COMPTELPlus

|

Monday, October 19, 2015

Beka Publishing,

www.bekapublishing.com12

Consolidated Communications Merges with Enventis

COMPTEL PLUS Fall 2015 Business Expo

DAY 1

C

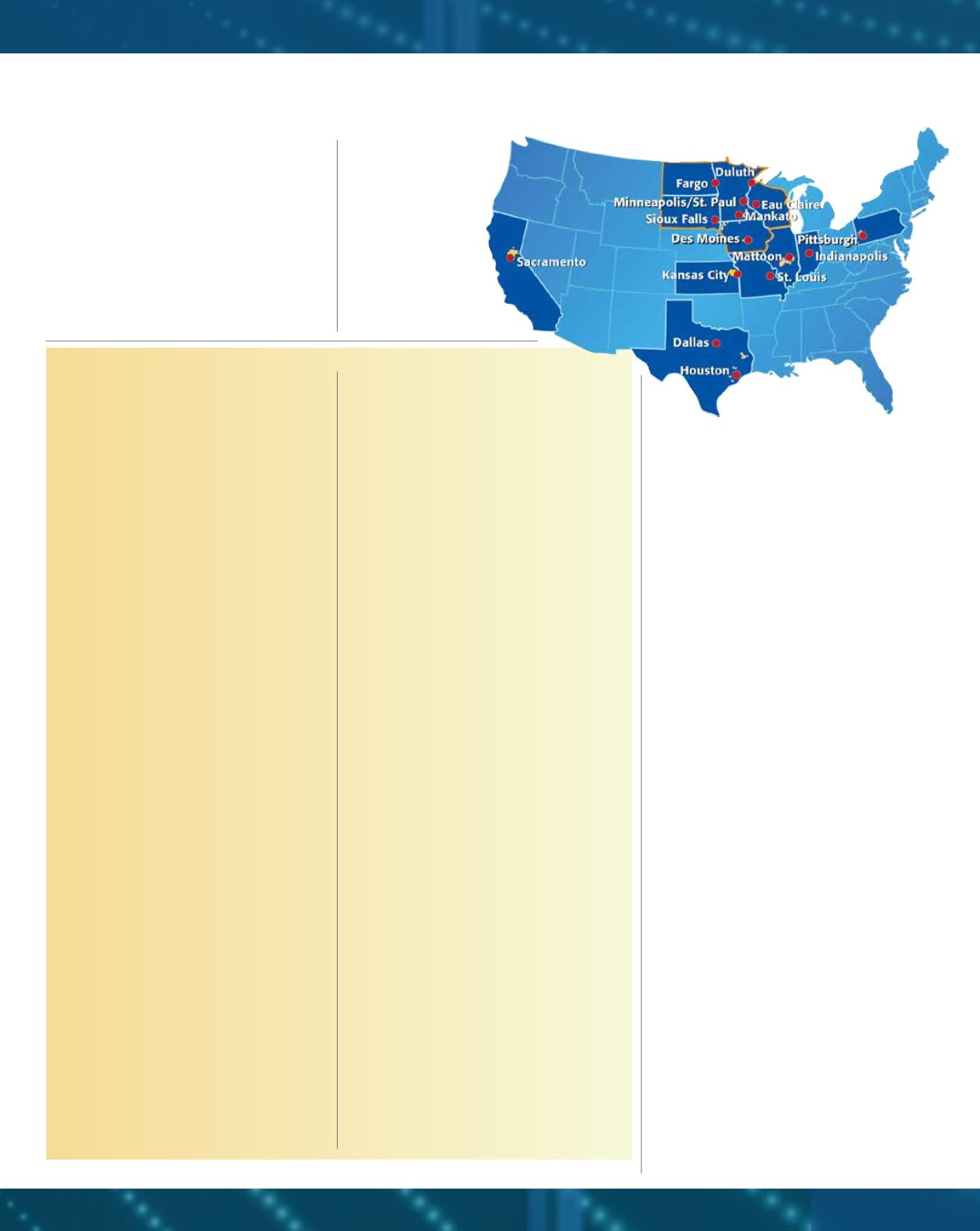

onsolidated Communications Holdings

Inc. and Enventis Corp. (formerly known as

HickoryTech) recently joined forces through

a merger, thus increasing the size and scale of the

Consolidated Communications fiber footprint.

The merger has significantly augmented the

capabilities of Consolidated’s carrier services

team, which is responsible for the wholesale

network and product portfolios. The strength of

the combined resources will help the company

to drive the expansion of access networks in all

regions, thereby increasing

the availability of lit build-

ings, near-net sites and

Ethernet access in CLEC

and ILEC territories.

The combined

company also intercon-

nects withmany local,

regional, national and global

carriers, and leverages its

advanced fiber-optic network

andmultiple data centers to offer a wide range of

communications services, including Ethernet, TDM,

wavelength, colocation and dark fiber.

“This merger combined two companies with

similar strategies and cultures, resulting in a finan-

cially strong company with a robust balance sheet

and attractive dividend payout ratio,” said Bob

Udell, Consolidated’s president and CEO. “Enventis

built a strong business delivering competitive

business and broadband services over a 4,200

route mile fiber network. The combination and

additional markets created a broader platform

from which to grow and expand.”

Formerly headquartered in Mankato, Minn.,

Enventis operates a next-generation fiber network

that enabled facilities-based operations in its home

state, as well as into Iowa, North Dakota, South

Dakota andWisconsin. The company has grown both

revenue and EBITDA at a compound annual growth

rate of approximately five percent since 2006.

Enventis serves more than 1,600 lit buildings,

12,000 near-net sites and 290 fiber-to-the tower

sites, and operates six data centers. Enventis’ network

reach both complements and bolsters Consolidat-

ed’s existing product portfolio and provides denser

network coverage in its northern region.

“Our long-term stability combined with exten-

sive colocations at LEC COs and carrier hotels

in both rural and metro markets, customer-

engineered solutions, dark-fiber availability and

an agile, professional wholesale team allow us to

operate a vast fiber network with unique reach in

key service areas,” said Brian Carr, vice president of

carrier services at Consolidated.

Foundedmore than a century ago, Consolidated

Communications provides advanced communications

services to both residential and business customers

in California, Kansas, Missouri, Illinois, Texas and

Pennsylvania, and itself already offers a wide range of

services over its IP-based network, including local and

long distance telephone, digital phone, high-speed

Internet access and digital TV.

o

1Gbps has led to programmers from across the

country to gather at DevMountain to develop

newWeb and mobile applications. In addition,

the UnitedWay of Utah County has promoted

new digital literacy programs throughout the

community; and one organization, called Now I

Can, has used Google Fiber to remotely connect

parents with their children undergoing intensive

physical therapy in Provo.

Key Trends Shaping Fiber

Deployment

The panelists certainly bring plenty of

perspective to the session. Google Fiber for

instance arguably kicked off the 1Gbps competi-

tion for the home when it announced its plans

to deploy it in Kansas City in 2011. Since then,

several broadband providers have announced

new deployments. In June, AT&T announced

the expansion of its “Gigapower” service to 12

communities, including Charlotte, N.C. And in

the cable sector, the DOCSIS3.1 rollout effort has

been dubbed the “GigaSphere” initiative. Time

Warner Cable notably has embraced the 1Gbps

movement with a $25 million network invest-

ment to support the rollout in Los Angeles and

other major markets.

And indeed, Google Fiber continues to expand

intometro areas, includingmost recently Atlanta;

Charlotte; Nashville, Tenn.; the Raleigh-Durham,

N.C. area; and Salt Lake City. Google is already live

in Austin, Texas; Kansas City, Mo.; and Provo, with

its fiber-fed 1Gbps Internet andTV packages. For

now, the five new cities are in the design phase,

with service turn-ups to be announced. Pricing

plans, if they follow other rollouts, should include a

free basic Internet connection at 5Mbps following a

$300 construction fee, a 1Gbps broadband available

for $70 a month, and a broadband plus TV service

for $120 a month. These are prices that are similar

to European offerings and well below a typical

cable subscription—meaning that the company is

certainly shaking up future business models.

Meanwhile FirstLight continues to grow its

fiber network throughout upstate New York and

northern New England, and several large market-

place trends are guiding its decisions on network

investment and the development of its portfolio.

For instance, it has seen a demand for higher

bandwidth, data-centric solutions, especially

Ethernet. That’s particularly true in the vertical

markets, and especially in the financial and

healthcare sectors.

“Customer demand for Ethernet and IP data

is absolutely one of our biggest drivers, espe-

cially from entities that are data centric but

may have some voice service needs,” CEO Kurt

Van Wagenen said in an interview late last year.

“Some smaller customers are okay with TDM. But

increasingly, the larger enterprises and carriers

are looking for IP.”

A second trend that the company has seen is

the fact that customers, particularly enterprise

customers, are outsourcing more communica-

tions and applications into data centers.

“This is a trend that we expect to continue,”

Van Wagenen said. “Increasingly they have a need

to ensure that equipment is in a highly secure,

managed data center. And we will continue to

ensure that we have sufficient data center inven-

tory in all of our markets.

Meanwhile, very large customers, including wire-

less carriers and the largest enterprises, are increas-

ingly interested in discussing dark fiber and leases,

he added. On the wireless side, there has been a

rapid shift fromTDM based-backhaul from towers

to Ethernet, and increased demand for dark fiber to

macro cells. Also, as small-cell rollouts, which boost

wireless density, are in the initial stages.

“How the network needs to be designed to

support the demand that’s driving long term

evolution is shifting,”Van Wagenen said. “They

need to support not just bandwidth growth

and the filling in of coverage, but also myriad

small cell solutions. And they’re looking for more

predictability around costs in their own networks,

which dark fiber can provide.”

o

(Gigabit Fiber, continued from page 10)