“Middle market firms are leading business growth in the

United States, outpacing both small and large-sized firms,”

said Jeff Stibel, vice chairman of Dun & Bradstreet. “More

specifically, the service industry continues to lead middle

market growth in terms of revenue, employment and number

of firms, reflecting the larger trend in the U.S. moving from

a manufacturing-based to a service-driven economy.”

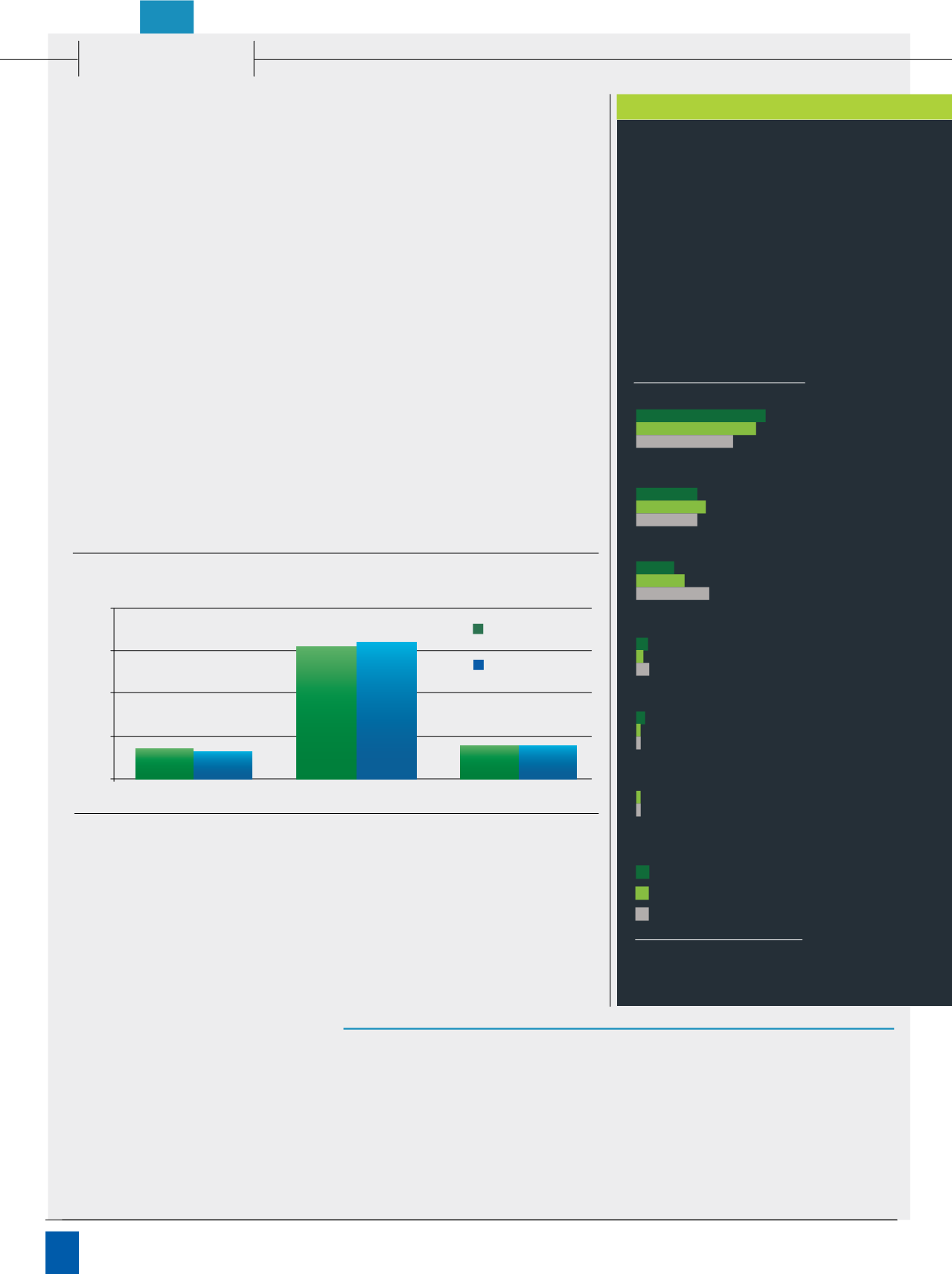

Business Software

Spending Slowdown?

The latest findings from 451

Research suggest overall business

software spending remains “bogged

down,” and the firm expects a decline

in purchasing going forward. The

October 2016 survey of executives

involved in software spending shows

a decrease in spending cuts across

all categories, with CRM and busi-

ness intelligence among the most

negatively impacted.

A total of 13 percent of corporate

respondents say their company will

spend more on software during the

next 90 days, down 2 points from

the previous survey in July. Another

16 percent predict less spending,

unchanged from the previous survey.

Overall corporate capital budgets are

registering a decrease as well. Only

9 percent of respondents said their

company’s cap budget has increased

during the past 90 days, and 18 per-

cent said it has adjusted lower – 3

points worse than previously and 1

point weaker than a year ago.

The number one reason is that

companies “currently do not need to

purchase any new software” (28 per-

cent) – up 5 points from July to the

highest level since October 2011. At

the same time, 20 percent say “exist-

ing software is getting outdated and

must be replaced” but that’s 1 point

lower than previously. Another 10

percent say they are “making better

use of existing resources,” down 3

points from July.

After registering one of the big-

gest increases in the second quarter

of 2016, CRM is now the category

taking the biggest hit, say 451 ana-

lysts. Just 10 percent of respondents

in the October survey said their com-

pany is increasing customer relation-

ship management software spend-

ing during the next 90 days, with 9

percent decreasing spending – a net

8 point drop from July. Spending for

business intelligence (BI), meanwhile,

has fallen 6 points to its lowest read-

ing in two years – with 11 percent

increasing spending during the next

90 days and 7 percent decreasing.

Security software remains a bright

spot in terms of overall projected

spending, but it is down 4 points from

the prior quarter. Spending for data

storage and virtualization also remains

in positive territory, though lower than

the previous three-month period.

Buyers Side

Global Service Provi

Source: IHS Markit

Growth in Global Broadb

Source: Point Topic

Corporate Software Spending Plans for Next Quarter

Source: 451 Research

Outsourcing Profile: Data Center Operations

Source: Computer Economics

0%

20%

40%

15% 13%

62% 64%

16% 16%

60%

80%

Previous Survey

(Jul ‘16)

Current Survey

(Oct ‘16)

More Spending

How would you characterize your company’s spending plans for

software over the next 90 days compared to the previous 90 days?

No Change

Less Spending

Frequency

Level

Net Growth

Trend

Volatility

Cost

Success

Service

Success

Low

Moderate

High

$360

$350

$340

$330

$320

$310

$300

$290

$280

$270

$260

2014 2015

US $Billions

100.00%

80.00%

60.00%

40.00%

20.00%

0.00%

-20.00%

-40.00%

6.5%

Cable

-16.4%

Coppe

20

Channel

Vision

|

January - February, 2017

Source: Deloitte

How does your

organization handle

adoption of new

technology trends?

Source: Cloudian

0% 20% 4

Large

(2,500 or more employees)

Small

(1 to 499 employees)

Medium

(500 to 2,499 employees)

Large

(2,500 or more employees)

We have no plans to

adopt hybrid cloud

storage

Consi

adoption

1 yea

14%

19%

3%

5%

Driven by IT leadership

We have processes in place

for exploring emerging technologies

Driven largely by

business leadership direction

Specialized business units

are focused on innovation

Reactionary (driven by customer/

supplier need or demand)*

Other

53.0%

48.6%

39.4%

24.6%

28.2%

24.8%

15.0%

19.4%

29.4%

4.2%

2.4%

5.0%

3.2%

1.4%

1.4%

0.0%

1.4%

1.4%

The Global Off-Premises Cloud Ser

$150

$200

$250

2016

2015

2014

(US$ Billions)

Out of the Shadows

IT departments may be gaining back control

of IT deployment, at least in terms of

emerging technologies. An increasing number

of mid-market firms say IT leadership is in

the driver seat when it comes to handling the

adoption of new technology trends, according

to a survey by Deloitte.