Cyber Patrol

Mobile security is a complicated

area by any gauge. In addition to the

myriad devices, BYOD of those de-

vices and inconsistent user behavior,

there are compliance issues, compli-

cated ecosystems of suppliers and

developers and still-evolving mobile

security policies. Even so, channel

partners’ biggest mobile security

challenge may lie further upstream.

A survey by Samsung and Chan-

nelnomics asked channel solution

providers which area of the mobile

security equation they felt they were

lacking, and the top answer, chosen

by a third of respondents, was “ven-

dor relationships.”

Likewise, when partners were

asked to highlight what they

would like from their vendors to

help them improve the mobile

security offerings they take to

customers, expected answers in-

cluding new and better products,

more training, improved market-

ing efforts and more certifica-

tion were among those listed.

However, the top response, far

and away, was “improved vendor-

partner relationships.”

What’s more, 49.9 percent of

partners said only 10 percent of

vendors offer them everything they

need to effectively manage their

customers’ security.

“Somewhere there is a break-

down in communication – a dis-

connect between security vendors

and their channel partners,” said

the report.

Avnet Introduces

Managed Security

Program

Avnet Technology Solutions recently

launched a managed security service pro-

gram, known as Recon, for its partners

in the U.S. and Canada. The new service

provides partners with a 24x7x365 security

monitoring and management offering for

their customers. Created to enhance part-

ners’ practices and margins in the security

and services markets, the managed security

program can be offered either as a branded

offering through a white-label approach or

as an Avnet-branded service.

Recon can easily bundled with security

technology from leading security compa-

nies, such as Cisco, Checkpoint and F5,

to create holistic security solutions for

customers. It enables partners to access

continuous threat detection and remedia-

tion through a unified security management

system. The service features on-premises

collection, correlation and analysis with

cloud-based monitoring and remediation. It

also includes assessment, discovery and

networking capabilities. Additionally, Recon

provides host-based intrusion detection, file

integrity monitoring, compliance reporting

and vulnerability assessment options.

“Threat monitoring and detection is one

of the most in-demand aspects of security

among end users. However, offering these

types of services in-house is a personnel-

and resource-intensive proposition,” said

Alex Ryals, vice president of security and net-

working solutions for Avnet Americas. “With

Recon, we have invested on our partners’

behalf to give them a way to monitor their

customers’ security environments without

draining their resources. This provides part-

ners with a critical element in being able to

offer truly comprehensive security solutions.”

Avent says its partners will be able to

engage dedicated solutions specialists to de-

velop complete security solutions and draw

upon a wide range of complementary secu-

rity offerings, such as deployment and inte-

gration services, activity monitoring, DDoS

protection and penetration tests. Avnet also

provides expertise in related technology

market segments, including cloud, cognitive

computing, data analytics, data center, IoT,

mobility and enterprise networking.

$10.8

Billion

Expected size of the global

network security appliance

and software market by 2020,

according to IHS Markit

forecasts, with it driven largely

by virtualization and cloud

enablement.

Source: IHS Markit

Global Port Revenue, 1G - 100G

Source: Samsung; Channelnomics

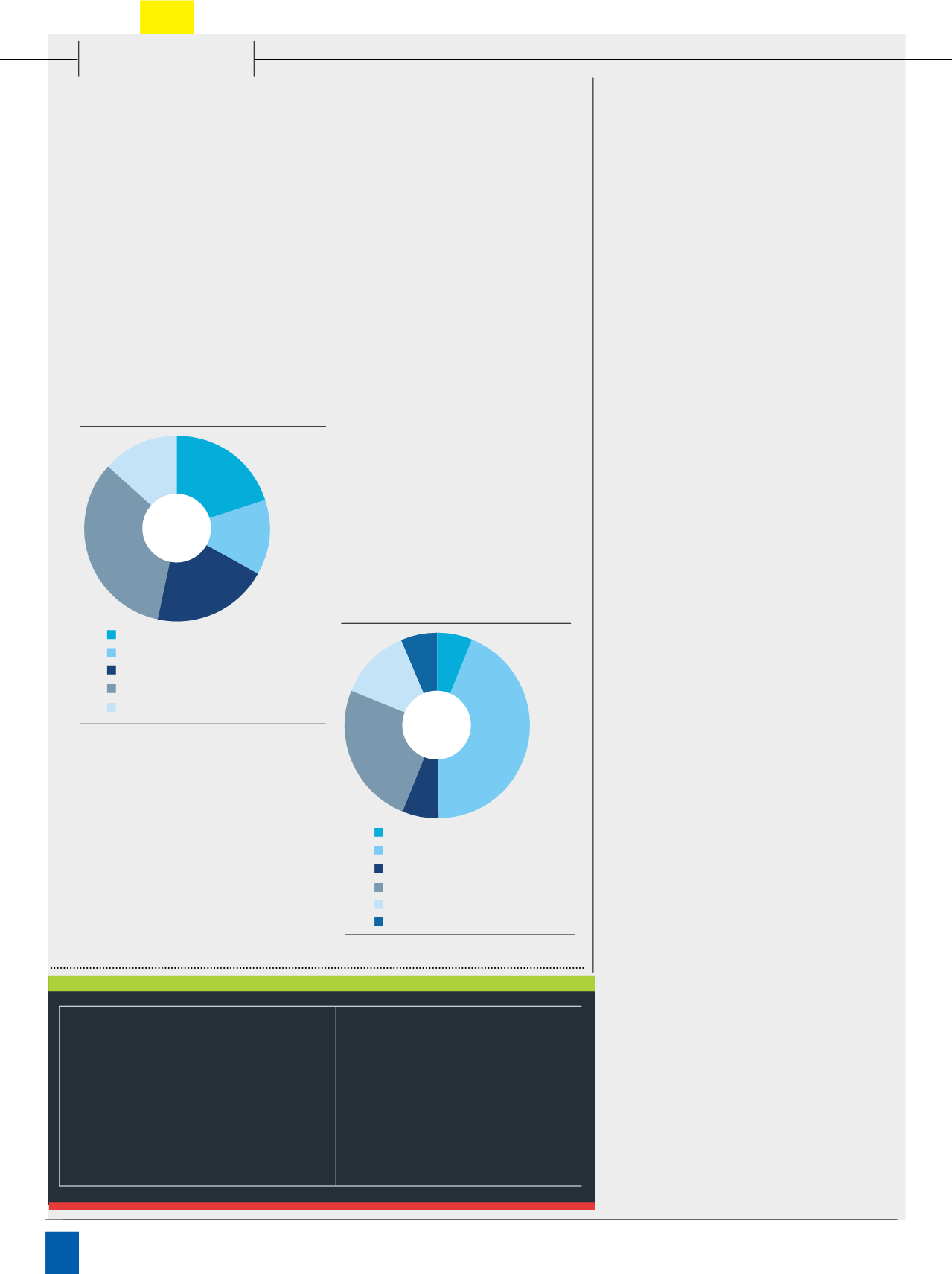

Which area of mobile security

do you think you are

lacking in?

What would you like from your

vendor to help you improve

your mobile security offering?

13.3%

20.0%

13.3%

33.3%

Source: Samsung; Channelnomics

$60

$50

$40

$30

$20

$10

$0

2015 2016 2017 2018 2019 2020

1G 2.5G 10G 25G 40G 100G

US$ Billions

Source: Unify Square

Daily Usage of U

12.5%

43.7%

25.0%

6.3%

6.3% 6.3%

Software offerings

Hardware offerings

Services

Vendor relationships

Knowledge

More training

Improved vendor-partner relationships

More certifications

Different/better product

Better marketing

Other

20.0%

lobal hosted hosted VoIP and UC seats

ill pass the 70 million mark in 2020

$6,000

$8,000

10,000

12,000

14,000

40

50

60

70

80

l Seats (Millions)

0% 10% 2

Desktop

Sharing

Video

Conferencing

& Voice

Instant

Messaging

Source: IHS Markit

Source: Samsung; Channelnomics

Which area of mobile security

do you think you are

lacking in?

What would you like from your

vendor to help you improve

your mobile security offering?

13.3%

20.0%

13.3%

33.3%

Source: Samsung; Channelnomics

$30

$20

$10

$0

2015 2016 2017 2018 2019 2020

1G 2.5G 10G 25G 40G 100G

US$ Billio

Source: Unif

12.5%

43.7%

25.0%

6.3%

6.3% 6.3%

Software offerings

Hardware offerings

Services

Vendor relationships

Knowledge

More training

Improved vendor-partner relationships

More certifications

Different/better product

Better marketing

Other

20.0%

Source: IHS Markit

Global hosted hosted VoIP and UC seats

will pass the 70 million mark in 2020

$2,0 0

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$0

0

10

20

30

40

50

60

70

80

Revenue

Seats

Global Revenue (US$ Millions)

Global Seats (Millions)

2015

2020

0

Conferencing

& Voice

Instant

Messaging

Mobile Sec Vendor, Partner Disconnect?

34

Channel

Vision

|

January - February, 2017