these transformations is that in some

instances up to 80 percent of the costs

of those traditional business models

can be removed.”

So for channel partners, the as-a-

service sector will continue to offer ripe

opportunity thanks to the broadband

foundation. This includes disaster re-

covery (DR)-as-a-service – which can act

as a starting point for longer-term man-

aged service engagements; SD-WAN;

and virtual desktops/desktop as-a-

service, which offers sales partners an

opportunity to add on offerings such as

enterprise-class security.

This latter opportunity recently prompt-

ed security vendor BeyondTrust to join

Westcon-Comstor’s Accelerate program to

expand its distribution footprint globally;

it plans to develop a global channel pro-

gram capable of recruiting and enabling

new solution provider partners around

the world. The move underscores growing

demand for security solutions that guard

against insider threats and data breaches

for businesses of all sizes.

Unified communications-as-a-service

(UCaaS) will continue to grow as an op-

tion for globally distributed enterprises

as well – mirroring the consumerization

of IT that we’re seeing in many sectors.

“The business environment of the

future is going to quickly move to a true

unified communications platform – more

along the lines of Slack, HipChat,

WhatsApp,” said Greg Praske, CEO of

master agency ARG. “Those consumer-

oriented apps are quickly leaking into

the business environment because it’s

how people want to interact. The good

news is that business-appropriate op-

tions like Cisco’s Spark are here now

with the appropriate controls, persistence

and security. The channel partners who

have experience in integrating voice,

collaboration, email, chat, etc. are in the

position to assist companies in their

evaluation of what’s right for a particular

company and then assist with the imple-

mentation and support.”

Another new opportunity worth men-

tioning involves voice service. With the

improved coverage and penetration of

LTE, as well as the massive adoption

of smartphones, VoLTE has become a

priority throughout the world for those

that wish to bring HD voice service to

their LTE customers. Nevertheless, while

VoLTE services certainly offer opportu-

nities, over-the-top (OTT) mobile VoIP

services will attract the largest revenue

market shares, at least in the short and

medium term, Budde-Comm noted. Both

arenas are ripe for channel partners

looking to optimize spending plans for

their international clients.

Some operators are facilitating this

strategy: Zen Mobile in India recently

added a new device to its budget 4G

smartphones portfolio with the launch of

its new Cinemax Click. The 4G VoLTE-en-

abled dual-SIM phone is bundled with an

offer that gives users free calling, data,

SMS and roaming.

Education Required

The opportunities are there, but an

understanding of the technology shifts

at play is a necessary ingredient for part-

ners looking to capitalize on all of this.

“Many channel sales professionals

know that they increasingly have to

leave valuable potential business on

the table because they simply don’t

have the specialist sales expertise or

confidence needed to bid for some of

today’s more complex cloud opportuni-

ties,” said Stephen Hackett, Intelisys

Global’s lead in the UK, speaking to

an EMEA outlet. “We’re looking to fix

that by providing our growing UK sales

partner community with access to the

skills, technologies and expertise they

need to capitalize on new cloud rev-

enue streams.”

It’s important to get ahead of this

now. The move to managed services

and the cloud is relentless and is going

to force other sectors to transform as

well. Developments linked to data cen-

ters, data analytics (big data), machine-

to-machine (M2M), the IoT and the

emerging Blockchain may all play a part

in transforming our current world.

“Looking at the big picture indicates

there are many more innovations to

emerge in the years ahead,” Budde-Comm

said. “However, the bottom line is convert-

ing these technological developments

into revenue-generating services and ap-

plications. The operators [and channel

partners] need paying subscribers and

consumers who will adopt the services

and applications on offer.”

o

International Agents

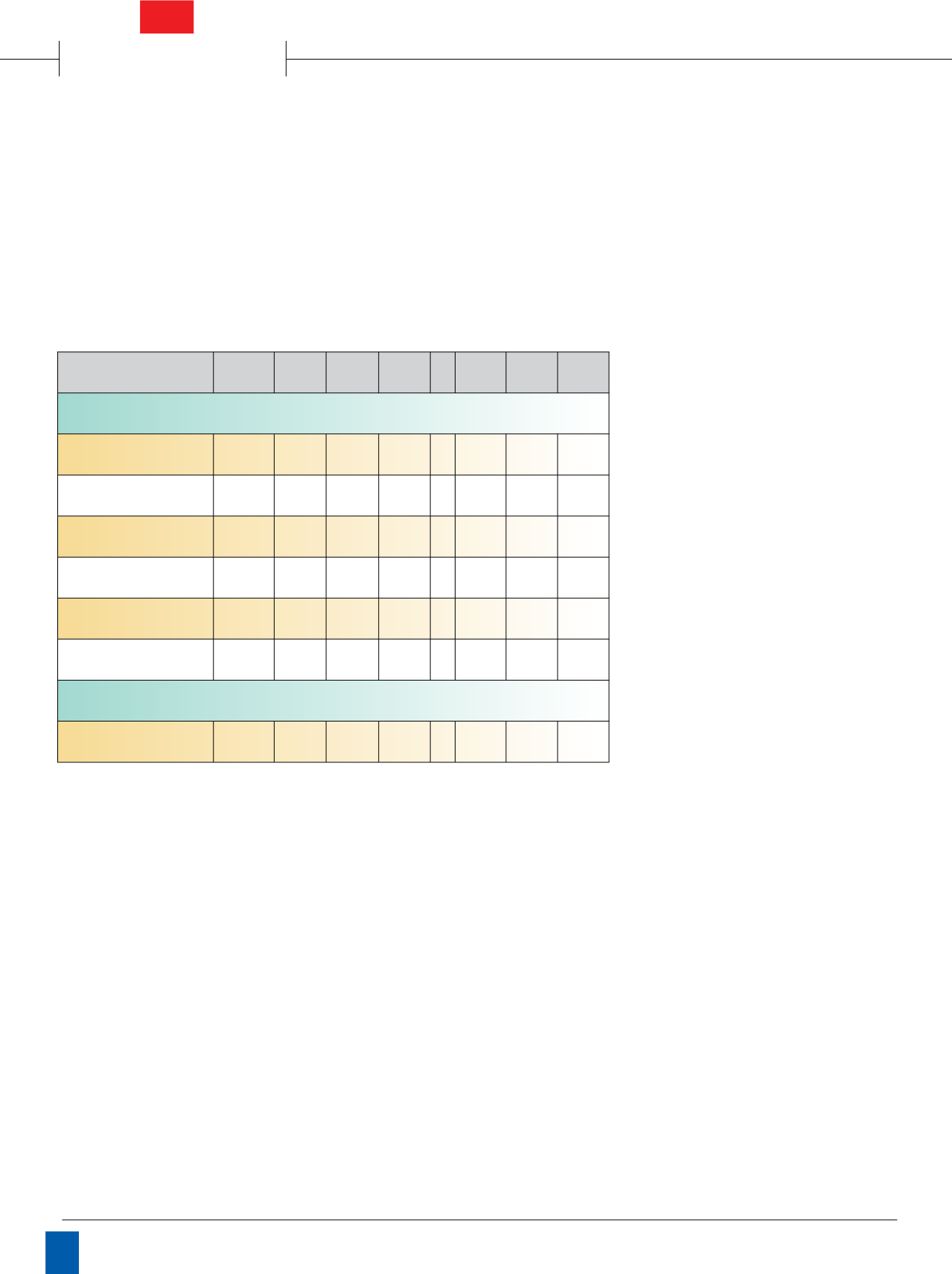

Global Mobile Data Traffic, 2015-2020,

2015 2016 2017 2018

2019 2020 CAGR

By Geography (PB per Month)

Asia Pacific

1,579 2,677 4,423 6,725

9,772 13,713 54%

Central and Eastern Europe 546

946 1,511 2,243

3,249 4,442 52%

Middle East and Africa

294

570 1,039 1,723

2,778 4,314 71%

North America

557

831 1,199 1,700

2,328 3,208 42%

Western Europe

432

708 1,045 1,477

2,061 2,795 45%

Latin America

276

448 715 1,066

1,521 2,092 50%

Total (PB Per Month)

Mobile data

3,685 6,180 9,931 14,934

21,708 30,564 53%

Source: Cisco

Channel

Vision

|

January - February, 2017

50