comes new opportunities for

resellers to expand their busi-

nesses by adding or refining new

services, products and solutions

that are in line with their busi-

ness goals and objectives, while

maintaining their existing compe-

tencies and customer base.

Global Regulations,

Local Businesses

The continued upsurge in ma-

licious data breaches worldwide

have heightened interest among

regulators, IT professionals and

corporate executives in data

security technologies that mitigate the

risks of sensitive data falling into the

wrong hands.

It’s this keener interest that may

be leading to the recent influx in cross-

border security regulations. Take, for

example, the General Data Privacy

Regulations (GDPR) recently adopted in

Europe, which are having a big impact on

security. Companies today are just start-

ing to sort out what GDPR implementa-

tion means to them, and these new rules

governing trans-Atlantic data transfers

will have an even greater impact in the

coming months and years. Taking the

GDPR legislation one step further is the

EU Privacy Shield regulation – recently

adopted between the EU and the U.S. –

which imposes even stricter obligations

on American companies to safeguard

the personal data of European citizens,

covering everything from health data to

social media activities.

Regulations such as these – and the

direct obligations they impose on U.S.

enterprises – present enormous oppor-

tunities to channel partners looking to

expand in the security space.

Innovative Solutions =

Channel Growth

Digital disruption is constantly

changing the IT landscape, presenting

opportunities for vendors to innovate

and bring new, game-changing solu-

tions to customers. While the host

of new opportunities has been trans-

formative for the way companies do

business, it also has introduced new

challenges that businesses are not

used to dealing with. The good news,

based on recent Ponemon Institute

studies, is that encryption technolo-

gies provide the second-highest ROI

for customers in safeguarding their

data. Partners open to learning about

encryption and tokenization technolo-

gies that address an existing and

growing customer problem will thrive

in this changing environment.

To help partners bring encryption so-

lutions to the market – and achieve prof-

itable ROI for the organization – it’s im-

portant for a vendor to take a strategic

approach in bringing their solutions and

offerings into the channel. They must re-

search their distributor and their reseller

base to understand their strengths and

weaknesses in adopting security solu-

tions that are “channel ready” today.

They must ensure that the partnerships

targeted are those that “match” the

offer with their expertise, services skills

and installed-based customers in key

market segments and industries. It’s

very important for the vendor, as well

as their distributors and resellers, to

ensure all their investments pay off and

achieve their long-term revenue

growth and success.

For example, resellers that

focus on storage and server

hardware infrastructure are a

logical choice for a security “at-

tach” solution. They are already

selling to the individuals and

organizations that buy servers

and disk arrays. Adding on or

upgrading to a solution within

that customer’s environment

to provide greater security for

data-at-rest is a logical next

step and great way for partners

to begin to “add data security”

and secure solutions to their portfo-

lios and business expertise.

Partners that focus on Microsoft-

based software solutions can also add

an encryption email solution easily to

their portfolio. They can use their ser-

vices expertise to help customers pro-

tect their current Outlook or Office 365

customer base with added functionality

and benefits through offering a new

email encryption solution.

Not all security solutions for the

channel, however, are as turnkey as the

two examples above. Tools that provide

security for data in-use and data in-

motion solutions are a perfect example.

Here, successful partners need a robust

knowledge of tool kits, API, ETL tools,

integrations, business applications, etc.,

as data is moving in and out for analy-

sis. These security solutions require

robust security knowledge and security

consulting expertise to understand how

to have customer conversations, find

projects, address needs, do a proof-of-

concept and close the deal.

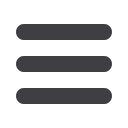

Source: Ponemon Institute; HPE Security; among 252 companies studied

The cost of cyber crime

Source: Forreste

Global ap

(percentage

Source: BIA Kelsey, U.S. market

Calls Driven to Business s fr m Search

Source: IHS

Number of Global VoLTE Subscribers

2010 2011 2012 2013 2014 2015 2016 2017 2018

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Paid Search

Organic Search

Mobile Search

34%

33%

%

%

%

%

E

2020E

Maximum

Mean

Median

Minimum

$7,217,030

$58,095,571

$60,525,947

$65,047,302

$7,574,791

$7,721,552

$5,479,234

$6,021,893

$5,533,432

$373,387

$567,316

$307,800

$15,000,000 $30,000,000 $45,000,000 $80,000,000 $75,000,000

FY2014 FY2015

FY2013

Five leadin

process ap

(IBM, Infor,

Oracle, SAP

Five leadin

process ap

(Adobe, Int

Salesforce,

All other ve

100%

80%

60%

40%

20%

0%

Source: Forreste

Global bu

by type of

Softwar

a perce

Source: Forr

2011 20

Customer re

ePurchasing

Human

Risk ma

Su

Governanc

Financi

Product

Call center

Manufacturin

Electr

Total, busine

2016

2018

2020

1.2

1.0

0.8

0.6

0.4

0.2

0

Global Vol TE Subscribers (Billions)

y Do you think US vendors will shift

their focus away from the UK if it

were to leave the EU?

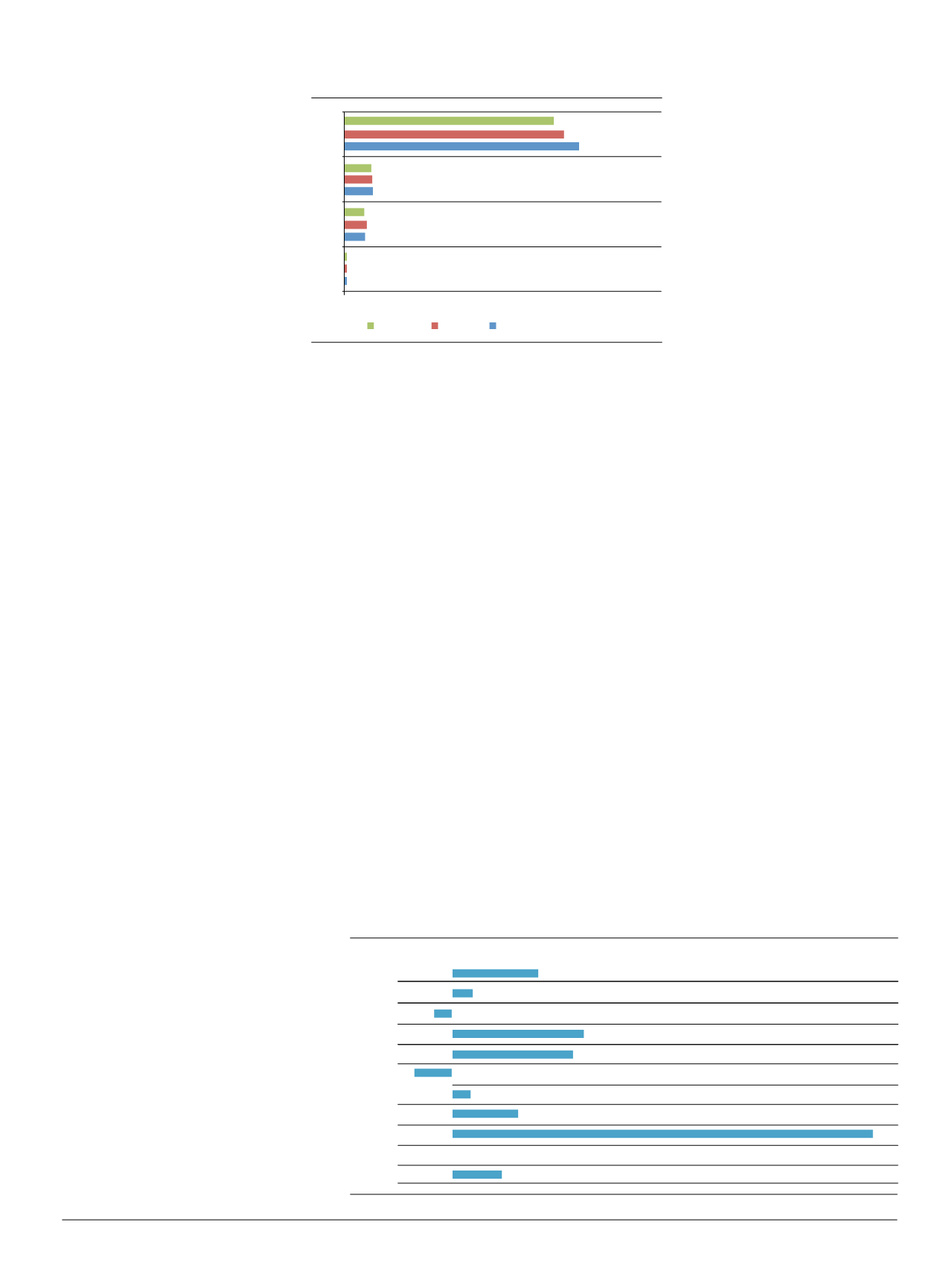

Yearly growth in newly discovered malware samples by platform (ReversingLabs)

Source: HPE Security

bers

he EU, how do you think it

ny’s profitability?

Cybersecurity Market A nu l For cast

28%

9%

63%

Yes

Not sure

No

Yes

Not sure

No

56%

22%

15% NET Positively

28% NET Negatively

ers

ment efforts to

esses have

6%

- Next 12 Months

top three information security projects over

22%

20%

18%

Source: 451 Research

Source: BIA Kelsey, U.S. market

Source: Business Insider Intelligence

Estimated Global Cybersecurity Market

(i.e. Smart Cities)

2015E

2016E

2017E

2018E

2019E

2020E

USD (Billions)

USD (Billions)

Global

$160

$80

$0

Connected Car

Connected TV

Mobile/Network

PCs

loT Devices

Wearables

$160

$140

$120

$100

$80

$60

$40

$20

$0

2015E 2015E 2015E 2015E 2015E 2015E

Android

Document

FreeBSD

iOS

Linux

MSIL

Other

Perl

PHP

UNIX

Windows

116%

153%

35%

235%

212%

33%

752%

88%

-2%

-67%

-33%

-100% 0%

100% 200% 300% 400% 500% 600% 700% 800%

40

CHANNEL

VISION

|

July - August 2016