buried within the per desk,

per user or per instance

charges paid to use any sort

of cloud service.

All that noted, Gartner

forecasts suggest that U.S.

businesses are spending less

money on telecommunica-

tions than they used to, or

perhaps, will spend less in

the future than they do today.

According to Gartner, less

money will be spent in 2019

than was spent in 2013, for

example, on a global basis.

Consultants at Deloitte,

though, working from tier

one service provider annual

reports, estimate that U.S.

business spending on telecommuni-

cations services sold by the tier one

service providers actually is drop-

ping substantially.

That is not the whole story,

though, as some business spend-

ing on telecommunications, or on

services that could be provided by

telecom service providers, is shifting

to newer and non-traditional suppli-

ers such as Amazon Web Services

and Google, Zayo and others.

That said, customers are buying

more “next-generation” products

that arguably offer better efficien-

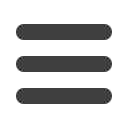

cies. BCG analysts suggest a

medium-sized retailer, for example,

could reduce baseline IT costs by

47 percent after replicating its exist-

ing IT stack in the cloud.

Still, one important change is

that “private global networks” now

have become truly significant. And

those new app and content provid-

ers do not buy as much wholesale

capacity from the public carriers as

they might have in the past.

These days it is a handful of

“enterprises,” namely big content

and app firms such as Facebook

and Google, that actually

build and operate their own

cable networks, essentially

removing as much as half

of all global long haul traf-

fic from carriage over any

public network through the

backbone.

“Content providers are

removing a large portion

of the customer base,”

says Brianna Boudreau,

TeleGeography senior an-

alyst. That “makes the rest

of the market extremely

competitive.”

So to answer the original

question, many enterprises

are buying less long haul

capacity than they used to. In some

cases, huge hyperscale app pro-

viders build and operate their own

private global networks.

Other enterprises and business-

es are spending more on mobility,

and less on other things. Where

those businesses buy managed and

cloud services, they pay only indi-

rectly for capacity services required

to deliver those services. And even

to support basic voice and data,

most businesses now require only

local Internet access connections,

not long haul capacity.

o

Source: US Telecom; Well Fargo: Merrill Lynch data

Inhibitors to Cloud Computing

Source: 451 Research

Outsourcing Frequency: Disaster Recovery

Shared use

2.4 GHz global/5 GHz global

licensed

ectrum

88%

79%

5%

5%

80% 100%

80%

79

%75%

2010

$1,515,000

$802,000

2015

Cloud Technologies Offer Huge Cost Savings

Source: BCG

-47%

48%

23%

13%

16%

41%

25%

11%

23%

Today

Future

Network

IT infrastructure

IT software

IT labor

ANNUAL IT SPENDING OF A MEDIUM-SIZED RETAILER

Companies

typically

reinvest savings

in cloud usage/

new services

Security

Control of Data Locality, Sovereignty

Budget/Cost/Pricing

Technical Migration/Integration

Compliance/Regulation

Internal Resources/Expertise

Process Integration/Governance

Change Management

Vendor/Provider Issues

Other

7.4

6.9

6.9

6.4

6.3

6.3

6.1

5.8

5.5

3.9

Please rate how much of an impact the following will have on inhibiting your

organization’s use of cloud computing. Please use a 0-10 scale, where 0 is

‘No Impact’ nd 10 is ‘Massive Impact.’ (Mean)

0%

20%

40%

60%

44% 42% 42%

49%

36%

Percent of Organizations

Zettabytes

Channel

Vision

|

March - April, 2017

40