Virtual Realities

applications running on the network.

But another market approach is for

businesses to use SD-WAN for secure

best-efforts traffic, in order to free up

MPLS for video and voice.

“SD-WAN is seen as an MPLS re-

placement product, but the concern

is that it sends traffic over the best

available connection,” said John Cun-

ningham, founder and co-CEO at BCM

One. “If there’s latency on all the con-

nections, you end up with a not-great

experience. If the broadband connec-

tions aren’t up to the task, SD-WAN

can’t help with that. So a hybrid ap-

proach where some applications are

still on MPLS makes sense for a lot

of companies.”

Having a hybrid option is also neces-

sary if customers have contracts with vary-

ing termination dates, requiring integrated

MPLS and SD-WAN support. “You have to

be looking to make sure the network has

proper routing support and devices that

interoperate with both,” said Baker.

SD-WAN also brings everything under

one roof from a management perspective –

the SD-WAN itself along with any cloud ap-

plications can be managed from one point.

“Moving into the software-defined

realm makes provisioning easier and

also easier to support and do everything

we need to do through the lifecycle,”

Loon said. “We can pretty much do ev-

erything remotely except plug cables in,

and customers like that.”

SD-WAN sales aren’t automatic, how-

ever. Loon explained that getting decision

makers to make the jump from dedicated

circuits to running things over public

broadband can be a bit of a challenge.

“It’s not fully understood by your av-

erage network manager or IT person, so

everyone wants a refer-

ral for their exact use

case,” he said. “This is

very similar to the early

days of VoIP – people

were worried about

quality. But eventually

everyone got the idea.”

There’s also market

confusion about what

SD-WAN actually offers.

“Any time you have a

disruptive tech, there’s

a certain degree of

end user and partner

education, and with this,

everything around orchestration seems to

mean different things to different people,”

Suitor said. “You can say, here’s how to

get the most utilization I can out of the

links, and you can optimize the perfor-

mance on the up and downlink; you can

have voice and video guarantees;

you can do this at distances because

there are offices spread out; it inte-

grates with legacy MPLS; and you can

do all of this with much simpler pro-

visioning, supporting multicast over

a fundamentally unicast environment

like the Internet. Oh and it’s secure.

It all sounds great, but from a market-

ing perspective, it’s a huge challenge

to explain how that works in practice.”

With all of the excitement over SD-

WAN, one caveat is to be aware that the

market is in its heady early days, and

that consolidation will be inevitable.

“Not one company we speak to

isn’t interested in it, and it’s a great

conversation for channel partners to

have in order to be relevant in the WAN

spaces,” Cunningham said. “But chan-

nel partners should understand that the

market is going to change.

“Gartner said there are now about

40+ companies offering SD-WAN. Re-

member when the automobile came

along, there was a time when there were

a hundred car companies,” continued

Cunningham. “We ended up with just

three. That doesn’t mean the other 97

didn’t have good cars.”

Rather, “the market can’t support

all of these companies indefinitely, so

that’s something that CPs should be

aware of,” he said.

That caveat can also be an opportunity.

“Any channel partner with a multi-site cus-

tomer base should get in now,” Baker said.

“And you should go after every big chain

in your market. There’s a lot of money to

make, and there’s no one established as a

dominant player in this yet, so treat it as a

land grab and get as much as you can.”

o

Source: IHS Markit

Source: Samsung; Channelnomics

Which area of mobile security

do you think you are

lacking in?

What are your organization’s top challeges

in network/WAN management at branch

office locations? (Select all that apply)

S urce: Forrester, survey of U.S. network/telecom decision makers

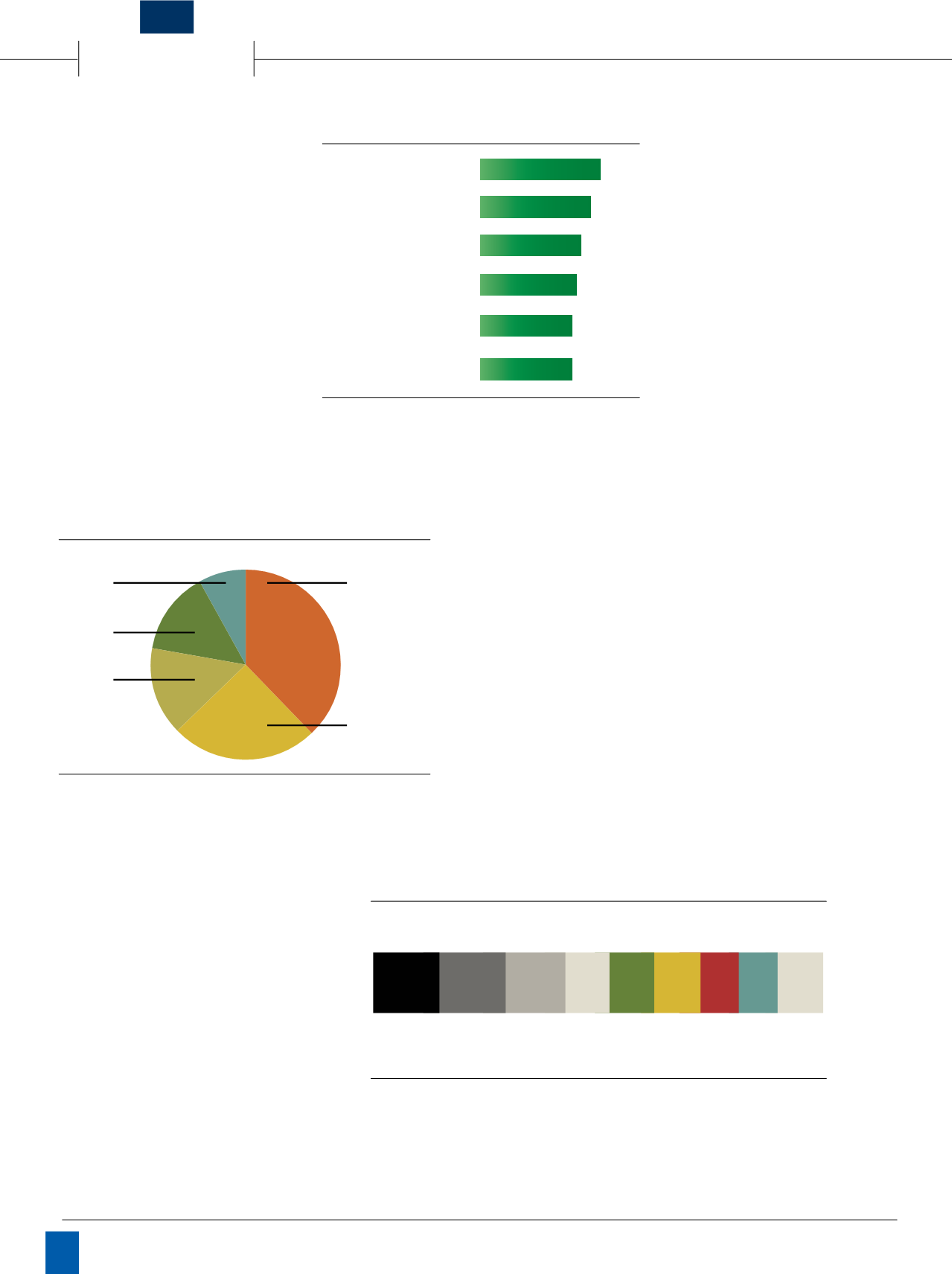

Do you currently have multiple connections to your

branch offices?

Source: IDG Connect, Silver Peak survey of 160 mid-market & enterprise companies

13.3%

20.0%

13.3%

33.3%

Maintaining security across

public and private connections

Managing cost of increased

bandwi th requirements

Ensuring performance of

business-critical applications

Deliv ring reliable and/or

highly available connectivity

Deploying new applications

and services cost efficiently

55%

50%

49%

46%

40%

What kinds of features or capabilities are

you inte ested in to help manag your WAN?

(Percentage rated “very i terested”)

Source: Forrester, survey of U.S. network/telecom decision makers

Centrally monitor WAN links,

dependencies, anomalies

Manage traffic between

different link types

Remotely provision/configure

branch office networks

Ability to deploy WAN services

on com odity computing

Latency mitigation and

application accel ration

Deduplication/caching data to

optimize bandwidth utilization

56%

51%

47%

45%

43%

42%

No 8%

Yes, MPLS

and Broadband

38%

Yes, MPLS

and LTE

25%

Yes, Dual

Internet

14%

Yes, Dual

MPLS Links

15%

$60

$50

$40

$30

$20

$10

$0

2015 2016 2017

1G 2.5G 10G

US$ Billions

Sof war offerings

Hardware offerings

Services

Vendor relationships

Knowledge

20.0%

Source: IHS Markit

Global hosted hosted VoIP and UC seats

will pass the 70 million mark in 2020

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$0

Revenue

Seats

Global Revenue (US$ Millions)

2015

2020

What kinds of features or capabilities are

you interested in to help manage your WAN?

(Percentage rated “very interested”)

Source: Forrester, survey of U.S. network/telecom decision makers

Centrally monitor WAN links,

dependencies, anomalies

Manage traffic between

different link types

Remotely provision/configure

branch office networks

Ability to deploy WAN services

on commodity computing

Latency mitigation and

application acceleration

Deduplication/caching data to

optimize bandwidth utilization

SaaS

Applications

14%

Remote

Replication

13%

None

9%

Voice

8%

Other

9%

Proprietary

Data Center

Application

14%

Workforce

Collaboration

9%

IaaS

9%

Guest

Wi-fi

8%

56%

51%

47%

45%

43%

42%

Is there one application you wish you could run over

the Internet that you are n t today?

Source: IDG Connect, Silver Peak survey of 160 mid-market & enterprise companies

Source: I

Globa

will p

$2,00

$4,00

$6,00

$8,00

$10,00

$12,00

$14,00

$

Global Revenue (US$ Millions)

branch offices?

Source: IDG Connect, Silver Peak survey of 160 mid-market & enterprise companies

)

aS

What kinds of features or capabilities are

you interested in to help manage your WAN?

(Percentag rated “very interested”)

Source: Forrester, survey of U.S. network/telecom decision makers

Centrally monitor WAN links,

dependencies, anomalies

Manage traffic between

different link typ s

Remotely provision/configure

branch office networks

Ability to deploy WAN services

on commodity computing

Latency mitigation and

application acceleration

Deduplication/caching data to

optimize bandwidth utilization

SaaS

Applications

14%

Remote

Replication

13%

None

9%

Voice

8%

Other

9%

Proprietary

Data Center

Application

14%

Workforce

Collaboration

9%

IaaS

9%

Guest

Wi-fi

8%

56%

51%

47%

45%

43%

42%

No 8%

Yes, MPLS

and Broadband

38%

Yes, MPLS

and LTE

25%

Yes, Dual

Internet

14%

Yes, Dual

MPLS Links

15%

Is there one application you wish you could run over

the Internet that you are not today?

Source: IDG Connect, Silver Peak survey of 160 mid-market & enterprise companies

Global Revenue (US$ Millions)

Channel

Vision

|

January - February, 2017

18