Does it Matter?

It is not clear that the “retail direct” sales model for mo-

bile and some other products necessarily is troublesome for

channel partners. To be sure, the channel would benefit from

ability to sell products representing half of total telecom ser-

vice sales volume. But channel sales is about niches.

True, channel partners have small roles, if any, in

sales of most consumer products, and mobility might be

likened to a consumer product, even when purchased by

business customers.

In that sense, mobility is a product akin to

consumer or even business voice or entertainment

video. There is little opportunity for channel part-

ners to add value in the distribution process.

At a high level, the bad news is that mobil-

ity, while representing half of total telecom sales

volume, offers scant channel partner upside. The

“good news” is that the pattern is not unusual.

Core channel products “always” involve

more-complicated products sold to SMB and

remote enterprise customers. While it is true

that this means the volume of sales opportunity

is limited, that always is the case for distribution

using the channel.

Channel partners always add the highest

value in the space between consumer retail and

enterprise direct distribution. That means prod-

ucts with some complexity, purchased by SMBs and other

business customers.

Simple products costing relatively little, in the consumer

space, can be purchased either online or using retailer chan-

nels. Complex and expensive products representing large

sales volumes can be effectively sold direct by suppliers to

targeted enterprise buyers.

So simple mobility products – devices and services – are

not generally suitable for channel sales.

Some will point to growing use of cloud-based business

software, for mobile users, as a potential area for channel

distribution. That is a developing opportunity, some would

argue. The biggest present opportunity is “software as a

service,” essentially the replacements for shrink-wrapped

software purchased by businesses and consumers.

The next-largest opportunity is outsourced storage and

backup services, part of the “infrastructure as a service” market.

The specific role for channel partners might be said to

be unclear at this point. SaaS is a product provisioned “on-

line,” though how it is sold is a more-fluid matter. Up to

this point, most SMBs might logically use cloud infrastruc-

ture for simple backup and storage purposes.

The point is that neither SaaS nor IaaS are “drop

dead simple.” And that means there is a potential role for

channel partners. The immediate issue is whether the op-

portunity mostly is created for data value added resellers

and integrators, or whether there is room for the telecom

channel to participate.

Right now, the existence of a significant opportunity for

the telecom channel is simply unclear. Traditionally, infor-

mation technology channel partners have “owned” the SMB

space. But cloud computing makes product solutions much

more standardized, and much easier to provision.

The fact that half of telecom revenue now is sold in ways

that do not offer opportunities for the telecom channel part-

ner is notable, but hardly unusual.

Traditionally, that always has been the case, of course.

International and long distance products once sustained the

whole telecom channel.

The portion of telecom service revenue potentially well

suited for the telecom channel always was a fraction of total

revenue opportunity, even after the product suite changed to

various forms of special access and cloud-based business voice.

None of that fundamentally changes, even if mobil-

ity products mostly are suited for “retail” or “consumer”

sales channels.

To be sure, if mobility represents more than half of

sales volume, that also means channel partners have little

role. But that generally has been true for other “con-

sumer” segment products, and for “enterprise” or “data”

products as well.

The nearly complete absence of telecom channel rel-

evance for sales of mobility products might be viewed, in one

sense, as a “missed” opportunity. That likely is inaccurate.

Oddly enough, the emergence of mobility services as the

largest segment of the telecommunications market, and a

segment largely unsuited to telecom channel sales, has not

been an especially “dangerous” development.

In the same way, mobility has not proven especially trou-

blesome for capacity providers, either. In many instances,

mobile backhaul, for example, has created new opportunities,

without the requirement to be involved in the retail side of

the business.

For the largest facilities-based service providers, that

is untrue. Failure to win at mobility can mean failure of

the business.

So the top line does not tell the whole story. Globally,

mobile drives the business. For telecom channel partners,

it does not.

B Business

9 Employed;

illion in Revenue

Enterprises

+ Employed;

illion in Revenue

ireless Revenues,

)

2016 2017 2018 2019

Wireless

and Mobile Revenu

2011

2012

2013

2014

2015

2016

Business network services

Fixed braodband

Fix d voice

Handset data

Mobile broadband

Mobile messaging

Mobile voice

ress; company reports

. Telecommunications and Content Distribution

3 2002 2013

Consumer net

2002 2013

Business

2002 2013

Business et

Cable and other

Wireless

Wireless

185

226

163

139 130

107

Source: Consumer Intelligence Research Partners

Carrier

57%

Best Buy

12%

Apple

9%

Source: Apps Run the World

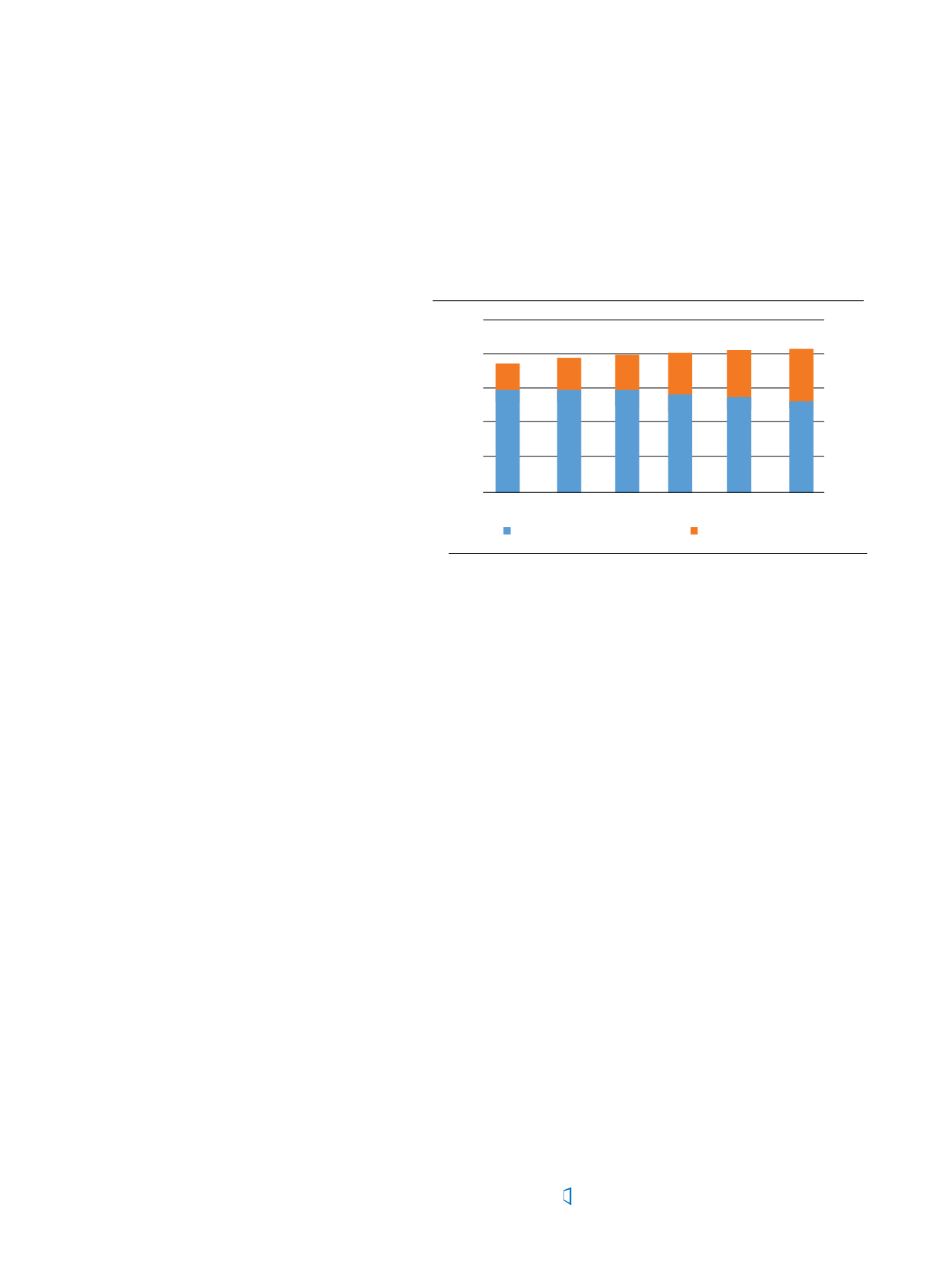

Enterprise Applications, Cloud vs Non Cloud Revenues, $M

License and Maintenance

Cloud Subscription

250000

200000

150000

100000

50000

0

38555

46502

53050

60681

67447

73133

148424

146924

144896

141498

138133

133066

2014 2015 2016 2017 2018 2019

9

14

20

37

Source: Bureau of Labor Stati tics

Percent of employed person who worked at home

in 2014 on an average workday, by education

0

10

20

30

40

Less t an high

school diploma

High school

diploma only

Some college Bachelor’s degree

or higher

Percent

Security Technologies

Source: Infonetics Research

Top 5 Technologies Service Providers Plan to

Deploy Virtualized Security Solutions for in 2015

Web application firewall

Firewall

Web security gateway

Mail security gateway

Next gen firewall

0%

40%

80%

Percent of Respondents

63

January - February 2016

|

Channel

Vision