implement UC, it will definitely be cloud-based,” found

UBM Tech researchers.

Of course, a cloud delivery model, in and of itself,

is not enough. UCaaS providers also have stepped up

their games.

“UCaaS offerings are increasingly functionally compet-

itive with their premises-based alternatives,” write Gart-

ner analysts Daniel O’Connell and Bern Elliot in the firm’s

most recent Magic Quadrant report on the category. Key

improvement in 2015, says Gartner, include an improved

UCaaS user experience, API connectivity with leading

cloud applications and mobile-first user deployments.

Among specific providers, Star2Star recently intro-

duced StarBox CCM 2.0 to facilitate onboarding and

support for large enterprises with specialized or com-

plex dialing needs. The company also introduced Star-

Band to its UCaaS offering, which supports primary and

secondary circuit support, traffic prioritization and auto-

matic failover and service quality monitoring. Recently

added capabilities also include Android mobile support,

screen sharing and an automated quoting tool.

Last year Mitel, for its part, acquired Mavenir to enhance

its mobility capabilities. The Mitel Open Integration Gateway

(OIG), meanwhile, supports integrations with Salesforce,

SugarCRM, Google, Microsoft, NetSuite and Zoho, as well

as custom integrations. And a partnership with Vidyo has

improved Mitel’s video capabilities, says Gartner, while also

enabling integration with Polycom and Cisco video.

RingCentral likewise continues to expand its capabili-

ties and in 2015 added integration with Google Apps for

Work, Microsoft Office 365, and a RingCentral-branded

contact center developed with inContact.

The good news for all providers and resellers of uni-

fied communications: UC adopters are seeing results.

According to UBM Tech findings, 82 percent of adopters

reported they their UC deployment met or exceeded their

expectations for improved team collaboration, which was

the number one expected benefit. Eight in 10 said UC

met or exceeded expectations in terms of improved user

productivity, while three-quarters said the same about

lowering technology ownership cost. All told, 87 percent

of adopters say UC met or exceeded their expectations.

And even more good news for UCaaS providers, ac-

cording to UBM Tech findings, whereas 47 of current us-

ers opted for on-premises UC, only 13 percent of future

adopters are likely to choose on-premises.

Source: UBM Tech, XO

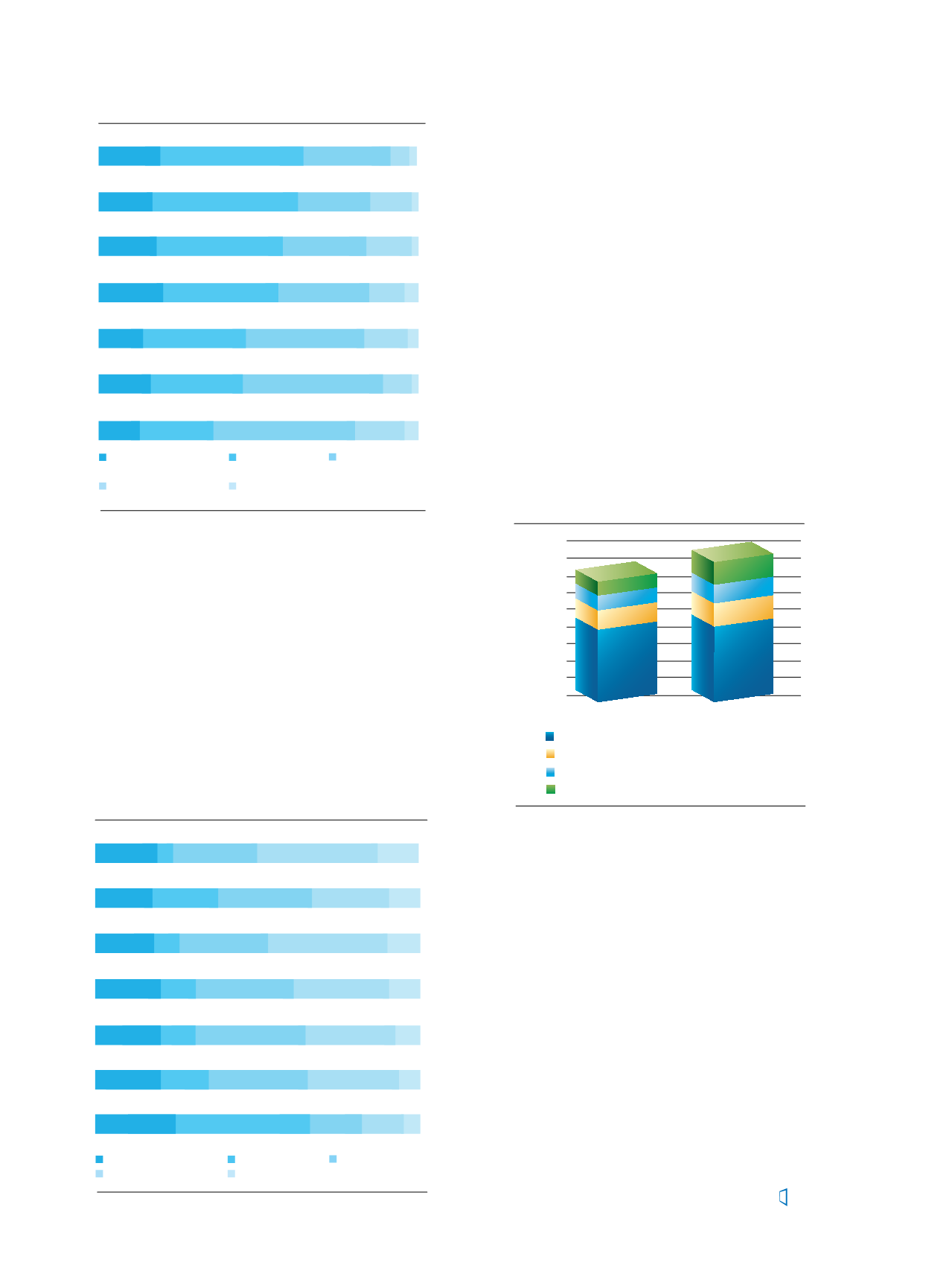

Over the next 5 years, hosted VoIP and

UC will be the segment with the largest

growth in the global VoIP and

unified communications market

IT security solutions expected to have an increas

Source: Spiceworks

Don’t know

Little or no

difficulty

Moderate difficulty

Significant difficulty

Almost derailed

the project

40

60

20

0

40

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

60

20

0

36%

32%

30%

30%

Intrusion

detection

Content

filtering

Firewalls

VPN

MDM

software

Patch

management

Penetration

testing

Anti-spam

25%

24%

23%

23%

Top Internal Security Pain Points

Source: UBM Tech, XO

How much difficulty did each of the

following present during your organization’s

UC implementation?

Choosing on-premises or cloud

Choosing UC vendor(s)

Solutions did not work as promised

Cost or time overruns

End-user adoption

Funtional problems during pilot

Technical complexity

19%

17%

45%

23% 13% 2%

18%

40%

26%

14% 2%

20%

36%

29% 11% 4%

14%

32%

37%

14% 3%

16%

29%

44%

9% 2%

13% 23%

44%

16% 4%

45%

27% 7% 2%

Don’t know

Not an obstacle Moderate obstacle

Significant obstacle

Deal-breaking obstacle

Source: UBM Tech, XO

How much of an obstacle i each of the

following to your organization’s adoption

of UC?

Cost

Lack of in-house technical expertise

Management not sure about benefits or ROI

Perceived risk of disruption

Confusing choices or conflicting vendor claims

IT not sure about benefits or ROI

Previous bad experiences

19%

18%

20%

29%

23% 10%

18% 8% 27%

37%

10%

20% 11% 30%

30% 9%

20% 11%

34%

27%

8%

20%

15%

30%

29%

6%

25%

41%

16% 13% 5%

5% 26%

37%

13%

Revenue (US$ Billions)

Source: Veeam

Lack of DR site

Lack of DR expertise

Cost of current DR infrast ucture

Lack of available personnel

Assistance with DR planning/testing

Assistance after disaster

Internal or external regulations

33%

33%

Source: UBM Tech, XO

Over the next 5 years, hosted VoIP and

UC will be the segment with the largest

IT security soluti ns expected to have an incre

Don’t know

Li tle or no

difficulty

Mod rat difficulty

Significant difficulty

Almost derailed

the proj ct

40

60

20

0

40

60

20

36%

32%

30%

30%

Intrusion

detection

Content

filtering

Firewalls

VPN

25%

24%

23%

23%

Avoidance of ongoing op

Faster time-to-befefit

Greater reliability or resiliency

47%

44%

35%

Source: UBM Tech, XO

How much difficulty did each of the

following present during your organization’s

UC implementation?

Choosing on-premises or cloud

Choosing UC vendor(s)

Solutions did not work as promised

Cost or time overruns

End-user adoption

Funtional problems during pilot

Technical complexity

19%

17%

45%

23% 13% 2%

18%

40%

26%

14% 2%

20%

36%

29% 11% 4%

14%

32%

37%

14% 3%

16%

29%

44%

9% 2%

13% 23%

44%

16% 4%

45%

27% 7% 2%

Don’t know

Not an obstacle Moderate obstacle

Significant obstacle

Deal-breaking obstacle

Source: UBM Tech, XO

How much of an obstacle is each of the

following to your organization’s adoption

of UC?

Cost

Lack of in-house technical expertise

Management not sure about benefits or ROI

Perceived risk of disruption

Confusing choices or conflicting vendor claims

IT not sure about benefits or ROI

Previous bad experiences

19%

18%

20%

29%

23% 10%

18% 8% 27%

37%

10%

20% 11% 30%

30% 9%

20% 11%

34%

27%

8%

20%

15%

30%

29%

6%

25%

41%

16% 13% 5%

5% 26%

37%

13%

What are drivers for your cust

DRaaS? (Select all that apply)

Source: Veeam

Lack of DR site

Lack of DR expertise

Cost of current DR infrastructure

Lack of available person el

Assistance with DR planning/testing

Assistance after disaster

Internal or external regulations

33%

33%

What are the top three tasks your company uses

cloud computing to complete?

Source: IHS, Inc.

Over the next 5 years, hosted VoIP and

UC will be the segment with the largest

growth in the global VoIP and

unified communications market

2015

2020

File Storage

/Disaster Recovery

App Deployment

p Testing/Development

Mobility

Collaboration

28%

22%

20%

21%

21%

20%

16%

17%

18%

13%

19%

14%

11%

12%

14%

12%

10%

14%

$90

$80

$70

$60

$50

$40

$30

$20

$10

$0

Third

Priority

Second

Priority

First

Priority

Don’t know

Not an obstacle Moderate obstacle

Significant obstacle

Deal-breaking obstacle

Source: UBM Tech, XO

Lack of in-house technical expertise

Management not sure about benefits or ROI

Perceived risk of disruption

Confusing choices or conflicting vendor claims

IT not sure about benefits or ROI

Previous bad experience

18%

20%

29%

23% 10%

18% 8% 27%

37%

10%

20% 11% 30%

30% 9%

20% 11%

34%

27%

8%

20%

15%

30%

29%

6%

25%

41%

16% 13% 5%

Residential/SOHO VoIP

Business VoIP - IP Connectivity

Business VoIP - Hosted VoIP & UC

Business VoIP - Managed IP PBX

Global Revenue (US$ Billions)

34

Channel

Vision

|

May - June 2016