Undersea transport providers and other regional or lo-

cal capacity providers actually are indifferent to the specific

size of the “mobile” opportunity. It simply does not matter

whether the underlying demand consists of “mobile access” or

“fixed access” bits.

Other providers, such as data center and cloud computing

providers, likewise are basically indifferent to “mobile” rev-

enue, as such, since their products are largely insulated from

“access” nuances.

In other cases, some industry participants are largely or

completely unable to participate in the mobile business, even

if they might prefer to do so. Smaller fixed network operators

or Internet service providers, for example, might never have

the footprint or capital to become viable contestants in the

mobile business.

In other cases – particularly for telecom channel providers –

there simply might not be a role. Whether that is a “problem”

or not is the issue. For some industry participants, mobile is an

essential part of all business strategy. The question is how im-

portant mobile is for the telecom channel.

Some products are more complicated than others, and fa-

vor use of channel partners that add value. The SMB market,

and computing products, are the classic examples.

Where is the Value?

It is fairly easy to describe how consumers use mobile

channels for e-commerce. It is fairly easy to describe the ways

enterprises or small and medium-sized businesses sell their

products through mobile channels.

Establishing the value of indirect telecom sales channels

for selling mobile services to enterprises and small and mid-

sized businesses is far less clear.

As much as 85 percent to 90 percent of partner sales are

based on use of indirect channels, according to Stephen Dent,

Partnering Intelligence founder.

And yet most participants in the U.S. telecom channel

business know instinctively that sales volume is not driven by

mobility products, if mobility products have any substantial

role in the sales portfolio at all.

Traditionally, channel sales have been most valuable for

products that are moderately complex, in the space between con-

sumer retail and enterprise direct sales. And that is significant.

Many products, even some that once were more complex,

now are simple. And simple is the enemy of channel partner

potential value. With some exceptions, international long

distance is simple. Video entertainment feeds – as used by

business customers – are simple.

As it turns out, mobility also is simple. To be sure, enter-

prises might want to neg

otiate volume purchase agreements.

They might wish to mandate use of virtual private networks

when employees and partners access enterprise databases.

But beyond using VPNs and negotiating volume dis-

counts, business buying and use of mobility services is rather

straightforward.

The mobility buying process also poses little financial risk,

compared to past decades.

The absence of a big “hand-holding” function is a tradi-

tional reason why indirect channel partners often are valuable.

So how do people buy mobile service?

By 2011, perhaps 66 percent of devices were sold di-

rectly through carrier retail stores, according to NPD. Per-

haps 29 percent of devices and associated service accounts

were sold through other retail locations (electronics stores,

grocery stores). Perhaps 5 percent of devices were sold us-

ing online channels.

Mobile service, as it turns out, has become a product more

akin to a consumer packaged good than ever seemed possible

in the past.

What is conspicuous about that pattern is the nearly

complete absence of traditional telecom “channel partner”

sales. There is high involvement by “retailer” channels,

but not the traditional telecom channel partner distribu-

tion mechanism.

That is not to say there are not potential changes coming

in the distribution function. As consumers (business or con-

sumer) become increasingly comfortable with the mechanics

of buying service and devices, there is room for new retailers

(national discount chains or retailers) as well as online chan-

nels to generate higher sales activity.

In 2013, the Apple Store, for example, sold 11 percent

of all mobile phones bought in the United States, and

about 25 percent of all U.S. iPhone sales, according to

Consumer Intelligence Research Partners. Electronics

retailer Best Buy represented 13 percent of U.S. mobile

phone sales.

The CIRP study also confirmed that carrier stores

were the leading channel. Big box retailers such as Target,

Walmart and Costco made up 12 percent of sales, while

Amazon represented about 7 percent of sales and eBay 2

percent of sales.

One might note that mobile is a well-understood product,

easy to source and activate, with few provisioning complica-

tions. That might not have been the case in the 1990s, which

is why mobile service providers opened their own branded

retail stores, allowing them to explain how to use the services

and how to choose devices.

Source:

Telco2research.comCable Business Services and Selected

Competitors’ Revenues

Comcast Business

TWC Business

Charter Business

Mediacom Business

L(3) Enterprise proforma

Cablevision Lighpath

WOW Commercial

VZ SBS

AT&T SBS

$10,000

$8,000

$6,000

$4,000

$2,000

$-

Q1 2012

Q4 2014

Millions

Source: CompTIA, 2014

Primary Catalysts for Channel Business Transformation

Cloud pushing in new directions

Demand for new services and IT delivery

Desire for recurring revenue model

New financial models are more lucrative

Vendor pushing for change

Margins on product sales declining

Defensive more against obsolescence

41%

36%

35%

32%

27%

23%

23%

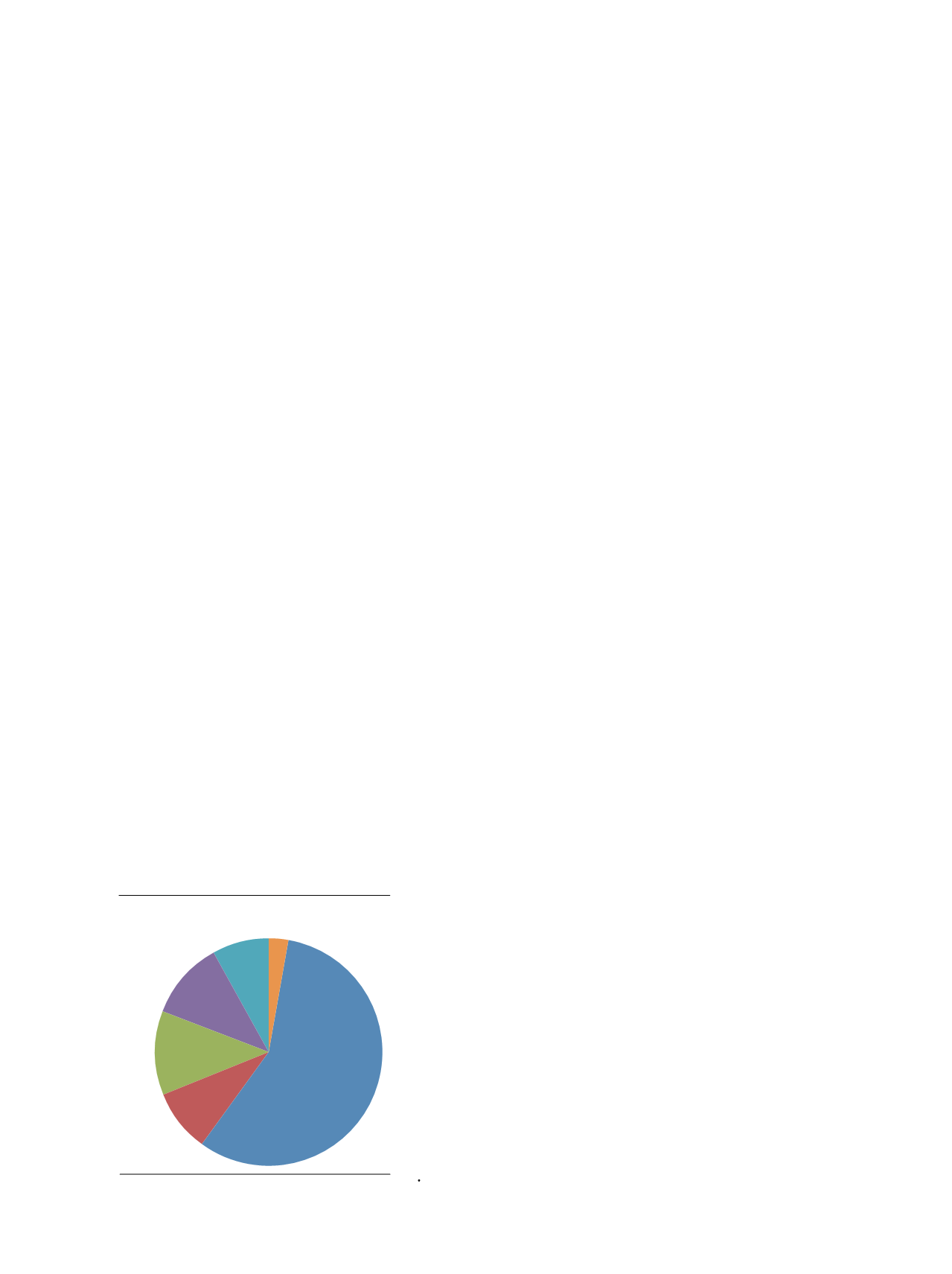

Source: Consumer Intelligence Research Partners

2013 U.S. Mobile Device Sales Pie

Carrier

57%

Amazon

8%

Mass/

Warehouse

11%

Best Buy

12%

Apple

9%

other

3%

Percent Saying “Likely to Respond” to Sales Call

Source:

InsideSales.com87% 87%

78% 78%

61%

43% 39% 35

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Text

Message

Mobile

Phone

Office

Phone

Voicemail Linkedin Instant

Messaging

Faceb

Source: The SIP School

If you could ask one question of your SIP trunk provider wh

Source: Research Triangle Institute

Comparing Respondents Reach

BRFSS, by age

When will you

support HD Audio?

What are you doing to

support FAX over IP?

Can you provide TLS/SRTP for

secure signaling and media?

When will you support SIP

‘profiles’ to match each PBX/SBC

manufac ures’s configurati n?

Other

11.55%

7.37%

0 20 40 60 80

18-24

35

30

25

20

15

10

5

0

25-34 35-44

Percent

Age Category

BRFSS

ICS

Comparing Respondents Reached,

BRFSS, By Education

45

40

35

30

t

62

Channel

Vision

|

January - February 2016