both sales

and human resource departments that play a critical

role in technology procurement. What’s more, final deci-

sions on technologies are more frequently being made

by the CEO, says CompTIA, even at large enterprises.

“Smaller technology investments may not rise

to this level of executive approval,” says the Digital

Organization study. “As business systems grow more

complex, though, they will require greater invest-

ment and affect many departments.”

What’s more, a good chunk of business professionals

now see responsibilities once left to IT departments as

being shared responsibilities. For instance, 69 percent of

business professional now say that “understanding techni-

cal details behind business systems” is solely a business

unit responsibility (22 percent) or a shared responsibil-

ity (47 percent). A full 79 percent believe “ensuring that

workforce has the tools they need” is either a business unit

(27 percent) or shared responsibility (52 percent).

“The business side of the organization is helping define

what this dual role should look like,” say CompTIA research-

ers. “Even if business units are not taking over technology

decisions en masse, their growing influence in the process

means that their view of the IT function should be given se-

rious consideration.”

That’s not to suggest solution providers should be

looking to sidestep IT or run the risk of marginalizing its

role. While it’s true business professionals are more aware

of technological capabilities than their predecessors of

decades past, IT still remains in the proverbial driver’s

seat for most companies – a sentiment expressed by 70

percent of the combined IT and business professionals sur-

veyed. It may even be necessary to reconsider how much

of what’s considered “rogue IT” can truly be described as

business users completely “going rogue.”

It’s often assumed that rogue IT budgets exists pri-

marily as a workaround of IT departments that might

move too slowly, fail to grasp strategic needs or simply

function as the “department of no.” While this surely

occurs in some cases, “business units tend to view IT as

a valuable partner rather than a hindrance,” says Comp-

TIA, as just more than half (52 percent) agree there is

Business Education

Technology solution providers have some work to do to

get their messages to business executives who increasingly

control a chunk of companies’ technology budgets. “The IT

channel is not yet playing a major role in educating business

units about available technology,” warns CompTIA in a study

on the emergence of digital organizations.

As might be expected, the primary source of technology

information for business executives is their own personal

research. Internal IT departments also rank high, further

suggesting the influence IT has over spending even when not

directly in control of budgets. Third-party firms, meanwhile,

fall below both business events and technology events as

a source of information, with mid-sized firms (41 percent)

using third-party technology firms for information most often,

compared to 32 percent of large businesses and 27 percent

of small businesses.

Among all firms that look to third-party solution providers

for their tech research, 40 percent utilize firms with an existing

relationship, 26 percent look to new firms and 34 percent use

a combination of the two.

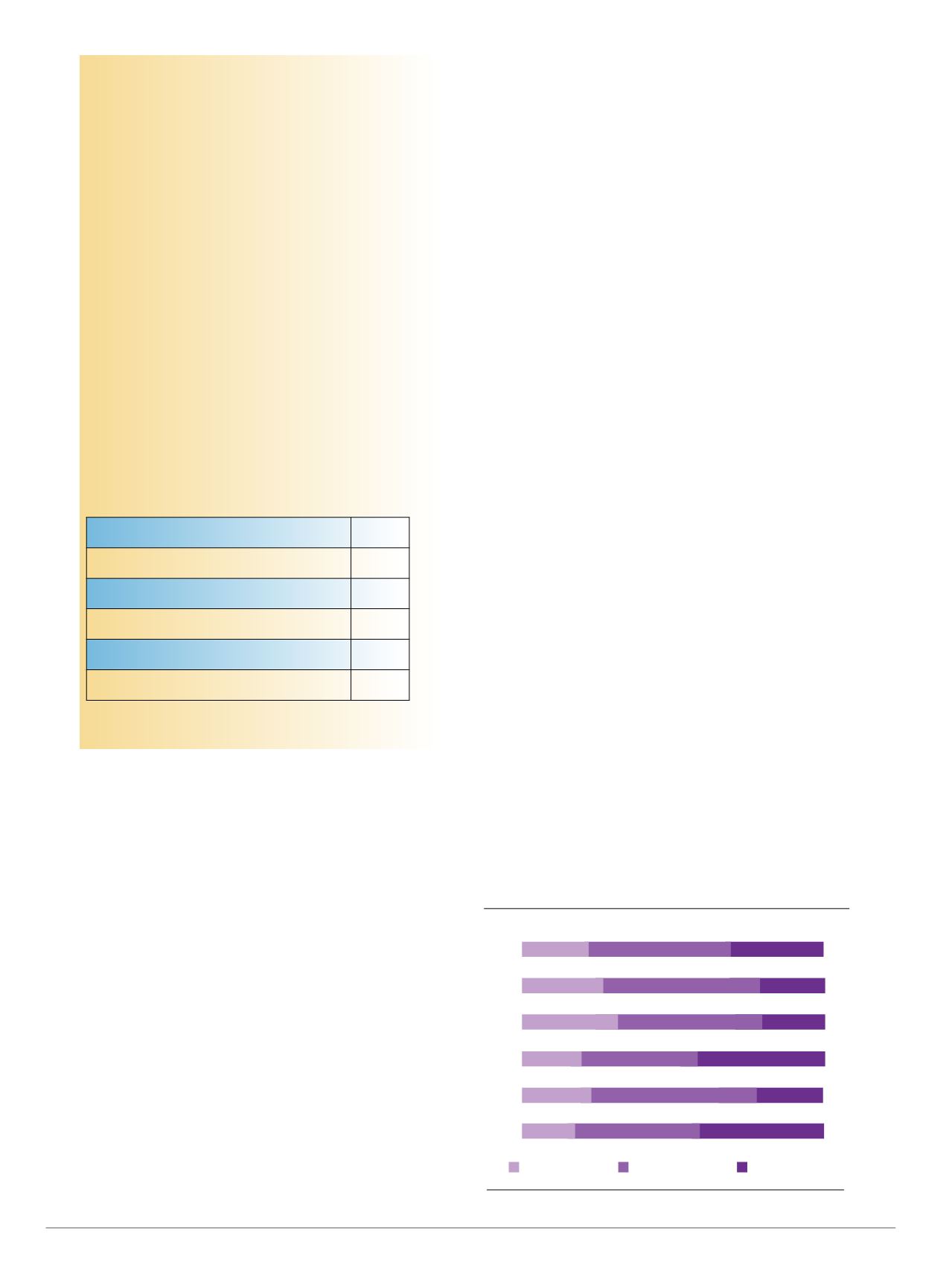

Technology Information Sources for

Business Units

Personal research

53%

Internal IT department

51%

Business events

47%

Technology events

41%

Peers

38%

Third-party firms

34%

Source: CompTIA

Source: ITU

Distribution of Mobile Broadband

Subscriptions, 2015

22%

14%

4%

5%

5%

50%

The Americas (765m)

Europe

(490m)

CIS (490m)

Africa (162m)

Arab States (155m)

Asia & Pacific

(1726m)

Source: CompTIA

Division of Responsibilities in Digital Organizations

Business

Unit Responsibility

Shared Responsibility IT Responsibility

Understanding technical details behind business systems

Ensuring that workforce has the tools they need

Creating business insights from corporate data

Keeping data secure and confidential

Meeting business objectives with technology

Seeking out new forms of technology

31%

47%

22%

22%

52%

27%

22%

47%

32%

43%

39%

19%

22%

55%

23%

41%

42%

17%