Applications and network resourc-

es can be accessed on-demand, and

performance management, security

and routing combine to make it an

effective way to address WAN needs

while harnessing the scalability and

cost effectiveness of the cloud.

According to research firm

Markets-andMarkets, the SD-WAN

market size is estimated to grow from

$738.9 million in 2016 to $9.1 billion

by 2021, at an expected compound

annual growth rate of 65.11 percent

during the forecast period. A rising

need for effective management of

networks and the need for better

security are increasing the demand

for SD-WAN. North America held the

largest market share in 2016. And,

since enterprises are focusing on

improving products and solutions, the

managed services segment is expect-

ed to witness a substantial growth

rate during the forecast period.

“The cloud breaks MPLS,” explained

Kevin Suitor, chief marketing officer

at TeloIP, which offers SD-WAN on a

wholesale basis. “You have a massive

cloud market out there – by 2020, it will

be worth $190 billion – plus there’s a

second massive mega-market behind

it in the Internet of Things. Bil-

lions of devices coming online

will require a different type of

network than what we’ve had

for the last 20 years.”

There’s a bit of a perfect

storm happening when it

comes to enterprise realities.

CFOs are cutting IT budgets

and staff, while deploying

and managing broadband,

MPLS and cloud links re-

mains a complex enterprise.

Meanwhile, emerging unified

communications and col-

laboration apps need voice

and video quality control so

that calls don’t drop out and so video

doesn’t become pixelated.

“If I wrap all of this up, it’s a mas-

sive opportunity for channel partners

looking to get into a managed service

opportunity or to move away from

selling boxes,” Suitor said.

SD-WAN

Opportunities

Shine in 2017

By

Tara

Seals

S

oftware-defined wide area network

are perhaps the hottest market

buzzwords at the moment, and

no wonder: SD-WAN offers multi-location

companies a way to connect their

disparate offices via the cloud, over

simple broadband connections.

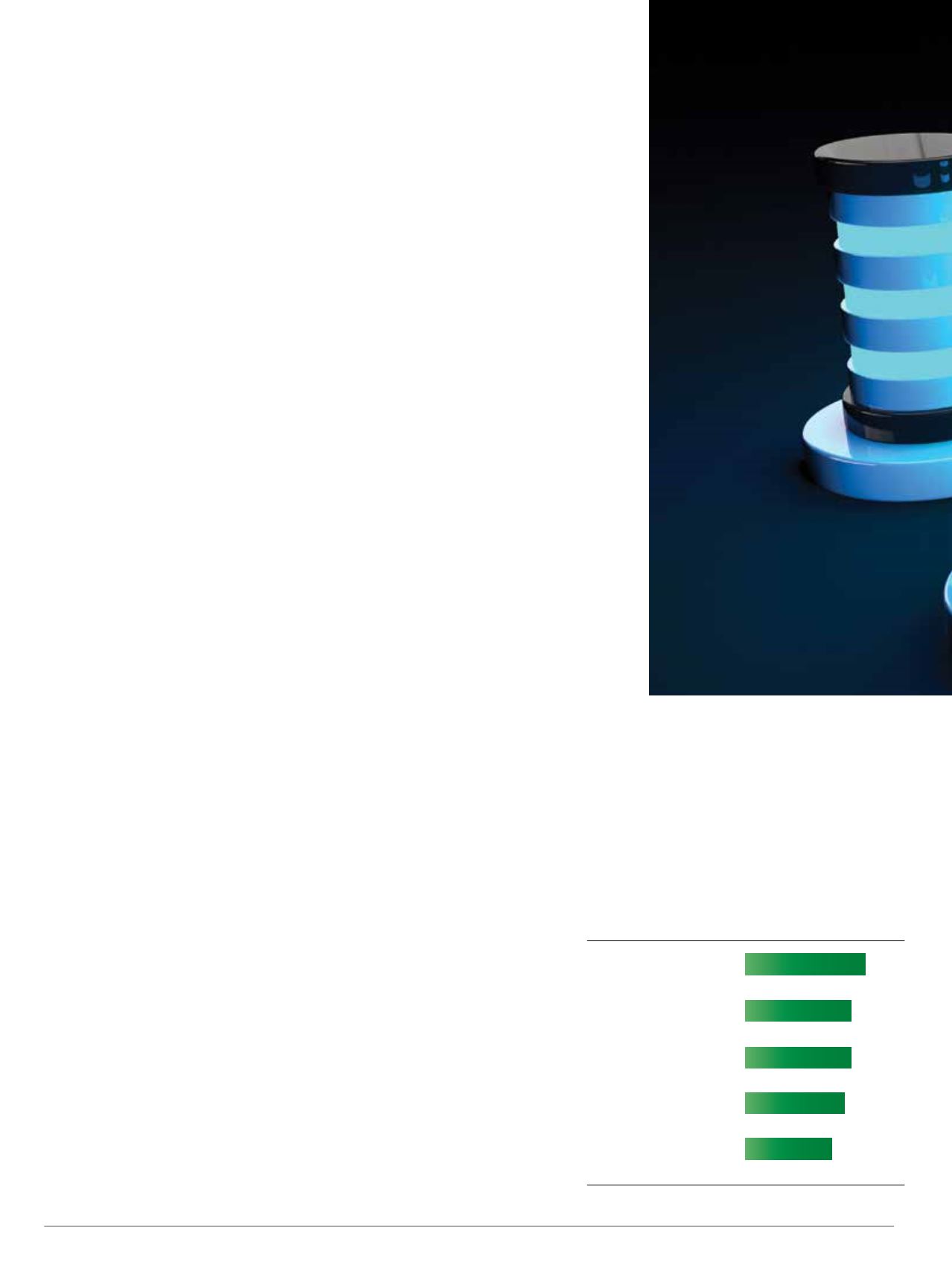

Corporate Software Spending Plans for Next Quarter

Source: 451 Research

What are your organization’s top challeges

in network/WAN management at branch

office locations? (Select all that apply)

Source: Forrester, survey of U.S. network/telecom decision makers

Outsourcing Profile: Data Center Operations

Source: Computer Economics

2015 2016

7.2%

7.3%

loy cloud storage to support

ng on premises?

20% 40% 60% 80%

62%

77%

82%

19%

20%

14%

19%

3%

5%

0%

20%

40%

15% 13%

62% 64%

60%

80%

More Spending

How would you characterize your company’s spending plans for

software over the next 90 days compared to the previous 90 days?

No Change

Frequency

Level

Net Growth

Trend

Volatility

Cost

Success

Service

Success

Low

Moderate

High

Maintaining security across

public and private connections

Managing cost of increased

bandwidth requirements

Ensuring performance of

business-critical applications

Delivering reliable and/or

highly available connectivity

Deploying new applications

and services cost efficiently

55%

50%

49%

46%

40%

10

THE CHANNEL MANAGER’S

PLAYBOOK