Small Businesses

Optimistic

For 2017

Schedule a call

to learn more about our

Business Opportunities and win a prize!

Business Opportunities

$

$

$

Visit booth #917 to enter raffle

*Drawing will be held Thursday, Feb. 9th at 3:30pm

$

Win with

Kaleidoscope

DShine@theKaleidoscope.comW: 800.387.0121 x720 • C: 415.497.3163

www.theKaleidoscope.com22

Channel

Vision

|

January - February, 2017

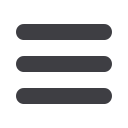

BusinessAnalyst

Staffing Continues Climb

As more evidence of the importance

of business performance impact when

discussing IT purchasing with customers,

the percentage of business analysts as

a percentage of the IT staff has risen for

the third year in a row after this position

suffered a retreat during the early part

of the recovery period, show figures from

Computer Economics. And the research

firm expects the business analyst role will

continue to grow in importance.

“As cloud computing and virtualization

lessen the need for data center staff,

a greater percentage of the IT staff is

shifting to the business side of the IT

organization,” said Computer Economics

researchers. “Business analysts have an

important role in this shift.”

While the business analyst function ap-

pears to have been in retreat during the eco-

nomic recovery period, declining from 7.4

percent in 2012 to a low of 6.3 percent in

2013, the decline may have been deceptive,

said Computer Economics. “It is likely other

functions were regaining lost ground

as opposed to there being a reduc-

tion in business analyst headcount.”

Job titles for business analysts

within companies may vary, but could

include any of the following: business

systems analyst, business process

analyst, enterprise system analyst

or MIS analyst. “The most important

attribute,” said the research firm, “is

that these professionals are busi-

ness-oriented first, and technology-

focused secondarily.”

Despite a dip in holiday sales expec-

tations, small business sentiment over-

all seems to be improving heading into

2017, according to Capital One’s latest

Spark Business Barometer, tracking 400

small business owners’ financial condi-

tions, economic perceptions and hiring

plans, among other indicators.

Half of business owners reported

“good” or “excellent” business condi-

tions in their area heading into 2017,

an increase of 8 points compared to

the first half of 2016 (41 percent) and

slightly above average since the Barom-

eter began tracking business conditions

in 2013. What’s more, 12 percent of

small business owners believe their fi-

nancial position will be “much better” in

the early half of 2017, up three points

from earlier in 2016.

Larger firms, in general, are more

optimistic than smaller firms, with 49

percent of businesses with more than $1

million in annual revenue reporting im-

proved financial positions versus 30 per-

cent of business owners with less than

$1 million in annual revenue. All told,

59 percent of larger small businesses

reported “excellent” or “good” business

conditions in their area, compared to 48

percent of very small businesses.

Female business owners also are

more encouraged by local conditions

than their male counterparts, with 55

percent saying business conditions are

“excellent/good,” compared to 46 per-

cent of men saying the same.

One possible source of the positive

sentiment, 38 percent of businesses

reported increased sales during the

second half of 2016, an increase of

6 points over the first half of the year.

Even so, only 23 percent of small busi-

ness owners plan to hire new employ-

ees in the first half of 2017, slightly

down from earlier in the year. According

to the study, the top three concerns of

small business owners in the coming

year include taxes (47 percent), manag-

ing cash flow (31 percent) and keeping

up with technology (25 percent).

Buyers Side

Business Analysts as Percentage of IT Staff

How does your

organization handle

adoption of new

technology trends?

Source: Computer Economics

Corporate Softwar

Source: 451 Research

Outsourcing Prof

Source: Computer Econo

2012 2013 2014 2015 2016

0%

4%

8% 7.4%

6.3% 6.6%

7.2%

7.3%

12%

Median

Source: Cloudian

When do you intend to deploy cloud storage to support

specific applications running on premises?

0% 20% 40% 60% 80%

Small

(1 to 499 employees)

Medium

(500 to 2,499 employees)

Large

(2,500 or more employees)

Small

(1 to 499 employees)

Medium

(500 to 2,499 employees)

Large

(2,500 or more employees)

Small

(1 to 499 employees)

Medium

(500 to 2,499 employees)

Large

(2,500 or more employees)

We have no plans to

adopt hybrid cloud

storage

Considering

adoption more than

1 year out

Planning implement

within the

next year

62%

77%

82%

19%

20%

14%

19%

3%

5%

0%

20%

40%

15%

60%

80%

More Spe

How would you characteriz

software over the next 90

Frequency

Level

Net Growth

Trend

Volatility

Cost

Success

Service

Success

Low