20

THE CHANNEL MANAGER’S

PLAYBOOK

By

Tara

Seals

T

he global unified communica-

tions (UC) market size is ex-

pected to reach $143.49 billion

by 2024, according to a report by

Grand View Research, largely driven

by increasing workforce mobility. The

substantial growth prospects of the

unified communications market also

can be attributed to the rapid interna-

tional expansion of organizations and

an increasing need for real-time and

efficient communication systems that

enhance the inter-organizational ex-

change of information.

The firm also said that favorable

government and institutional initiatives

worldwide supporting the introduction of

UC deployment across various industry

sectors are expected to positively impact

the market during the forecast period.

Grand View also stressed that UC allows

firms to have better operational agility,

better customer engagement and con-

nected employees – all strategic busi-

ness goals that offer a conversation for

savvy channel partners.

Some verticals are particularly

hot right now: Global Market Insights

pointed out that the government sec-

tor has witnessed increased adoption

of UC systems, especially when it

comes to public safety. These solutions

help governments to effectively deal

with emergencies and support effec-

tive crisis conferencing. The report

estimates revenue from this segment

alone to exceed $20 billion by 2023.

Rising Tide

UC integrates real-time commu-

nication services such as presence

information, telephony, conferencing,

instant messaging and so on with non-

real time services such as SMS, email

and voicemail. As such, Intense Re-

search said that the sustained growth

of the information and communica-

tions technology (ICT) market overall

is expected to enhance the growth of

UC markets, as it is generating lot of

interest in software and application

development communities as well as

enterprises. In the latter segment,

large investments in communica-

tion and collaborative technologies

Mobility to Drive Global

UC Uptake to New Heights

ri

Source: Aberdeen Group

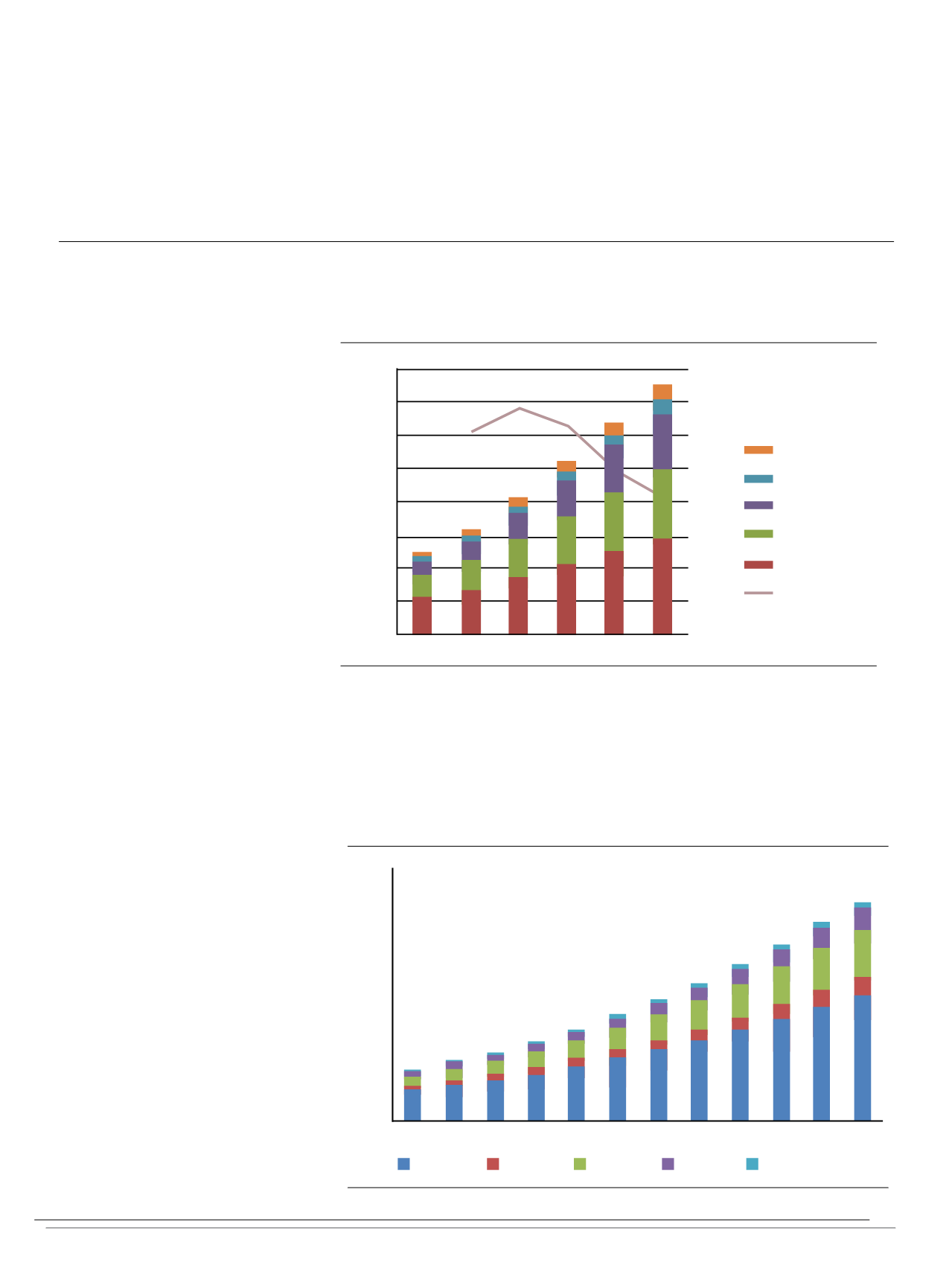

Performance of Intelligent Contact Centers Outpace “All Others”

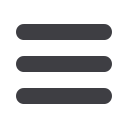

Source: Global Market Insights

Global UCaaS Revenue by Region

Source: MarketsandMarkets

25.00

20.00

15.00

10.00

5.00

0.00

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Enterprise

Education

Government

Healthcare

Others

8.00

7.00

6.00

5.00

4.00

3.00

2.00

1.00

0.00

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

2013 2014 2015 2016 2017 2018

Middle East

& Africa

Latin America

APAC

Europe

North America

Y-o-Y

$Billion

Year-over-year percent change

14%

12%

10%

8%

6%

4%

2%

0%

-2%

12.7%

5.6%

9.9%

4.0%

8.5%

3.2%

8.3%

7.9%

5.2%

-1.8%

-1.0%

-1.1%

Annual

company

revenue

Customer

retention

Customer

lifetime value

Number of

quality SLAs

met

Improvement

in number of

customer

complaints

Improvement

in average cost

per customer

contact

Best-in-Class

All Others

haul

Source: Ericsson

North America UC Market by Delivery Method,

2013 - 2024 ($B)

Source: Grand View Research

Europe UC Market Size, by Vertical 2012 - 2023 ($B)

Source: Global Market Insights

100%

Solar electric generation

Compressed natural

gas (CNG) vehicles

Energy-efficent water

treatment technology

All-electric vehicles

Methanecapture (landfills, biosolids)

Solar hot water

Geothermal

Waste-to-energy conversion

Cogeneration

(combined heat & power)

Advanced biofuels

Smart grids/smart meters

25.00

20.00

15.00

10.00

5.00

0.00

2012 2013 2014 2015 2016 2017 2018 2019 2020

Hosted

On-premise

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Enterprise

Education

Government

Healthcare

Others

31%

23%

22%

21%

19%

16%

12%

11%

11%

11%