Verizon would rank fourth. CenturyLink would rank

fifth, Cablevision Systems sixth and Frontier Communica-

tions seventh.

In the top five spots, cable TV companies would be num-

ber one and two providers, with even the largest U.S. telcos

ranking third, fourth and fifth.

There are a few additional questions which might engage

many observers of the telecom business.

Among the most startling possibilities is that former in-

cumbent telcos might struggle to maintain even the number-

two positions in some markets.

Some might argue it is only a matter of time before cable

TV operators build on their success in the smaller business

segment to move up to enterprise services as well as mobility.

If, someday, providers such as Google Fiber (and possibly

others) start to take more share in consumer and business

markets, while other providers (cloud and mobile services

providers, for example) chip away at revenues in the business

markets, could telcos actually fall into third place, at least in

some markets?

Another issue is the ultimate role of mobile and fixed

services generally. Up to this point, mobile networks have

not been real substitutes for fixed Internet access. But that

could change.

We might not get a clear answer to the amount of viable

business mobile-fixed substitution until fifth and subsequent

generations of mobile networks are widely deployed. The

design standards call for gigabit, up to 10-Gbps downstream

speeds for standard mobile devices.

That should be plenty fast to make

mobile access a functional substitute for

fixed access. The business issues include

tariff levels and usage buckets. The mo-

bile price per gigabyte would have to be

comparable to fixed pricing, and usage

allowances would likewise need to be

somewhat comparable.

Whether telcos will continue to in-

vest aggressively in their fixed networks

is a real issue, if financial returns are bet-

ter in mobile and international arenas.

Verizon already has become a mo-

bile company with fixed assets. And

Verizon earns very little from its fixed asset portfolio.

At some point, opportunity costs will push many firms to

look elsewhere for higher returns. That will have important

ramifications for all other participants in the ecosystem.

Implications

For the immediate future, participants must contend with

business markets that are smaller – in some cases much small-

er – than they once were. Competition also is more intense.

Cable TV and other new providers are assuming larger

roles in the business, obviously representing some new po-

tential opportunities and threats for channel partners. While

much of the broader market opportunity has shifted to mo-

bile, a future issue is the shift to cloud-based applications and

online provisioning.

The issue is that “sales and distribution” of cloud-based

products are highly amenable to online purchases and sup-

port, directly by buyers, without reliance on retail, channel

partner or direct sales channels.

The bottom line is that the business customer segment

has changed quite a lot since 1996, both qualitatively and

quantitatively. It is a smaller, lower margin, more complicated

business with a greater number of suppliers and products, with

Internet channels and retail having grown in importance.

At the same time, more products and networks are “vir-

tual” and more amenable to self-provisioning. The impor-

tance of Wi-Fi hotspot access for mobile users provides one

example. Cloud computing facilities and app stores provide

other examples.

Among the mo

re shockingchanges, for those who have

been in the business for some decades, is the shrinking of

fixed network revenues overall, to half of 2002 levels. Busi-

ness customers are buying different products. But they are

spending half as much, as well.

That explains much about how sellers and buyers now behave.

st year (2015)

1%

1%

1%

1%

0%

0%

0%

1%

1%

Source: Deloitte University Press; company repo ts

$39

$6

$3

$9

$3

$43

$17

$28

1999 2013

Revenues

1999 2013

EBITDA

1999 2013

EBITDA-CAPEX

50

25

0

$79

$39

$33

$34

$14

$25

Source: Trading Economics

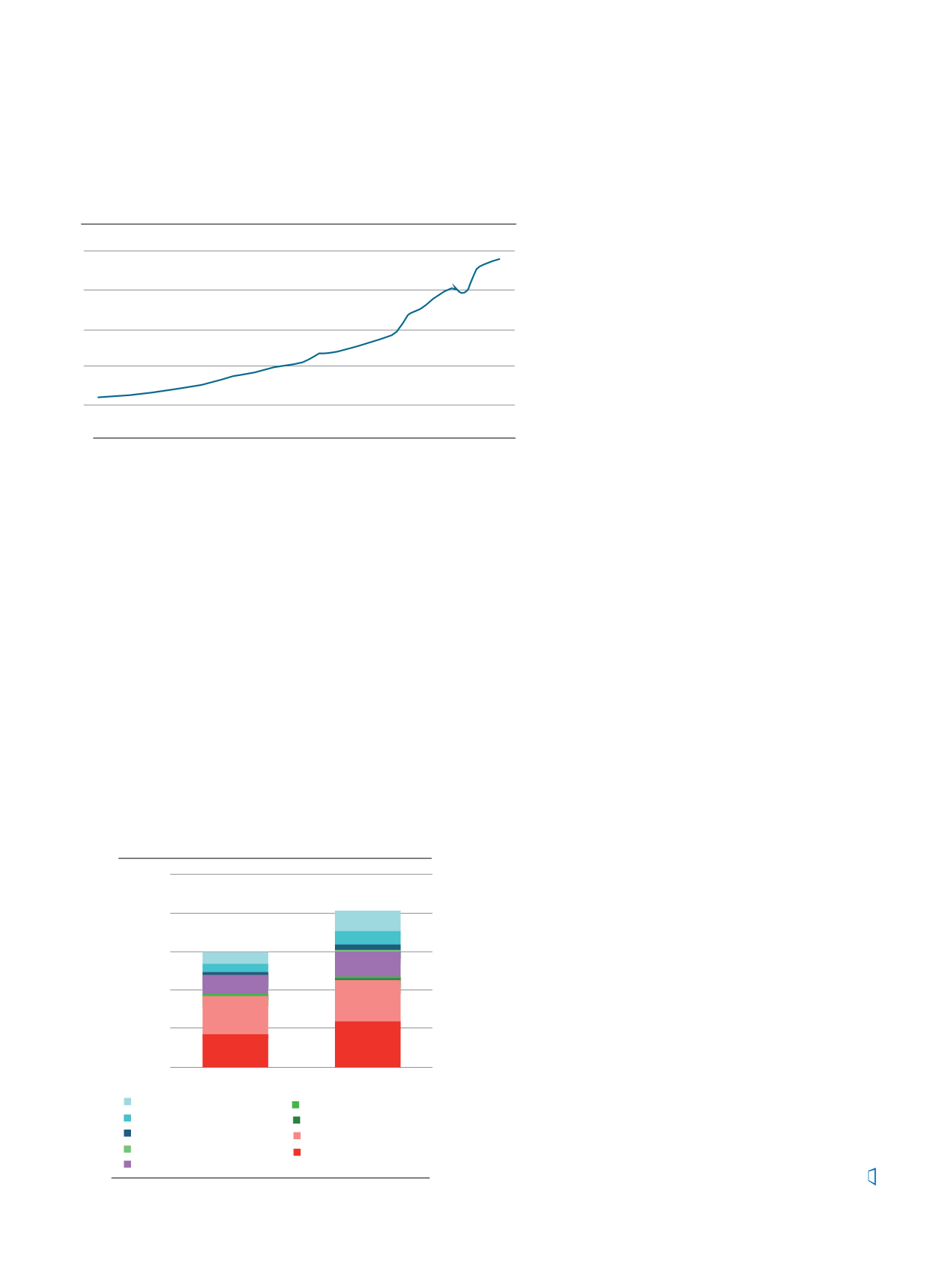

U.S. Telecommunications Revenue

1974

1981

1988

1955

2002

400000000000

300000000000

200000000000

100000000000

0

Source:

Telco2research.comCable Busine s Servic s and Select d

Competitors’ Revenues

Comcast Business

TWC Business

Charter Business

Mediacom Business

L(3) Enterprise proforma

Cablevision Lighpath

WOW Commercial

VZ SBS

AT&T SBS

$10,000

$8,000

$6,000

$4,000

$2,000

$-

Q1 2012

Q4 2014

Millions

-

Primary Catalysts for Channel Business Transformation

Cloud pushing in new directions

Demand for new services and IT delivery

Desire for recurring revenue model

New financial models are more lucrative

Vendors pushing for change

Margins on product sales declining

Defensive more against obsolescence

41%

36%

35%

32%

27%

23%

23%

Source: AT&T

G

Jag

.6

.4

.2

0

Q3

2014 2015

Q4 Q1 Q2 Q3

Source: HIS

Spending is up for unified commu

pure and hybrid PBXs, down for T

VoIP gateways in 3Q15

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

Global Revenew Growth

Percentage, 2Q15 to 3Q15

VoIP

Gateways TDM PBXs

Hybrid IP

PBXs

Pure

PBX

Percent Saying “Likely to Respon

Source:

InsideSales.com87% 87%

78% 78%

61%

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Tex

Message

M bile

Phone

Office

Phone

Voicemail

Source: The SIP School

If you could ask one question of your SIP

Comparing R

BRFSS, by a

When will you

support HD Audio?

What are you doing to

support FAX over IP?

Can you provide TLS/SRTP for

ecure signaling and media?

When will you support SIP

‘profiles’ to match each PBX/SBC

manufactures’s configuration?

Other

7.3

0 20 4

Source: Deloitte University Press; company reports

Verizon Performanc , 1999-2013, $ Bill on

$96

$120

$39

$6

$3

$9

$3

$43

$17

$28

1999 20 3

Revenues

1999 20 3

EBITDA

99 2013

EBITDA-CAPEX

150

125

100

75

50

25

0

Wireless

Wireline

$79

$17

$81

$39

$33

$34

$14

$25

ding Economics

ommunications Revenue

74

1981

1988

1955

2002

400000000000

300000000000

200000000000

100000000000

0

Source:

Telco2research.comCable Business Services and Selected

Competitors’ Revenues

Comcast Business

TWC Business

Charter Business

Mediacom Business

L(3) Enterprise proforma

Cablevision Lighpath

WOW Commercial

VZ SBS

AT&T SBS

$10,000

$8,000

$6,000

$4,000

$2,000

$-

Q1 2012

Q4 2014

Millions

Source: AT&T

Big Driv r for AT&T?

1 million

CUSTOMERS

AT&T’s net adds in connected cars:

AT&T has deals with these

automakers

A i

BMW

Ford

General Motors

Jaguar Land Rover

Nissan

Subaru

Tesla

Volvo

PARTNERS

.8

.6

.4

.2

0

Q3

2014 2015

Q4 Q1 Q2 Q3

Source: HIS

Spending is up for unified communications and

pure and hybrid PBXs, down for TDM PBX and

VoIP gat ways in 3Q15

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

Global Revenew Growth

Percentage, 2Q15 to 3Q15

VoIP

Gateways TDM PBXs

Hybrid IP

PBXs

Pure IP

PBXs

UC

Percent Saying “Likely to Respond” to Sales Call

Source:

InsideSales.com87% 87%

78% 78%

61%

43% 39% 35%

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Text

Message

Mobile

Phone

Office

Phone

Voicemail Linkedin Instant

Messaging

Facebook T

If you could ask one question of your SIP trunk provider what wo

When will you

support HD Audio?

What are you doing to

support FAX over IP?

Can you provide TLS/SRTP for

11.55%

23.1

48

Channel

Vision

|

January - February 2016