on individual agent endpoints, which can provide significant

management efficiencies.

Avaya, for instance, is collaborating with Google on a

cloud-based solution, dubbed the OnAvaya Powered by

Google Cloud Platform. It includes a subscription-based

license and the customer engagement OnAvaya software –

from there, users can provision a Chrome device and a head-

set. Customer service reps will be able to access the Cus-

tomer Engagement OnAvaya agent and supervisor desktops

with a Google Chrome device and communicate through a

WebRTC-enabled interface and headset.

In the U.S., certified Avaya and Google business partners

and Google for Work partners authorized by Avaya will be

able to sell the solution.

“Avaya is bringing its customer engagement technology

leadership to midmar-

ket companies with an

easy-to-use subscription

service,” said Joe Manu-

ele, senior vice president

and general manager

of global cloud services

at Avaya. “Through

the power of Google

Cloud Platform, Avaya

is providing a simple

and scalable foundation

that allows customers

and partners to deploy

contact centers faster,

and agents to work from

anywhere.”

“We continue to see

our customers transi-

tioning to cloud-based offerings to speed the implementa-

tion of business-critical customer engagement services,” said

Tony Bianco, president of the cloud computing division at

Onix, one of the first partners to pilot and offer the platform.

“This offer from Avaya, working with Google, eliminates

installation complexity and provides us with access to the

industry’s leading contact center software-as-a-cloud service.

We anticipate that customers in a variety of industries will be

very excited about this product offering.”

These traditional benefits are critical talking points in the

sales process. But there’s also a benefit (and additional value

for the channel partner) when it comes to providing differ-

entiating, omnichannel, personalized customer service.

It’s a Multichannel World

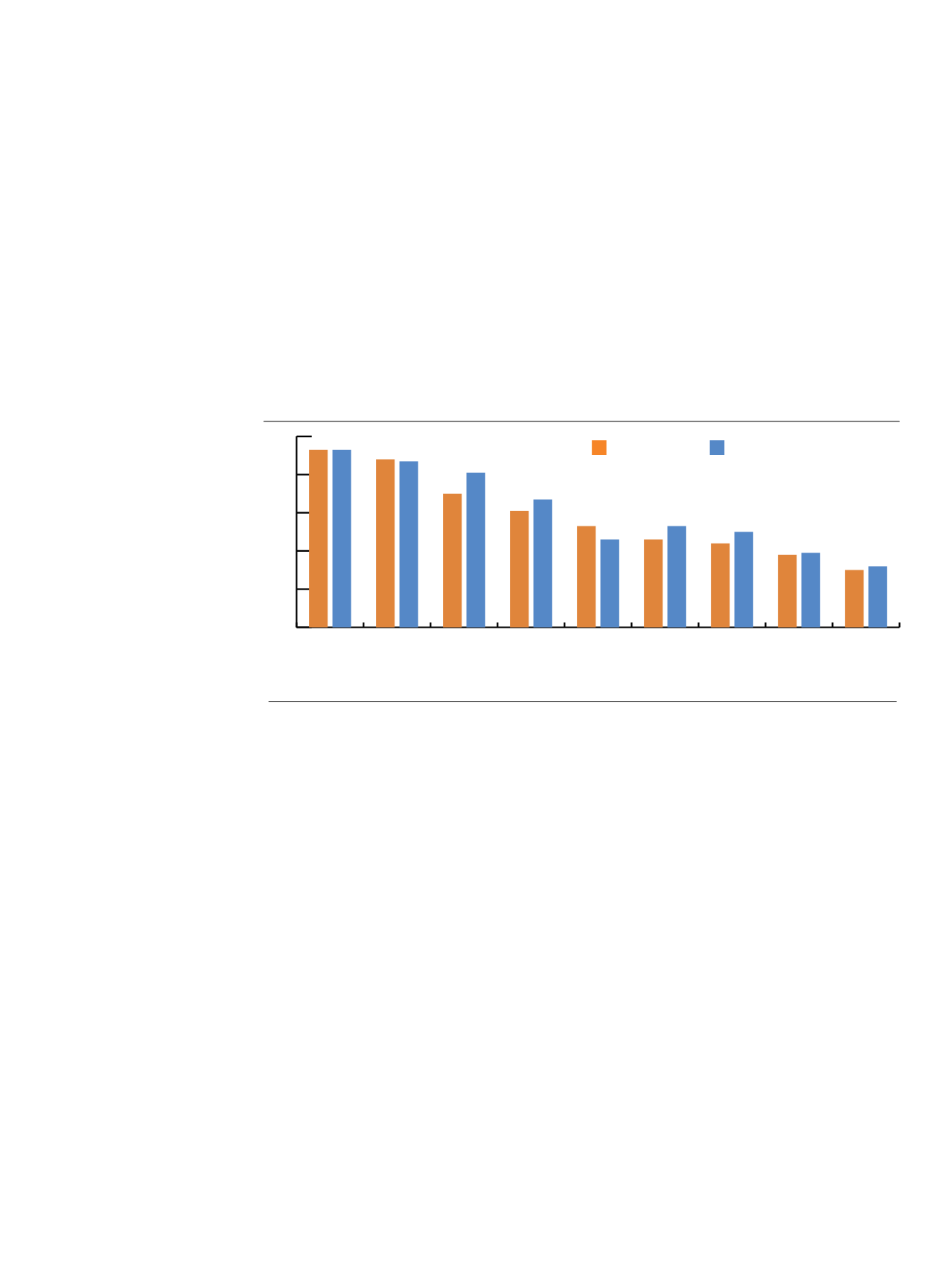

A January 2015 customer experience survey examined con-

sumer perceptions of service while making online or phone

purchases of more than $25 in the previous six months. The

study, conducted online by Harris Poll on behalf of inContact,

found that consumers expect a personalized, omnichannel

customer journey that includes agent service continuity and

choice of channels for follow-up communications.

In order of importance to consumers, preferred agent-sup-

ported channels include: email (93 percent); 1-800 to live reps

(81 percent); online chat (67 percent); apps for mobile devices

(50 percent); SMS/text message (46 percent); social network-

ing sites (39 percent); and online video chat (32 percent).

When feeling dissatisfied with an order, the majority (81

percent) of U.S. adults prefer assistance from a live repre-

sentative via phone or online chat rather than using email

or online self-service – but, they want these other channels

available too.

According to the findings, 43 percent of U.S. adults who

made at least one purchase online of more than $25 during the

last six months had interacted directly with a company rep-

resentative at least once, with an average of two interactions.

When purchasing via phone, 84 percent of buyers were in

touch with a company representative an average of five times.

“We set out to understand how shoppers interact with com-

panies when they are making purchases online or via phone,”

noted Paul Jarman, CEO of inContact. “Consumers still fre-

quently turn to agent-assisted channels in addition to using self-

service options during different stages of the purchase cycle,

which makes the contact center a vital link to the customer

experience when it matters most – when they are buying.”

A Focus on Personalization

Given this expectation for multichannel communication,

it’s perhaps unsurprising that personalization is a key to

loyalty and a good experience for consumers.

According to the InContact research, a full 65 percent

of U.S. adults expect customer service reps to know their

purchase history regardless of method of communication

(e.g., phone, chat, email). And, there’s a need for more focus

on transition times. About two-thirds (67 percent) expect

to be able to call the same company representative they

worked with previously if they had an order or service issue.

And research from Aspect Software found that nearly all (96

percent) of the consumers surveyed said when contacting

customer service about the same issue, they should be able to

pick up where they last left off, regardless of channel.

Media Monthly Lease Price, DIA vs. IP VPN, 10 Mbps

Source: Harris Poll, inContact

Source: Aberdeen Group

Strengths of Publ c Cloud Co tact Centers

Source: Software Advice

Consumers Expect Multichannel Choices

Consumers who think these channels are important for service when purchasing online

87% of s

have SD

with SDN in

ata Center

100%

0% 10% 20% 30% 40% 50% 60%

Difficult to use

Malfunctioning

system

Lack of

scalability

Too ex ensive

10%

9%

7%

10%

3%

7%

10%

6%

10%

3%

19%

7%

Legacy PBX

On-premises

IP PBX

Cloud PBX

0%

20%

40%

60%

80%

100%

Online

self-service

order

tracking

0800

to

advisors

Online

chat

SMS

/Text

0800

to IVR

Apps for

mobile

devices

Social

media

sites

Online

video

chat

93%93% 88% 87%

70%

81%

61%

67%

53%

46% 46%

53%

44%

50%

38%39%

30% 32%

0%

10%

20%

30%

40%

50%

Customer interactions

are delivered through

channel preferred by

clients

Formal organizational

intitiative to

ensure PCI

compliance

Each interaction is

measured based on its

influence on customer

experience results

Public Cloud Contact Center

In-House Contact Centers

47%

23%

45%

33%

45%

30%

$1,800

D)

Source: Compu

0%

10%

Great Britain

U.S.

30

Channel

Vision

|

May - June 2015