are better suited to deliver [con-

stant bit rate applications such as

video] than networks that share

capacity among many users,”

Vantage Point analysts argue.

But even beyond video, consid-

ering that business fiber penetra-

tions in U.S. commercial buildings is

less than 50 percent, according to

the last count by Vertical Systems

Group, fixed 5G seems to represent

a huge opportunity in “lighting up”

lots of businesses.

“The arrival of 5G technology will

completely transform fixed wireless

broadband network deployments,”

says Khin Sandi Lynn, analyst at

ABI Research. “Trials show that the

technology’s superior performance

over LTE will allow operators to de-

ploy 5G for fixed wireless broadband

service in densely populated areas.”

Seeing the Spectrum

Also not content to wait for 2020

standards, the Federal Communica-

tions Commission has already iden-

tified multiple spectrum bands for

5G use. While there certainly will be

more added to the band plan, the

initial 5G spectrum is concentrated

in the millimeter wave (mmWave)

band, which is characterized as

high bandwidth and high capacity

but with short range.

“The characteristics will require

specific wireless engineering tactics

to achieve acceptable performance,

chief among them is densification of

the network,” say Finley Engineer-

ing consultants.

That seems to suggest opportu-

nities for infrastructure and device

providers, as early 5G will likely

require not only more towers but

also more small cells and distributed

antenna systems than previous 3G

and 4G deployments.

“Because of its high power, low

range characteristics, early 5G net-

works with look and act more like

a super Wi-Fi network, providing

very high bandwidth, low latency

connectivity in short range, than a

traditional mobile network,” says

Finley Engineering. “5G mobile ap-

plications will come later, as the 5G

interface is applied to lower spec-

trum bands.”

In addition to the opportunities

for wireless carriers and infrastruc-

ture providers, there are distinct

wireline opportunities early on as

well. Most notably, the densification

of the network required by 5G will

mean lots more sites will need fiber

backhaul than did in 4G environ-

ments, “and it’s not just traditional

wireless towers,” says Finley Engi-

neering. “Hundreds of sites, includ-

ing the use of small cells and DAS

sites, will be needed to cover a 5G

area that may have only needed 20

to 30 towers in a 4G environment.”

These site will more than likely

not require optical wavelength

services over traditional Ethernet,

due to lower latency requirements,

continues the engineering and pro-

fessional services firm.

In terms of the top 5G vendors

so far, IHS Technology recently

surveyed service providers from

around the world that have de-

ployed or trialed LTE, and in an

open-ended question, respondents

named the manufacturers they

consider to be the top three in 5G

research and development. Nokia

and Ericsson, not surprisingly,

topped the list, since both have

been at the forefront of 5G devel-

opments and are both engaged to-

gether in every single account that

matters in Japan, South Korea,

and the U.S., where the 5G front-

runners are, said IHS researchers.

Huawei is also involved in many

5G projects but misses some mar-

kets such as the U.S., where the

company is banned.

In the long term, 5G has the

potential to be transformational to

all sorts of technology and IT ser-

vices. “Perhaps the biggest single

lesson is that any supplier that is

touched by the mobile Internet, the

Internet of things, cloud services

and consumer electronics or auto-

mation needs to track and assess

the coming impact of 5G,” say ana-

lysts at 451 Research. “Few will be

left unaffected.”

Implementation, however, will be

patchy at best, and the earliest ap-

plications will likely be those that do

not cannibalize existing 3G and 4G/

LTE mobile investments.

o

Source: IHS Markit

Average Wired Price per Mbps

ireless

ired

015

3.02

-67%

-82%

$10

$8

$6

$4

$2

$0

.01

By end of

2016

Lab trial

Production trial

Live production

2017

0%

5%

10%

2018

2019 2020 or

later

Don’t

know

No plans

Percent of ent

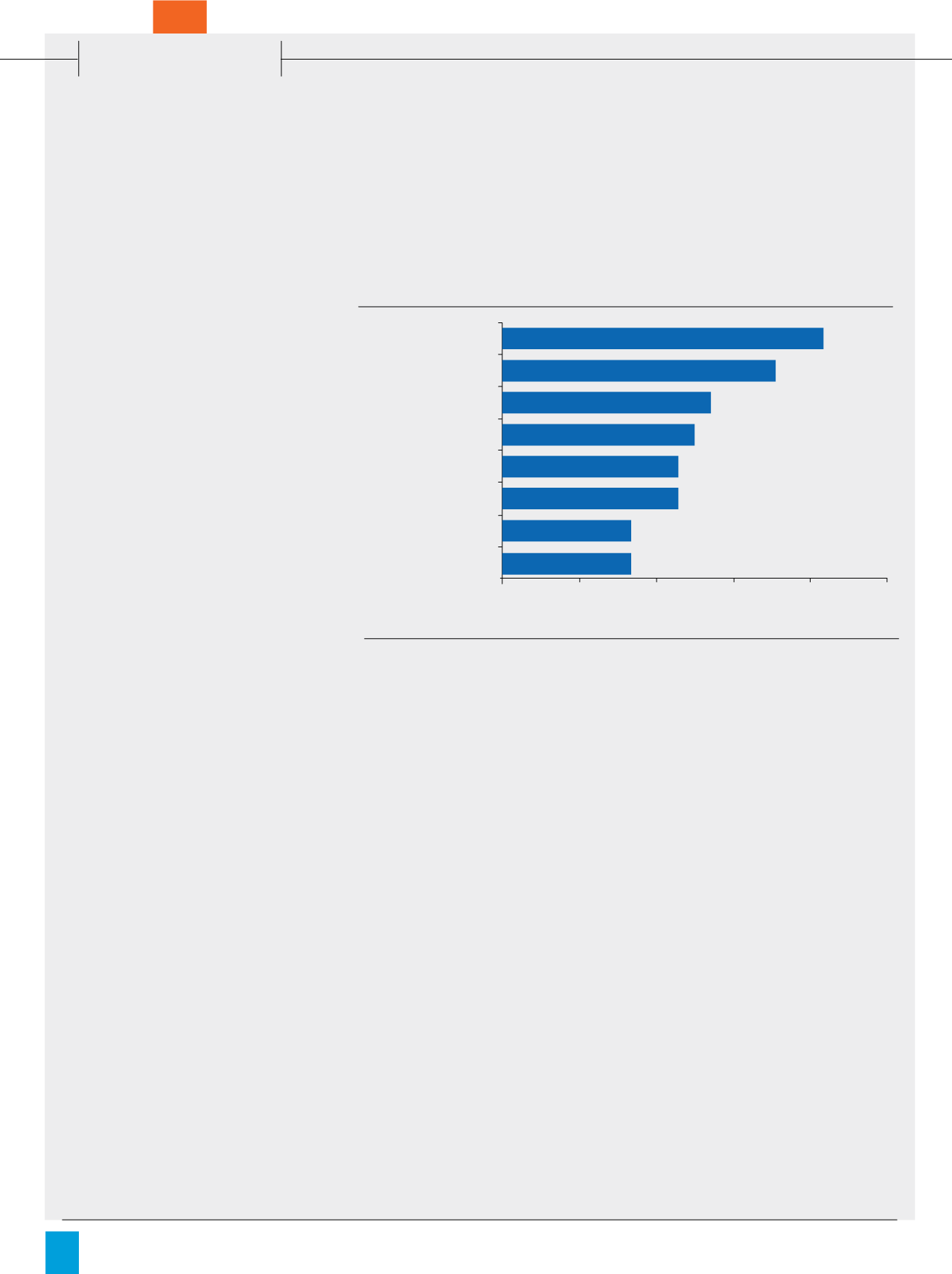

5G Technology Challenges

Source: IHS

1ms latency

1000x bandwidth per unit area

Perception of 100% coverage

Perception of

99.999% availability

10 to 100x

connected devices

1G to 10G connections

to end points in the field

90% reduction in energy use

Up to 10 year battery

life for low power

machine-type devices

Challenges

0%

20%

40%

60%

80%

100%

Percent of service providers rating 6 or 7 on a scale of 1 to 7

83%

71%

54%

50%

46%

46%

33%

33%

Datacenter Refresh Drivers

Source: 451 Research

What are the drivers of datacenter refresh at your organization?

Aging infrastructure

Increased Demands

From the Business

Increased Storage

Requirements

New Workload

Requirements

N ed for Greater

Uptime/Resiliency

Increasing Networking/

I/O Requirements

N ed for increased

Automation/Orchestration

Increased Processing

Requirements

58%

46%

33%

31%

26%

26%

21%

21%

Mobile & Wireless

Channel

Vision

|

March - April, 2017

26