To gain this competitive advantage, SIs and VARs first

need to understand the cloud forces driving the need for new

business models, and then they must learn how to successfully

create and package IP in a cloud services world.

With the rise of cloud applications and in-

frastructure, such as Office 365 and Azure, Mi-

crosoft and other software vendors are taking on

more infrastructure and deployment needs, and

as a result, there’s less of a need for software and

hardware resellers and lengthy on-premises de-

ployment projects. This new world of cloud ser-

vices offers significantly lower channel margins,

meaning SIs and VARs need to better optimize

the total hours and expensive senior personnel

allocated t

o each project.

For continued success, SIs and VARs need to

replace their traditional services by developing ser-

vices tied more tightly to the ongoing operations

of their customers – making them less dependent

on the installation phase of a project. Two impor-

tant opportunities exist to leverage their expert

insight – one is to build ongoing services around

helping customers use the data the applications generate, and

the other is to productize and package their IP into scaleable

offerings to create repeatable, recurring cloud revenue.

What is Packaged IP?

Packaged IP is created when an SI or VAR solves a

problem shared by a number of organizations by creating a

unique, productized software solution based on the partner’s

expertise

in a specific area. For example, big data has a

number of challenges that need to be solved including data

capture, data curation, data storage, analytics, visualization,

decision-support and more. SIs and VARs that deal with

big data for particular industries – such as retail – typically

have deep insight into the data structure and the types of

applications their clients need for sales, marketing and

finance in that industry. In this instance, the SI or VAR

could create pre-packaged IP by applying their experience

with one or more retail industry clients and their use of big

data to create a pre-integrated solution with the applica-

tions and functionality that other retail organizations need,

including specific field-mappings, inte-

gration logic and analytics. After solv-

ing for these vertical needs once, the

partner could scale their solution as a

publicly available “out-of-the-box” of-

fering for additional companies in the

particular industry.

Another tangible example comes

from inbound marketing, Web de-

sign and integration services agency,

LyntonWeb. A long-time provider of

HubSpot deployment and integration

services, the company’s team took ad-

vantage of the marketing expertise they

gained creating customized HubSpot

integrations to create a pre-packaged,

self-service integration offering. The

result, Integrate HubSpot, provides a

low-cost, easy-to-deploy SaaS solution

that integrates the HubSpot marketing

automation platform with Microsoft

Dynamics CRM. Integrate HubSpot

allows companies to purchase, configure

and deploy integrations in just a couple

of hours, and due to the hands-off ap-

proach, LyntonWeb can easily scale the

SaaS solution to serve as many companies

r

8%

7%

0%

1%

.S. Census; Market Realists

Segment, 2013

Cable

Wireline

Others

Residential fixed voice

58%

37%

SoHo

(micro) Business

1-4 Emplyed; $0.2

Trillion in Revenue

SMB Business

5-499 Employed;

$1.9 Trillion in Revenue

Large Enterprises

2,500+ Employed;

Over $3 Trillion in Revenue

and Wireless Revenues,

illions)

2015 2016 2017 2018 2019

Wireline

Wireless

Fixed and Mobile Revenue

Source:

Telco2research.comCharter Business

Mediacom Business

L(3) Enterprise proforma

VZ SBS

AT&T SBS

-

Source: CompTIA, 2014

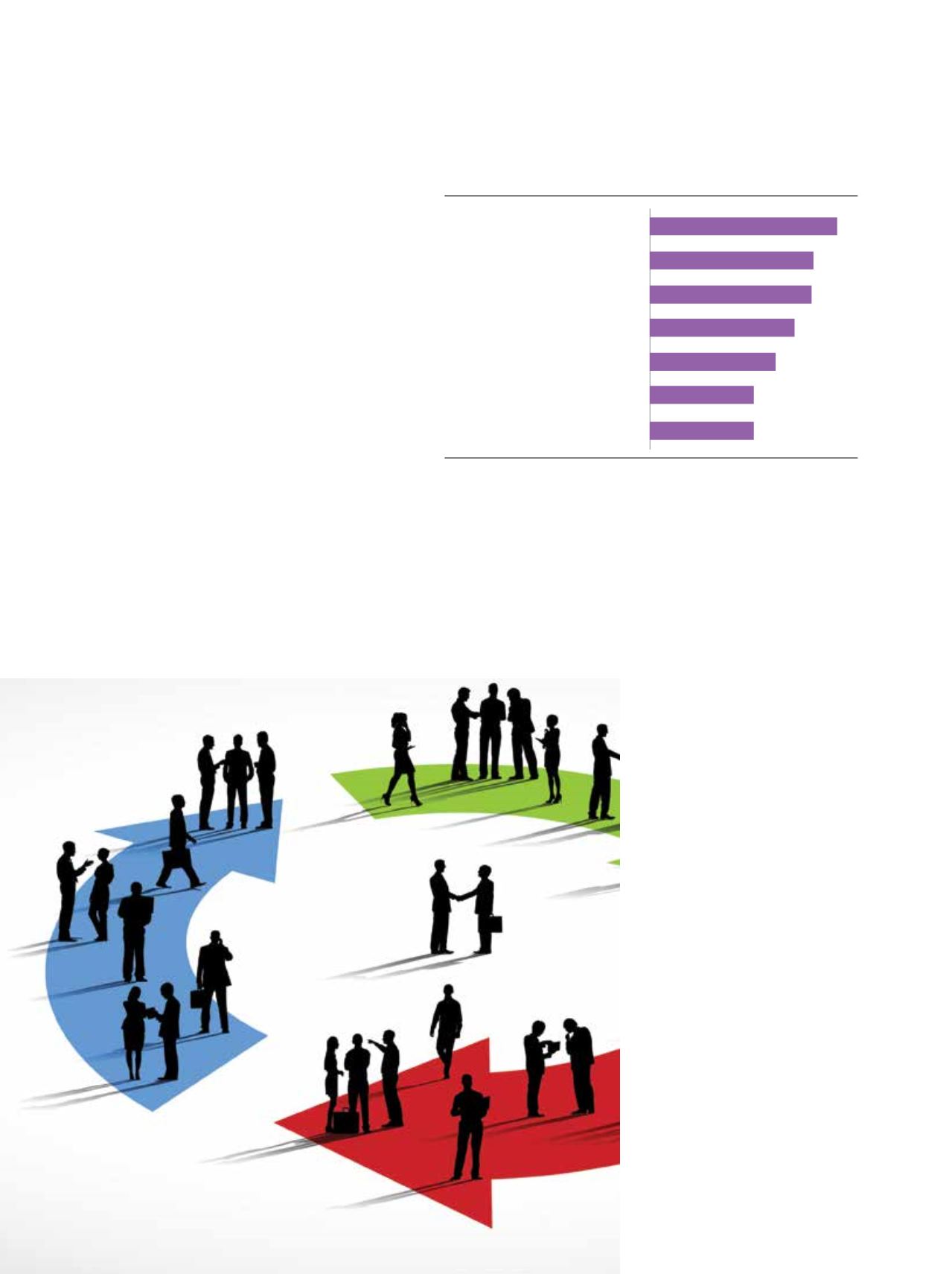

Primary Catalysts for Channel Business Transformation

Cloud pushing in new directions

Demand for new services and IT delivery

Desire for recurring revenue model

New financial models are more lucrative

Vendors pushing for change

Margins on product sales declining

Defensive more against obsolescence

41%

36%

35%

32%

27%

23%

23%

Source: Consumer Intelligence Research Partners

2013 U.S. Mobile Device Sales Pie

Carrier

57%

Amazon

8%

Mass/

Warehouse

11%

Best Buy

12%

Apple

9%

other

3%

Source: Apps Run the World

Enterprise Applications, Cloud vs Non Cloud Revenues, $M

License and Maintenance

Cloud Subscription

250000

200000

150000

100000

50000

0

38555

46502

53050

60681

67447

73133

148424

146924

144896

141498

138133

133066

2014 2015 2016 2017 2018 2019

58

Channel

Vision

|

January - February 2016