What Customers Buy

Beyond the contraction of the fixed market and the im-

portance of mobility, among the more-important changes

market participants clearly recognize are a shift in customer

demand from traditional voice to Internet-based products.

That obviously has affected demand for business phone

systems and new cloud-based alternatives, as well as access

products, data center services and “cloud” apps.

Consider what is happening in Verizon’s fixed network

voice business.

Increases or declines of any quantity at a 10 percent rate

are serious matters. If anything grows at 10 percent annually, it

doubles in 10 years. If something declines at a 10 percent annual

rate, it disappears in 10 years.

It’s something to ponder seriously: Sowmyanarayan

Sampath, Verizon Communications senior vice president of

transformation says Verizon’s copper-based revenue is de-

clining 8 percent to 10 percent a year.

At that rate, the revenue stream disappears in a decade.

That’s simply a directional statement, however. Every fixed

network service (except entertainment video) Verizon delivers

over copper can be delivered over fiber or mobile networks.

So eventually, much of today’s “copper” network revenue

will simply shift. Whether the business shifts to other suppli-

ers or to Verizon’s own fiber network is the real issue.

In other words, “what” business and consumer customers

want to buy has changed.

Mobility and Internet access are the two categories for

which demand has grown the most.

Other categories generally have experienced flat or lower

demand, including traditional forms of data access.

There also has been a shift in market supplier dynamics.

Cable TV suppliers are more important, while traditional

telcos less so. And some services are dominated by non-tradi-

tional suppliers, whether the products are long-haul capacity

products, mobility or cloud computing apps and capabilities.

Profit margin compression also is an issue. International

long distance providers have for decades noted a steady de-

cline in prices per minute. Suppliers of international, national,

regional or metro capacity products have seen the same trend.

But it is the mobile profit contribution that is an im-

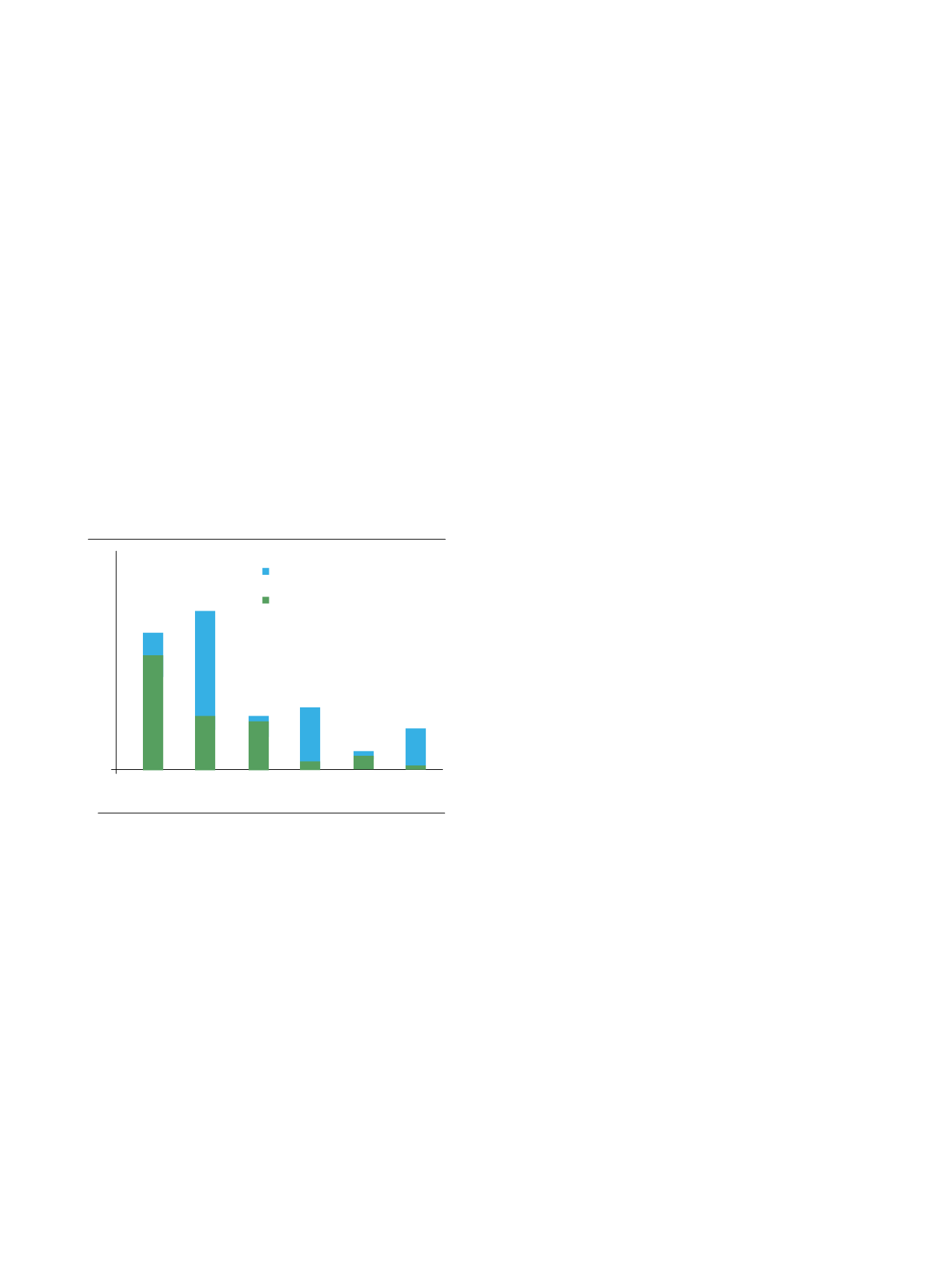

portant part of the story, at least for AT&T and Verizon. In

1999, Verizon earned 82 percent of its total revenue from

fixed line operations. By 2013, Verizon was earning just 33

percent of total revenue from fixed network services.

The profit contribution was quite different by 2013.

Where in 1999 85 percent of Verizon’s earnings were driven

by the fixed network, by 2013, just 21 percent of earnings

were generated by the fixed network.

Back out required capital investment and the picture is

even more stark. Where in 1999 Verizon generated 82 per-

cent of earnings from the fixed network, even subtracting ca-

pex, by 2013 mobile drove 89 percent of earnings, after sub-

tracting required capex to support earning those revenues.

AT&T has greater exposure to fixed network revenue,

but even AT&T earned 54 percent of total revenue from

mobile services; got 60 percent of its 2013 earnings from

mobile services. Mobility represented 67 percent of earnings

after subtracting required capex.

All those trends affect supplier and buyer dynamics in

the business market. Business customers are spending more

on mobile, less on fixed services of all types. Of the fixed

network services they do buy, more is of the Ethernet or IP

type, less is of the TDM type.

Competition, which normally leads to lower prices, also

has led to higher consumption of many products.

New Competitors, Changed

Markets?

Perhaps the most-significant fruit of the Telecom Act

of 1996, which legalized competition in the U.S. local

telephone business, was the emergence of cable TV as a

facilities-based supplier of competition for incumbent local

exchange carriers, or “telcos.”

But the emergence of independent providers such as

Google Fiber and others might soon be seen as the second-

biggest change.

Indeed, while the Telecom Act also underpins the ability

of efforts such as Google Fiber and other independent Inter-

net service providers, it is the cable TV industry (especially

Comcast and Charter Communications, which now has

emerged as the Verizon and AT&T of the cable TV seg-

ment) that represents the main challenge to telco providers.

Cable TV’s entry into the top ranks of the mobile business

will complete the transformation. In fact, one might speculate on

what impact cable ultimately will have on the broader business.

Should the Charter Communications bid to acquire Time

Warner Cable pass regulatory muster, and some of us would

bet it will, more light will be shed on the relative roles of cable

TV and telephone companies in the fixed network high-speed

access market, and also of market power generally.

The perhaps surprising result would be that in the fixed

network Internet access segment, Comcast would be number

one, Charter number two, AT&T third.

Think about that: the two largest legacy telcos would

rank no better than third and fourth in the core service pro-

vided by the fixed network.

15)

Source: Deloitte University Press; company reports

Verizon Performance, 1999-2013, $ Billion

$96

$120

$39

$6

$3

$9

$3

$43

$17

$28

1999 2013

Revenues

1999 2013

EBITDA

1999 2013

EBITDA-CAPEX

150

125

100

75

50

25

0

Wireless

Wireline

$79

$17

$81

$39

$33

$34

$14

$25

Source: Trading Economics

U.S. Telecommunications Revenue

1974

1981

1988

1955

2002

400000000000

300000000000

200000000000

100000000000

0

Cable Business Services and Selected

Competitors’ Revenues

$10,000

Source: AT&T

Big Driver for AT&T?

1 million

CUSTOMERS

AT&T’s net adds in connected cars:

AT&T has deals with the

automakers

Audi

BMW

Ford

General Motors

Jaguar Land Rov

Nissan

Subaru

Tesla

Volvo

PARTNERS

.8

.6

.4

.2

0

Q3

2014 2015

Q4 Q1 Q2 Q3

Source: HIS

Spending is up for unified communications

pure and hybrid PBXs, down for TDM PBX

VoIP gateways in 3Q15

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

Global Revenew Growth

Percentage, 2Q15 to 3Q15

VoIP

Gateways TDM PBXs

Hybrid IP

PBXs

Pure IP

PBXs

UC

Percent Saying “Likely to Respond” to Sale

87% 87%

78% 78%

100%

90%

46

Channel

Vision

|

January - February 2016