By

Martin

Vilaboy

B2B Chatter

How fragmented is B2B marketing? When con-

sidering B2B tech purchases of $10,000+, at least

a quarter or more of respondents site any one of

10 possible sources of research and information

prompted in an Arketi Group survey. We could eas-

ily add a handful of others sources to the list.

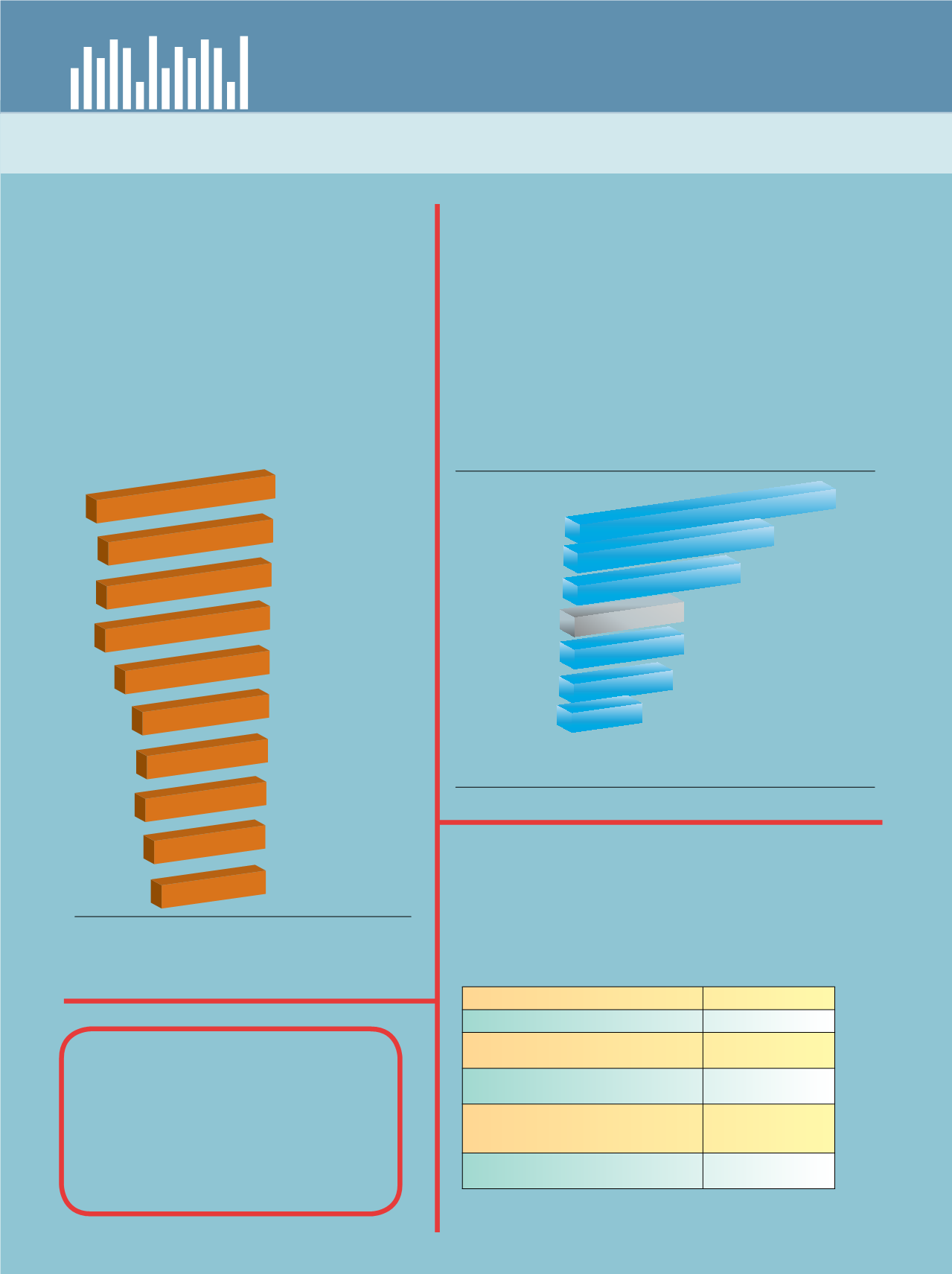

Services Sectors Lead Opex Growth

The modest growth in IT operational spending in 2016 is

being led by the services sectors, which far outpace the slow

or no-growth manufacturing, distribution and public sector,

according to the annual Computer Economics IT spending

and staffing benchmark study.

Small Clouds but Forming

Research from IDC suggests smaller firms are still on

the fence about cloud computing but moving forward are

expected to rapidly increase adoption over the coming years.

Source: Arketi Group

Perceived risk of network-connected

endpoints in 2016

(Percentage of IT pros who selected “moderate” or “high” risk)

Source: Forrester Research

Customer relationship management

Commerce servers

ePurchasing and business networks

Human resources management

Risk management and payment

Supply chain management

Governance, risk, and compliance

Financial management systems

Product life-cycle management

Call center/contact center systems

Manufacturing resource management

Electronic design automation

Industry analysts

Internal colleagues

Vendor face-to-face meeting

Vendor website

Case studies or

customer testimonials

Vendor comparison charts

Industry/professional online

communities or forums

Live or in-person demo

Web searches

Tradeshows and

conferences

Total, business proc ss applications

55%

53%

41%

38%

30%

23%

22%

11%

10%

7%

3%

34%

42%

40%

40%

40%

36%

32%

31%

31%

29%

28%

In-Use (Not Including Pilots)

In Pilot/Proof of Concept

Planning to Implement in the Next 6 Months

Planning to Implement in the Next 12 Months

Planning to Implement in the Next 24 Months

37.6%

10.3%

2.8%

6.2%

7.2%

DCIM Adoption Plans

y platform (ReversingLabs)

Source: IHS

Number of Global VoLTE Subscribers

Source: Computer Economics

Change in IT Operational Budgets from Prior Year:

All Sectors

Source: CBRE, eMarketerx

Number of Stores that Retailers

Worldwide Plan to Open in 2016

23%

21%

20%

2019E

2020E

nabling

752%

500% 600% 700% 800%

Prof./Tech. Services

Financial Services

Health Services

All Sectors

Process Manufacturing

Retail/Wholesale

Government/Nonprofit

Discrete Manufacturing

2016

2018

2020

1.2

1.0

0.8

0.6

0.4

0.2

0

Global Vol TE Subscribers (Billions)

4.7%

3.6%

3.0%

2.0%

2.0%

1.8%

1.3%

0.0%

Median

None

1%

1-5

19%

6-10

25%

11-20

23%

40+

17%

21-30

10%

31-40

5%

21

Percentage of an average

employee’s work week

spent away from their

desk, 25% for middle

managers and 37% for

executives, according to

BT Research.

Cloud Enthusi sm Amo g Small Businesses

(Fewer than 50 Employees)

Small businesses “embracing” the cloud

11%

Small businesses currently deploying cloud

29%

Small business saying they are “evaluating”

whether to adopt cloud

35%

Small businesses planning to deploy cloud-

based office tools and productivity software

56%

Small businesses that are using or planning

to adopt a cloud solution for email and

collaboration

63%

Small businesses that will “fully adapt” to the

cloud by 2020

78%

Source: IDC

data

POINT

NUMBERS WORTH NOTHING

18

CHANNEL

VISION

|

July - August 2016