Consider international and long

haul capacity across North America,

for example, a product essential for

a growing number of content and ap-

plication companies. Virtually every

statistic you see about demand shows

skyrocketing volume. From 1983 to

2016, for example, user bandwidth

has grown 50 percent per year, ac-

cording to the Nielsen Norman Group.

So the easy assumption would be that

enterprise buying of capacity prod-

ucts, and therefore channel partner

and service provider revenue from

such sales, has continued to grow.

Not so much. A huge percentage

of those requirements no longer are

supplied by “public network suppliers”

but instead are fulfilled by enterprise-

owned-and-operated private networks.

That is a huge change, as a dispro-

portionate share of global traffic and

capacity now is driven by a handful of

hyperscale app and content providers.

Firms such as Google and Face-

book build and operate their own

private networks, and relatively rarely

must buy capacity (retail or wholesale)

from long haul capacity suppliers.

Also, the structure of demand

has changed: most businesses now

mostly need local access to local

Internet points of points of presence,

not long-haul capacity. So retail and

wholesale capacity demand has

shifted to “metro” connections, not

wide area connections.

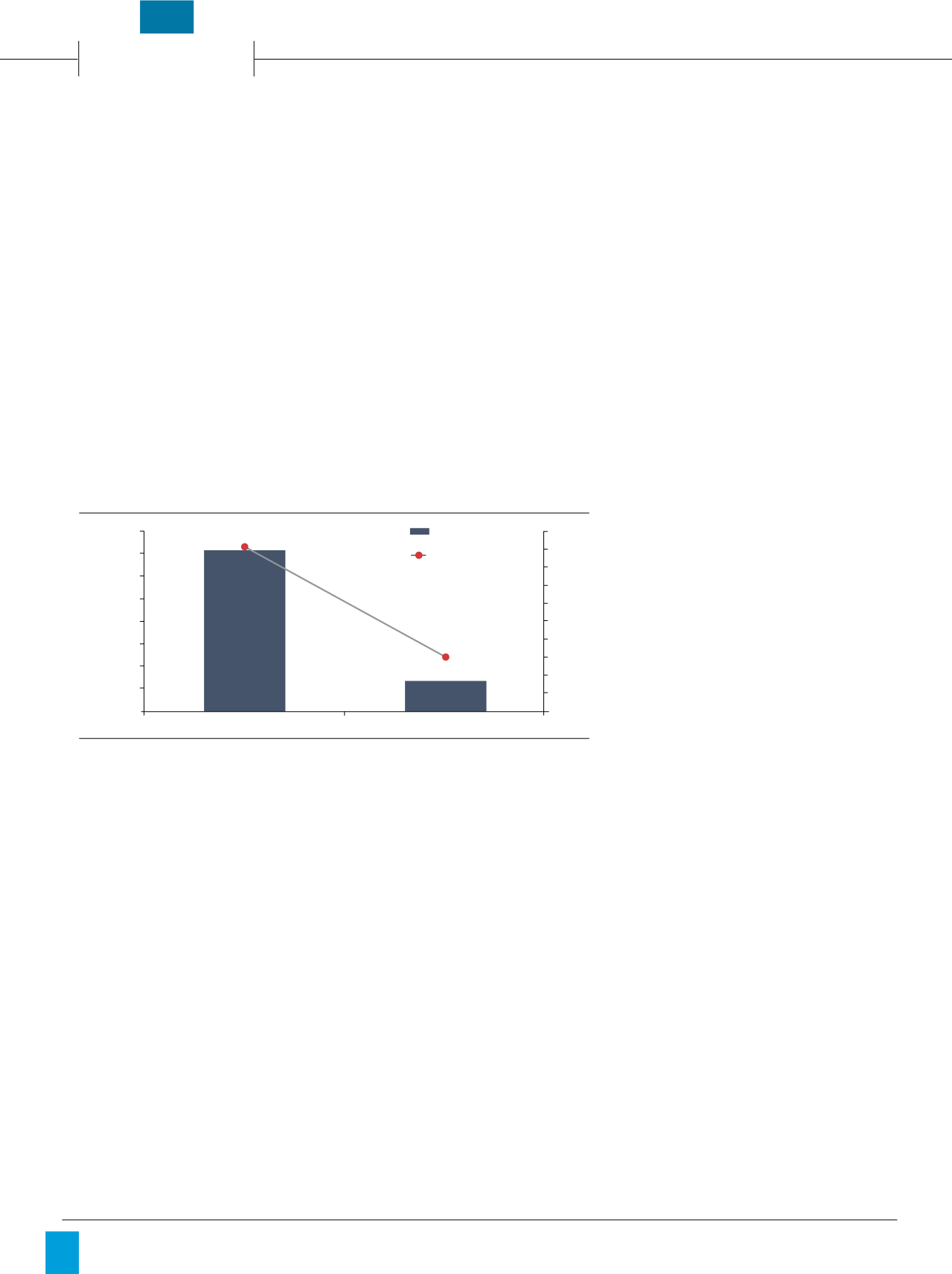

Also, prices for any required ca-

pacity have fallen steadily during the

last two decades. So margin com-

pression and product substitution

are key issues affecting both service

providers and channel partners. Not

only do legacy products cost less,

they are used far less, as business

customers have substituted Internet

access for legacy data products.

In turn, the market for long haul

wholesale and retail products sold by

channel partners arguably is smaller

than it used to be. Also, businesses

have made big shifts in the types of

communication products they buy.

In addition to price declines and

margin compression, plus the shift to

local access as the key capacity prod-

uct, mobility now represents a huge per-

centage of business communications

spending. Nearly half of all enterprise

spending is for mobility, where there

is no need to separately buy “long dis-

tance voice” capacity or services; those

are simply part of the base service.

In addition to the fact that busi-

ness data services in most cases

involve Internet access, which is a

“local” service, not a “long haul” ser-

vice, managed services increasingly

use cloud mechanisms, which like-

wise only require local access to the

nearest Internet point of presence.

Overall, retail “capacity” services

for businesses increasingly require

only local access to a point of pres-

ence, not dedicated capacity across

the long haul network.

Some 50 years ago, nearly all

that traffic would have moved over

the “public” (telecom) networks. Dur-

ing the last 20 years, much long-haul

traffic has shifted off the “public net-

works” and onto private networks.

In fact, as much as 60 percent

of trans-Atlantic traffic now moves

over private networks operated by

the likes of Facebook and Google,

according to Jonathan Hjembo, a

senior analyst at TeleGeography.

On Latin American routes, about

70 percent of total traffic now moves

over private networks. In other

words, only about 30 percent of un-

dersea, long haul traffic actually is

sold to customers who use “public”

networks, according to Erick Contag,

Globenet CEO.

On trans-Pacific routes, over-

the-top app providers account for

about 33 percent of lit demand on

the “public” networks, says Jonathan

Kriegel, CEO of Docomo Pacific.

And these are private networks

that generate no revenue – whole-

sale or retail – for public network

service providers.

That now seems to be a promi-

nent theme in telecom industry dy-

namics: even as usage grows, mar-

kets for “paid” services shrinks, as

a percentage of total usage. In the

long haul capacity markets, a grow-

ing percentage of traffic (33 percent

to 70 percent) now is removed from

the “public” markets.

Efficiency also now is an issue.

Businesses these days often find

they can spend less than they used

to, and achieve higher performance.

That applies to any long haul product

as it does to any computing product.

Also, some spending might now

be avoided because consumers use

their own tools and apps, and such

spending is not captured in busi-

ness accounts, or applications have

no retail price (consumer versions

of Google Docs, Sheets or Slides,

for example).

On the other hand, a hosted or

cloud service provider obviously has

to recover its bandwidth charges of

supplying a retail service, so some

amount of “long haul” costs actually are

Source: RAD-INFO INC

Examples of Decling Broadband Prices

Source: US Telecom; Well Fargo: Merrill Lynch data

The Market Segments, Pick One

Source: IHS Markit

Average Wired Price per Mbps

Wireless

Wired

Average Wireless Price per MB

1-4 employees

4-10 employees

11-20 employees

21-50 emp

51-99 emp

<100-250 emp

<250 emp

$0.08

$0.06

$9.03 per Mbps

$0.07

per MB

2010

$1,515,000

$802,000

2015

$3.02

-67%

-82%

$0.04

$0.02

$0.00

$10

$8

$6

$4

$2

$0

Cloud Technologies Offer Huge Cost Savings

Source: BCG

-47%

48%

23%

13%

16%

41%

25%

11%

23%

Today

Future

Network

IT infrastructure

IT software

IT labor

ANNUAL IT SPENDING OF A MEDIUM-SIZED RETAILER

Companies

typically

reinvest savings

in cloud usage/

new services

$0.01

Lab tria

5G Technology Chall

Source: IHS

1ms latency

1000x bandwidth per unit area

Perception of 100% coverage

Perception of

99.999% availability

10 to 100x

connected devices

1G to 10G connections

to end points in the field

90% reduction in energy use

Up to 10 year battery

life for low power

machine-type devices

Challenges

0%

Datace

Source: 451

What are t

Agin

Incre

Fro

Incr

N

Upti

Increasin

I/O

Nee

Automatio

Increa

Zettabytes

Channel

Vision

|

March - April, 2017

38