Google Fiber Turns

to Fixed Wireless

It’s probably not a coincidence

that shortly after Google Fiber ac-

quired wireless ISP Webpass, it began

pausing its FTTP overbuild plans in

previously announced Google Fiber

markets. Webpass offers fixed wire-

less services, including 100 Mbps, 200

Mbps, 500 Mbps and 1 Gpbs tiers, in

Boston, Chicago, Miami, Oakland, San

Diego and San Francisco, with prices

starting at $60 per month.

“Webpass has been offering superfast

Internet service – up to a gigabit per sec-

ond – in these cities for some time, and

has the full support of Google Fiber to

continue doing so going forward,” posted

Google Fiber president Dennis Kish.

Kish says Google Fiber and Web-

pass have been “working together in

the cities both Webpass and Google

Fiber share: Chicago, San Diego and

San Francisco.”

Webpass currently uses point-to-

point technology, limiting wide cov-

erage of a market, and it does not

currently blanket any market with its

fixed services. But with all the hype

around 5G, its expected boost in ca-

pacity and cost savings over fiber in an

overbuild scenario, it’s not hard to see

why Google Fiber might view “Google

Fixed” as a smarter option, especially

now that the company has had a taste

of passing actual homes with fiber.

Enterprises to Up

WAN Spending

T

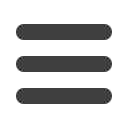

he WAN is becoming a strategic component of technology

infrastructure for enterprises and is driving a renewed

focus on WAN security and performance, say research-

ers at IHS Markit.

Interest in software-defined wide area

networking (SD-WAN) also is reach-

ing critical mass, with four out of five

respondents having plans for SD-

WAN during the next 4 years.

Across private, public and hybrid

networks, enterprises surveyed by

IHS plan to increases WAN spending

by more than 20 percent annually.

The top changes expected over the

next year are increasing capacity

and improving security. The leading

drivers of WAN traffic, show survey

figures, are backup/storage and col-

laboration tools.

Meanwhile, SD-WAN lab trials of

2016 are turning into production de-

ployments in 2017 and 2018. Forty-two

percent of respondents started SD-

WAN lab trials in 2016, and in 2017,

many are moving into production trials

and onto live production networks.

Most North American Enterprises Have Some SD-WAN Plans Brewing

Source: IHS Markit

By end of

2016

Lab trial

Production trial

Live production

2017

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

2018

2019 2020 or

later

Don’t

know

No plans

Percent of enterprise survey respondents

5G Technology Challenges

1ms latency

1000x bandwidth per unit area

Perception of 100% coverage

Perception of

99.999% availability

10 to 100x

connected devices

1G to 10G connections

to end points in the field

90% reduction in energy use

Challenges

83%

71%

54%

50%

46%

46%

33%

Where Google Fiber is Going

Source: Google Fiber, 1/17

Zettabytes

Channel

Vision

|

March - April, 2017

34

Overheard

“Our DVD by mail service was the original digital distribution network. Each DVD carries 5 GB

of data – and sending that out to people by mail was still the fastest way to get content to a

computer. We launched in 1997, and started streaming in 2007. We knew that eventually

the Internet would catch up with the U.S. postal system, but it took 10 years.”

– Netflix CEO R ed Hastings, speaking at Mobile World Congress, on broadband growth