Mallen also said that if other European countries

elect to follow suit with their own exits, there could be

disruption in Europe-based equities. But Mallen said

he doesn’t believe the Brexit, in isolation, will be nega-

tive either for the U.S. or for the United Kingdom. Ulti-

mately, Mallen says he believes the U.K. will become a

pseudo-member of the EU, similar to the relationships

Norway and Switzerland have with the EU.

“I believe it’s a positive move for the U.K.,

giving it more freedom to act independent of

EU governance,” Mallen said. “The U.K. has

more to offer the EU than the EU has to offer

the U.K.”

In terms of impact on the market, the at-

tention actually should be on the presidential

election, he added.

“As much as Brexit was a welcome reprieve

from the election, I believe that within weeks

the U.S. elections will become the primary glob-

al-market media focus and that will continue

through November,” Mallen says. “It promises

to be a volatile campaign that, I believe, will

impact global markets directly.”

Tech Company

Operational Worries

Despite positive outlooks such as Mallens,

others point out that there will almost certainly

be consequences for those that do business

with the U.K.

For tech companies, currency fluctuation is

at the center of much of the short-term con-

cern. As companies are looking to invest more

in overseas growth markets, a strong dollar works against

those efforts. According to Mark Mulligan, managing direc-

tor of MIDiA Research, “buying goods and services from

across the globe, not just Europe, looks set to become

more expensive for media and tech companies of all sizes

due to the weakening of the pound on the international cur-

rency markets. Though the flip side of a weakened pound

is that British goods are cheaper to buy, so export demand

could rise.”

The British pound hit its lowest point since 1985 right

after Brexit, losing 7 percent of its value against the dol-

lar, while the euro saw its biggest drop (16 percent) since

it was introduced in 1999. It recovered but has trended

weaker than before the vote.

Some companies have plans in place to combat this,

including Discovery, which said: “In the short-term and me-

dium-term, our currency hedging program will significantly

minimize the foreign exchange impact of the Brexit vote on

our financial performance.”

That said, it’s not just the big guys at risk. “There could

be countless implications for the U.K. media and [related]

sectors, but smaller companies such as independent

labels, independent production companies and tech start-

ups look set to be hardest hit,” Mulligan said.

For instance, companies are also evaluating whether

to keep outposts in the post-Brexit capital.

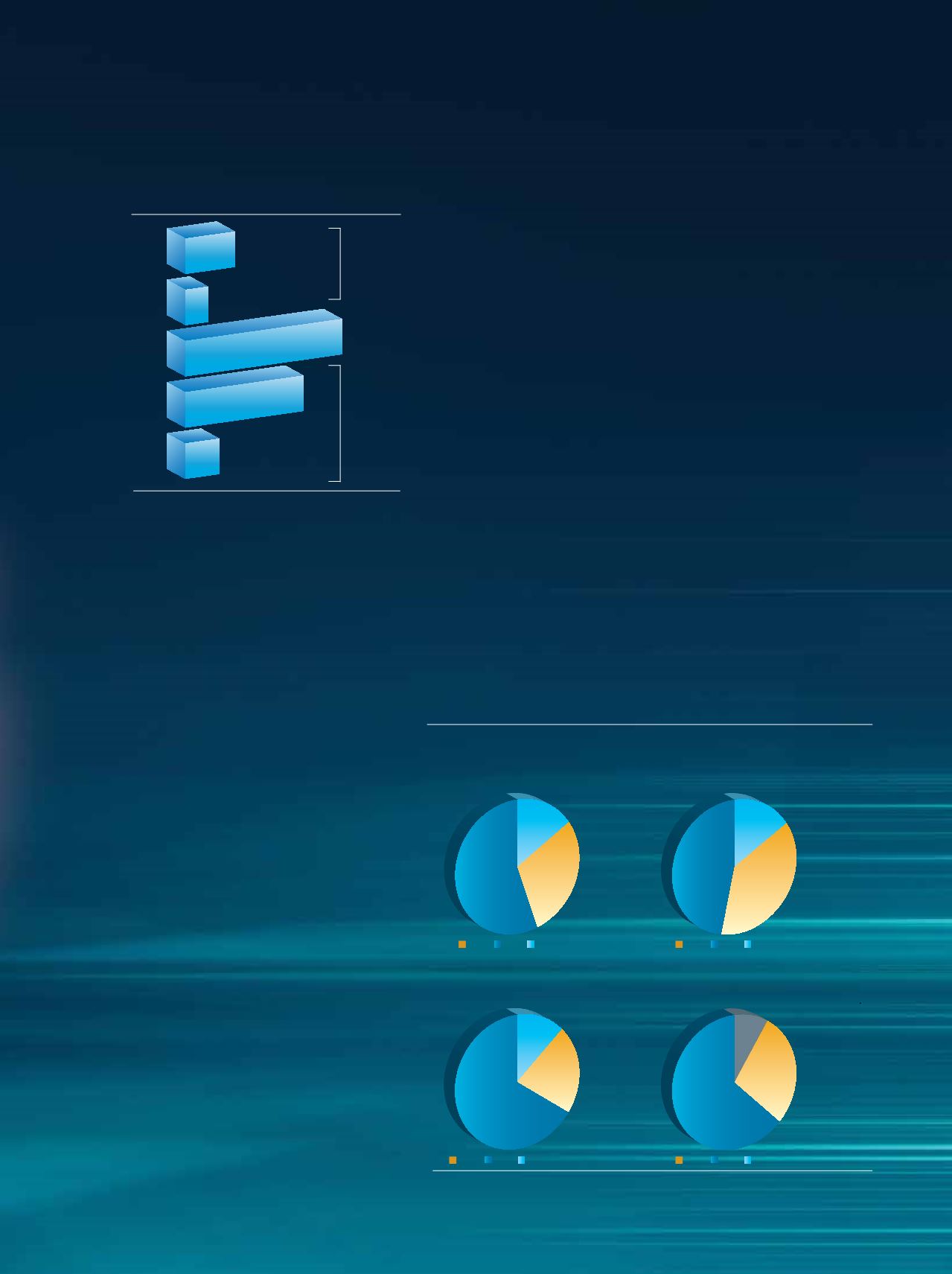

How do you think a Britain exit from the EU

would affect your company’s competitiveness

in UK and European markets?

CompTIA UK Members Respond to Brexit

Source; CompTIA

Are you in favour of Britain

leaving the EU?

Would your employment strategy

change if Britain were to leave

the EU?

Do you think US vendors will shift

their focus away from the UK if it

were to leave the EU?

Do you think Britain leaving

the EU would affect the purchsing

decisions of your clients

13%

6%

41%

31%

9%

Very positively

Positively

Neutral

Negatively

Very negatively

Source: CompTIA, among UK members

19% NET Positively

40% NET Negatively

If Britain were to leave the EU, how do you think it

would affect your company’s profitability?

16%

19%

28%

13%

22%

28%

9%

63%

47%

53%

66%

38%

Yes

Not sure

No

Yes

Not sure

No

Yes

Not sure

No

Yes

Not sure

No

9%

Very positively

15% NET Positively

Source: 451 Research

Channel-Oriented Revenue Expe

Opinions based on those expecting to ma

Estimated Global Cybersecurity Market

Deployment/integration

Infrastructure related

(i.e. networks, cloud)

Selling/Reselling loT products

Consulting/Advisory services

Complete solutions involving

HW + SW + services

Managed loT services

Cybersecurity/data loss

prevention/privacy

Data analytics/Business

intelligence

Repair/Troubleshooting/

Break-Fix

Custom app development

loT focus areas

(i.e. Smart Cities)

2015E

2016E

2017E

USD (Billions)

$160

$80

$0

Connected Car

Connected TV

Mobile/Network

PCs

loT Devices

Wearables

How do you think a Britain exit from the EU

would affect your company’s c mpetitiveness

in UK and European marke ?

CompTIA UK Members Respond to Brexit

Source; CompTIA

Are you in favour of Britain

leaving the EU?

Would your employment strategy

change if Britain were to leave

the EU?

Do you think US vendors will shift

their f cus away from the UK if it

were to leave the EU?

Do you think Britain leaving

the EU would affect the purchsing

decisions of your clients

13%

6%

41%

31%

9%

Very positively

Positively

Neutral

Negatively

Very negatively

Source: Com TIA, amo g UK members

19% NET Positively

40% NET Negatively

16%

19%

28%

13%

22%

28%

9%

63%

47%

53%

66%

38%

Yes

Not sure

No

Yes

Not sure

No

Yes

Not sure

No

Yes

Not sure

No

D (Billions)