Once again, the cloud comes to the rescue.

Of course, cloud or hosted UC is nothing new either.

The concept of cloud communications and the basis of

UC-as-a-service (UCaaS) go back at least 15 years. But

it’s only more recently that UCaaS has hit performance

and feature levels rivalling on-premises solutions. And

many pundits and proponents believe the cloud is ready

to push a powerful second wave of UC adoption.

“Private and public cloud-based UC-as-a-service solu-

tions are expected to fuel the next phase of growth,” says

BCC Research analyst Nandita Bhotika. “The cost efficien-

cies and operational flexibility of these shared services

are proving a potent model for market players. Although

challenges in its adoption are still a concern, UCaaS is

expected to give the UC&C market its needed boost.”

BCC researchers expect the market for UCaaS to

total nearly $18 billion by 2020, up from $6.5 billion in

2015 and reflecting a five-year CAGR of 22.5 percent.

Much of the growth, say BCC, will be driven by wider

adoption among SMBs, which tend to find cloud-based

services more accessible due to smaller capital outlays.

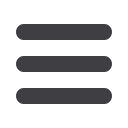

UC&C Market Size and Expectations

Service Type

2015

2020

CAGR

Global UC&C market total

$26.5 billion $62 billion

18.5%

On-premises deployments $18.2 billion $37.8 billion 15.7%

Hybrid deployment

$1.8 billion

$6.2 billion 28%

UCaaS

$6.5 billion

$18 billion

22.5%

Source: BCC Research

According to Diane Myers, senior research director at

IHS, Inc., hosted UC seats, which made up 22 percent of

the unified communications market in 2014, will jump to 46

percent of the market by 2019. Myers says hosted PBX and

UC services are being pitched alongside SIP trunking as more

multi-site businesses seek out hybrid solutions. Markets and

Markets, meanwhile, makes an even more ambitious fore-

cast, putting the UCaaS market at $24.88 billion by 2020.

Here again, the research firm attributes much of this growth

to SMB adoption as these buyers look to update and simplify

communication processes at an affordable cost.

In a bit of a twist, the optimism around future cloud

UC adoption has a lot to do with the reasons why busi-

nesses have not adopted UC up to this point. And, not

surprisingly, the top barrier to UC adoption, at least ac-

cording to UBM Tech’s findings, has to do with perceived

costs and subsequently getting an ROI on those expens-

es, both of which were named by about three-quarters of

respondents. For more than two-thirds of non-adopters,

UC implementations are perceived as posing a risk of

disruption to the business, while 62 percent cited a lack

of in-house technical expertise.

“The cloud may well provide one possible answer,”

say UBM Tech analysts.

Indeed, more than half (54 percent) of respondents

who don’t yet have UC in production believe cloud can

help overcome their top obstacle to implementation:

cost, while about the same percentage (53 percent) see

the cloud as offering more flexible scalability – a key

concern for incremental UC rollouts, say UBM analysts.

In addition to addressing objections about upfront

capital investment, the as-a-service model also is known

to alleviate issues with internal IT skills shortages,

while allowing firms to bypass technical implementa-

tion issues and, in turn, start delivering results to the

business sooner. A cloud-based deployment also can

facilitate the kind of smaller-scale pilot that can provide

the proof-of-value executives need to green-light broader

enterprise adoption, UBM Tech researchers point out.

“These advantages, combined with ongoing ad-

vancement in cloud technology and market acceptance

of the cloud model, are making it more likely that future

adopters will opt for some type of UC-as-a-service offer-

ing,” says the UBM Tech study.

Among respondents who made their decisions to

implement UC a year or more ago, for instance, only 35

percent even considered the cloud, and just 19

percent wound up going with a cloud-based solution. Of

respondents who are still contemplating their UC imple-

mentations, on the other hand, more than half say they

are now likely to consider cloud. “In fact, 15 percent

have already made up their minds that if and when they

Source: IHS, Inc.

Hosted UC seats made up 22% of the unified communication

services market in 2014, growing to 46% in 2019

70%

2014

2019

35%

0%

Source: UBM Tech, XO

Next Wave of UC

Don’t know

Little or no

difficulty

Moderate difficulty

Significant difficulty

Al ost derailed

the project

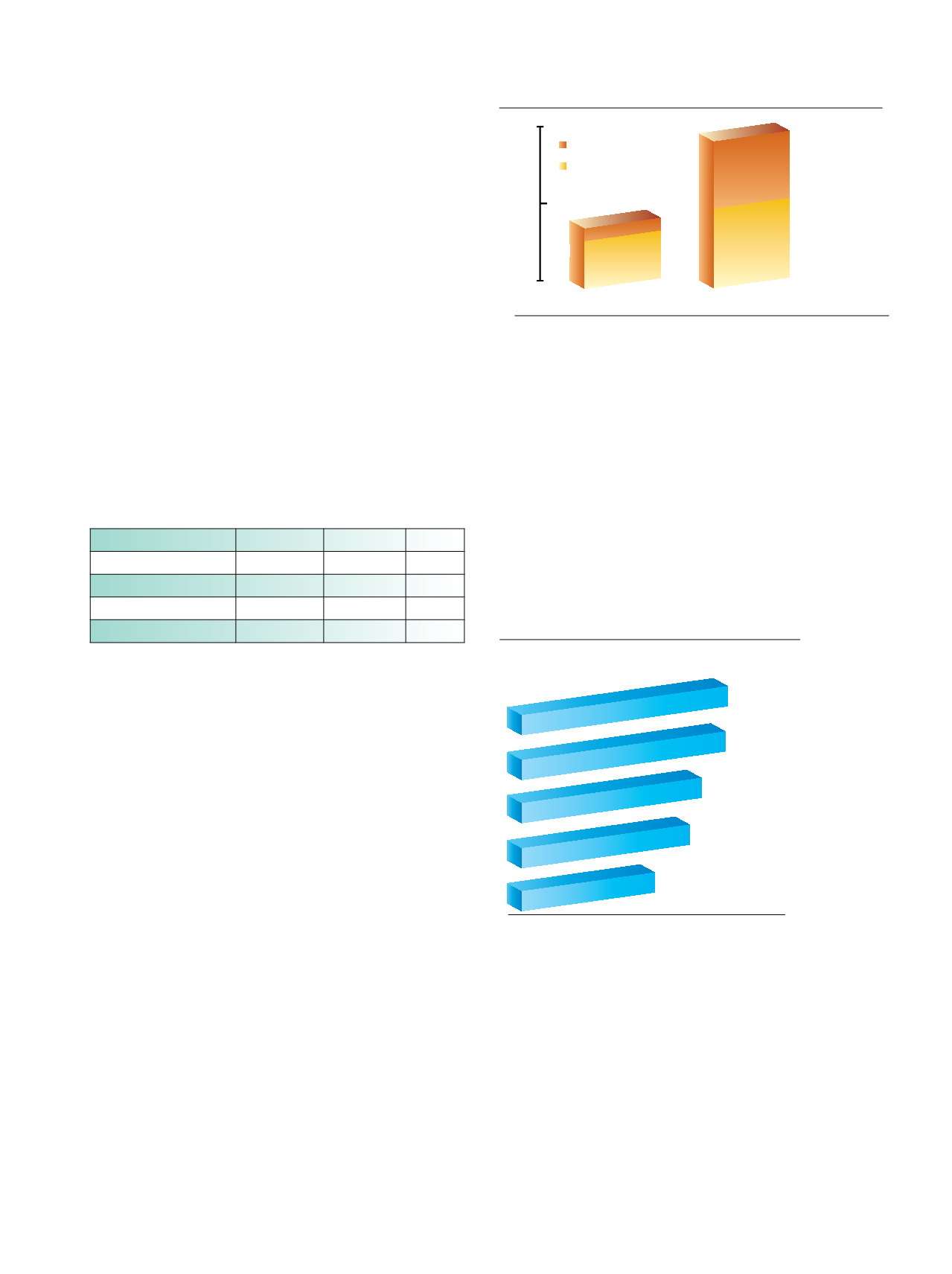

Which of the following do you per eive as advantages

of cloud-enabled UC?

Hosted UC

Hosted PBX

Global Seats (Millions)

Reduction of major capital costs

More flexible scalability

Avoidance of ongoing operational management burdens

Faster time-to-befefit

Greater reliability or resiliency

54%

53%

47%

44%

35%

Source: UBM Tech, XO

How much difficulty did each of the

following present during your organization’s

UC implementation?

Choosing on-premises or cloud

Choosing UC vendor(s)

Solutions did not work as promised

Cost or time overruns

End-user adoption

Funtional problems during pilot

Technical complexity

19%

17%

45%

23% 13% 2%

18%

40%

26%

14% 2%

20%

36%

29% 11% 4%

14%

32%

37%

14% 3%

16%

29%

44%

9% 2%

13% 23%

44%

16% 4%

45%

27% 7% 2%

Source: IHS, Inc.

Hosted UC seats made up 22% of the unified communication

services market in 2014, growing to 46% in 2019

70%

2014

2019

35%

0%

Source: UBM Tech, XO

Next Wave of UC

Which of the following do you perceive as advantages

of cloud-enabled UC?

Microsoft

Adobe

SAP

Other Top

Ten

0%

5% 10% 15% 20% 25%

Source: Syngergy Research Group

Worldwide Market Share - 2015

ADP, Google, IBM, Intuit, Oracle, Workday

Annual Growth

70%

Adobe

55%

SAP

73%

Other top Ten

29%

Hosted UC

Hosted PBX

Global Seats (Millions)

Reduction of major capital costs

More flexible scalability

Avoidance of ongoing operational management burdens

Faster time-to-befefit

Greater reliability or resiliency

54%

53%

47%

44%

35%

How m ch difficulty did each of the

following present during your organization’s

UC implementation?

Choosing on-premises or cloud

Choosing UC vendor(s)

Solutions did not work as promised

Cost or time overruns

End-user adoption

19%

17%

45%

23% 13% 2%

18%

40%

26%

14% 2%

20%

36%

29% 11% 4%

14%

32%

37%

14% 3%

45%

27% 7% 2%

32

Channel

Vision

|

May - June 2016