create problems, such as expensive per-minute rates and

a lack of routing functionality for calls between locations.

Other buyers work at organizations that are opening new

locations, and want to replace existing systems with a new

one that will be deployed uniformly across the company.

VoIP is helping buyers reduce their overall number of lines.

It allows businesses to provision lines more flexibly, because ser-

vices are priced according to the average number of employees

simultaneously on the phone, as opposed to the total number

of employees. Small businesses with 20 to 49 employees are

making particularly good use of this cost-saving characteristic of

VoIP technology, suggest the findings from Software Advice.

To satisfy this varied slate of requirements, cloud system

adoption is becoming more widespread.

“The adoption rate for cloud systems among small busi-

nesses is nearly even with those for on-premises IP PBX

systems and legacy PBX systems,” Software Advice said in

the report. “Many buyers move to the cloud to save money

and avoid the hassle of updating and maintaining their phone

systems themselves, though some buyers prefer to manage

their own systems and opt for on-premises solutions.”

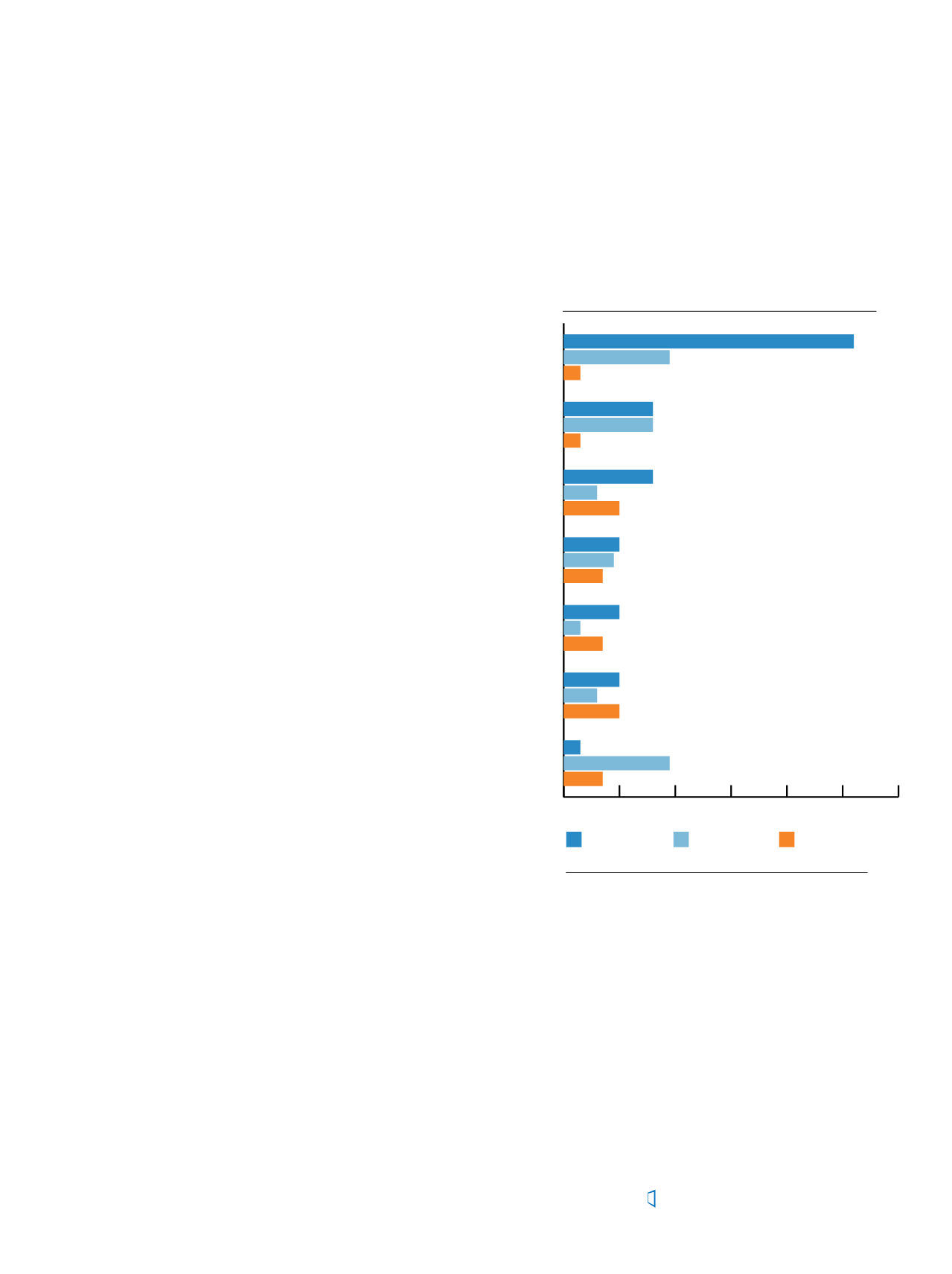

Purchase Drivers

for Small Businesses

Communications needs are one thing, but when it comes

to actually pulling the trigger to purchase technology, the

evolution of VoIP sales has been driven by the organizational

needs of the customer. This trend is most obvious in the

market for UC software.

There are thousands of small business organizations

now looking for the right voice and unified communica-

tions service. In a look at the top purchase drivers shaping

the market, budget, call-quality and uptime issues turn out

to be relatively insignificant, said Software Advice. That

suggests that most buyers looking for VoIP systems al-

ready receive reliable service with satisfactory audio qual-

ity at a decent price.

Instead, the highest percentages of buyers seek new

phone systems because they need a more scalable solution

to accommodate growth (15 percent), or need to replace an

aging system (14 percent).

The vast majority of buyers seeking to replace aging

systems are using legacy PBX systems with PRI (52 percent)

and/or POTS service (36 percent). Almost one-fifth (19

percent) of the buyers in the Software Advice sample report

difficulties with aging on-premises IP PBX systems.

First-generation IP PBX systems from the early 2000s

generally don’t have the dramatic problems that plague aging

legacy PBXs from the late ’80s and ’90s (which lack support,

qualified technicians, replacement parts, etc.). That said,

some buyers still complain that their older on-premises IP

PBX systems don’t offer the functionality of newer ones, and

that they’re more challenging to use.

For instance, one buyer with an on-premises IP PBX

purchased in 2005 complains, “We have an auto-attendant,

but it’s difficult to use. We have remote checking of voice-

mail, too, but it’s difficult to use and program.”

Many businesses also have the need for a centralized

phone-system setup (cited by 7 percent). Some of these buy-

ers work at organizations with multiple locations that each

have their own PBX system. These multi-vendor setups can

create problems, such as expensive per-minute rates and lack

of routing functionality for calls between locations. Other

buyers work at organizations that are opening new locations

and want to replace existing systems with a new one that will

be deployed uniformly across the company.

Also, businesses relying on cellular service run into dif-

ficulties scaling their systems more frequently than other

groups in the sample. This is likely because only 1 percent

use a “virtual number system,” which adds a business line to

users’ personal mobile devices. Businesses relying on cellular

service don’t have a unified phone system, but rather, work

using just a collection of employees’ personal devices. This is

a ripe opportunity for UC.

According to the FCC, 15 percent of all American

businesses have now adopted VoIP and UC. And the Soft-

ware Advice findings indicate that many small businesses

are eager to jump on the bandwagon. Understanding what

motivates buying behavior can be invaluable to capitaliz-

ing on the opportunity.

By Current Phone System Type:

Top Reasons for Evaluating New VoIP

Source: Software Advice

Consumers Expect Multichannel Choices

Consumers who think these channels are important f

0% 10% 20% 30% 40% 50% 60%

Aging system

Lack of call

routing

functionality

Lack of PBX

applications

Difficult to use

Malfunctioning

system

Lack of

scalability

Too expensive

52%

19%

3%

16%

16%

3%

16%

6%

10%

10%

9%

7%

10%

3%

7%

10%

6%

10%

3%

19%

7%

Legacy PBX

On-premises

IP PBX

Cloud PBX

0%

20%

40%

60%

80%

100%

Online

self-service

order

tracking

0800

to

advisors

Online

chat

SMS

/Text

93%93% 88% 87%

70%

81%

61%

67%

53%

46%

Great

38

Channel

Vision

|

May - June 2015