according to the European Telecommunications Network

Operators’ Association.

For retail service providers, cable TV entry into con-

sumer voice, Internet access, small and mid-sized business

services has meant more pricing pressure, revenue growth

limitations and lower profit margins.

At the wholesale and capacity levels, cable TV compa-

nies generally have been capacity buyers, but have steered as

much of their buying toward non-traditional suppliers, not

telco-affiliated business units.

In the small and mid-sized business market, cable TV

companies have provided huge competition for many other

independent SMB specialists. Gradually, cable TV providers

have assumed roles in both consumer voice and SMB voice

and data that displace other providers.

Now cable TV operators have begun a long-planned ex-

pansion into enterprise customer services, as well as the core

mobility services market.

In the channel segment, cable TV operators also have

emerged as key product suppliers for agencies and distributors.

Since cable TV operators use an entirely-different net-

work platform (hybrid fiber coax) instead of the traditional

telco all-copper, fiber-to-node or fiber-to-premises plat-

forms, the cable TV industry also supports a distinct sup-

plier base, where it comes to access infrastructure.

For the first time in the history of the telecom busi-

ness, we have the emergence of a segment of the business

that does not rely on the traditional fixed network plat-

form, enters the market from a different position (video

entertainment first, telecom the new business), often with

different cost structures and business culture, and often

sees itself in a distinct way.

U.S. Cable Impact:

Consumer Market

Cable’s emergence as a significant force in the U.S.

telecom market has affected most of the rest of the busi-

ness, with the exception of mobility and enterprise services,

though that also will change.

Most affected have been retail telcos, which have seen

cable TV become the dominant supplier of consumer high-

speed access, the second-biggest provider of consumer voice

connections, and perhaps the second-biggest supplier of

voice and data services to small and mid-sized businesses.

In 2013, looking at overall high-speed access services, for

example, cable already had the majority of market share, as

estimated by Market Realist. And that is true not only in the

U.S. market, but elsewhere.

U.K. cable operators are providing a disproportionate

share of the fastest connections, according to Ofcom, the

U.K. communications regulator. Average telco ADSL speeds

were 6.7 Mbps in November 2013 compared to 5.9 Mbps in

May 2013, according to Ofcom.

In the U.K. market, the average download speed of resi-

dential cable broadband connections in the same time frame

was 40.2 Mbps in November 2013 compared to 34.9 Mbps

in May 2013.

That is true elsewhere in Europe as well. Investments in

high-speed broadband networks helped Europe’s cable operators

such as Liberty Global and Altice accelerate revenue growth in

2014 to 4.6 percent, industry group Cable Europe says.

A separate analysis conducted for the U.S. Federal

Communications Commission as part of its work on the

national broadband plan found cable operators supplied

the top 5 percent of the fastest Internet connections

since 2007.

In the consumer fixed network voice business, cable had

37 percent of the consumer fixed network voice business,

compared to 58 percent for telcos. All other providers had

just 5 percent share.

For those who remember the excitement and market

share gained by competitive local exchange carriers in the

Cable’s Impact

Source: Accenture

21%

are not too concerned

about: security breaches

such as hacker attacks

37%

decided to be more

cautious when using

loT devices and services

Source: Accenture

Consumers who intend to buy these

device in the next year (2016)

% point movement over last

Smartphone

TV

Laptop computer

Tablet

Smartwatch

Wearable fitness monitor

Wearable health device

Home connected surveillance camera

In Vehicle automation system

In vehicle entertainment system

Smarthome thermostat

Home 3D printer

Personal drone

48%

30%

30%

29%

13%

13%

11%

11%

10%

10%

9%

8%

7%

-6%

-8%

-6%

-9%

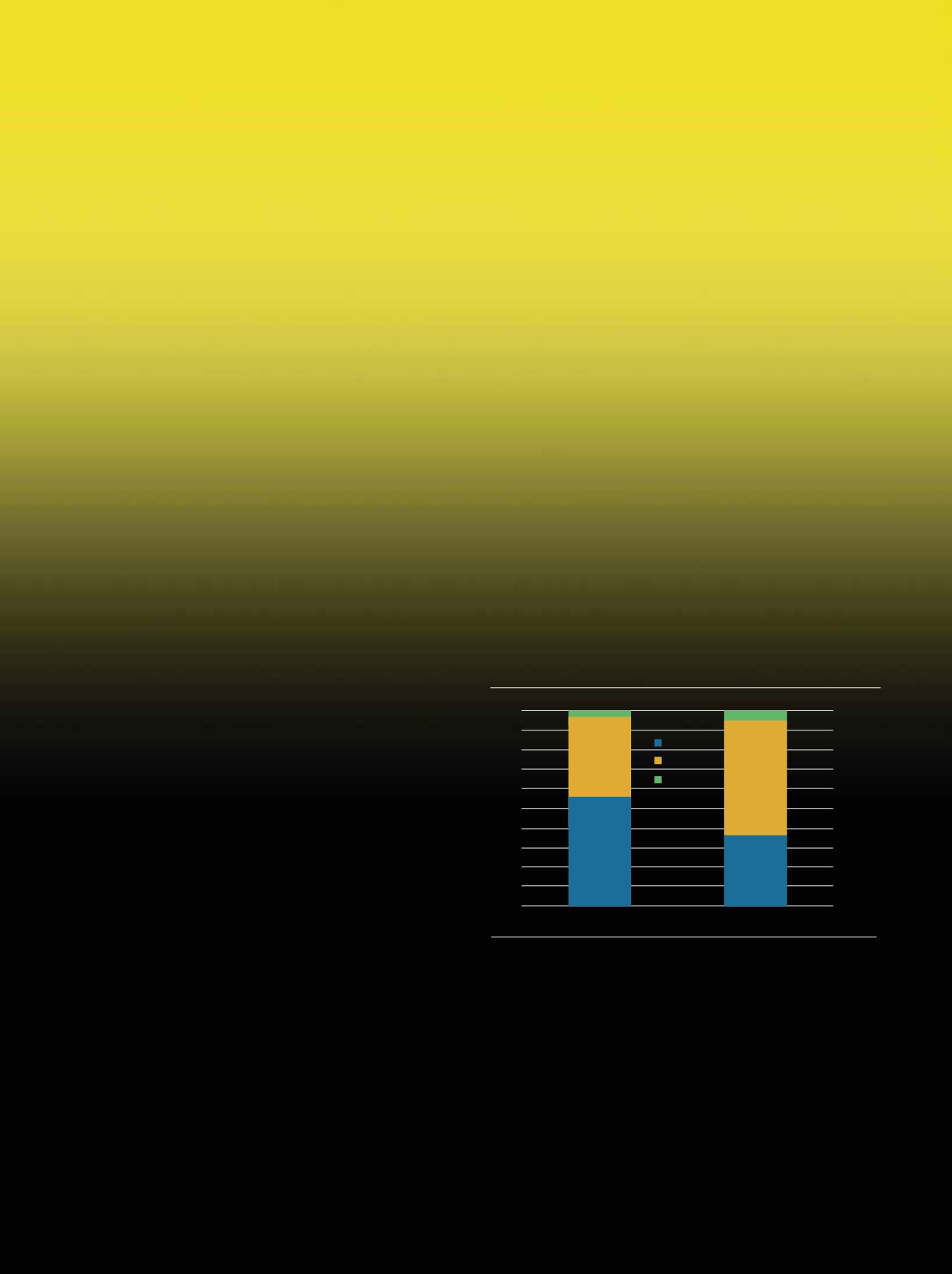

Source: Center for Disease Control; U.S. Census; Market Realists

Market Share in Fixed Segment, 2013

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Cable

Wireline

Others

Fixed broadband

Residential fixed voice

41%

56%

58%

37%

SoH

(micro) Business

1-4 Emplyed; $0.2

Trillion in Revenue

SMB Business

5-499 Employed;

$1.9 Trillion in Revenue

Large Enterprises

January - February 2016 |

Channel

Vision

37