wake of the passage of the Telecommunications Act of

1996, the present market share statistics are sobering.

In 2006, for example, about 82 percent of CLEC

voice lines were based on use of ILEC wholesale. In other

words, firms other than cable TV companies were the

leaders of the CLEC voice market. Cable TV, in 2006,

had about 18 percent fixed network voice share, according

to the FCC.

By the end of 2009, cable TV had gained a majority

of all CLEC lines. In other words, cable TV supplied

more than half of all CLEC industry voice lines, includ-

ing those CLEC lines sold by incumbent telcos operat-

ing out of territory.

On one hand, as the Florida Public Service Commis-

sion notes, all telcos lost voice lines between 2007 and 2012,

while CLEC lines grew. What is noteworthy is “who” gained

those CLEC lines.

By 2011, according

to JSI Capital Advisors,

some 17 percent of voice

lines were supplied by

cable TV companies, just

1 percent by all other

CLECs.

That speaks to the

reality of the fixed net-

work competitive voice

business. Cable TV

leads all others, includ-

ing incumbent telcos

operating out of terri-

tory as well as indepen-

dent firms.

In other words, the

U.S. CLEC business has not worked out as many

had expected.

Initially, the stand-alone long distance carriers thought

the way had been cleared for a re-emergence in the local ac-

cess business from which they had been barred in 1984, with

the divestiture by AT&T of its local facilities, leading to the

creation of the Baby Bells.

For a time, that seemed to be happening. At one time,

the two contestants with a majority of market share were

AT&T and MCI Communications.

A 2004 report by Frost and Sullivan noted that a “ma-

jority of ILECs’ retail access line loss is attributable to two

consumer-focused CLECs, AT&T and MCI.”

At that point, nearly all the CLEC lines used wholesale

lines sourced from the big legacy phone companies. But a

subsequent change in wholesale pricing rules then destroyed

that business strategy, leaving cable TV operators, using

their own facilities, as the market leaders.

The point is that cable TV operators have become the

primary market share beneficiaries of the deregulation of

local telephone services in the U.S. market, and likely will

develop in that same way in European and other fixed

network markets they might enter.

Impact in Business Markets

In addition to emerging as leaders in consumer voice

and data, cable operators have become key competitors in

fixed network business markets as well. In the SMB seg-

ment, cable TV revenues and market share have grown

steadily. In 2015, cable TV business revenues grew 20 per-

cent, according to Zacks.

Cable companies now have gained a significant presence

foothold in the small business market.

In 2010, Insight Research predicted U.S. cable TV op-

erators would have 6.4 percent share of the business market,

including SMB, enterprise and wholesale revenues.

Heavy Reading estimated that U.S. cable operators had

about 5 percent market share of the U.S. business services

market in 2012. Moody’s analysts had in 2012 predicted

cable could grab as much as 13 percent market share of busi-

ness services revenue.

In 2015, U.S. cable TV operators will have earned about

$12 billion in business services revenue, according to Zacks.

If the U.S. business services market represents $138

billion, as estimated by CMR Market Research, then

U.S. cable TV operators already have gotten 9 percent of

the market, while addressing only the SMB and whole-

sale segments.

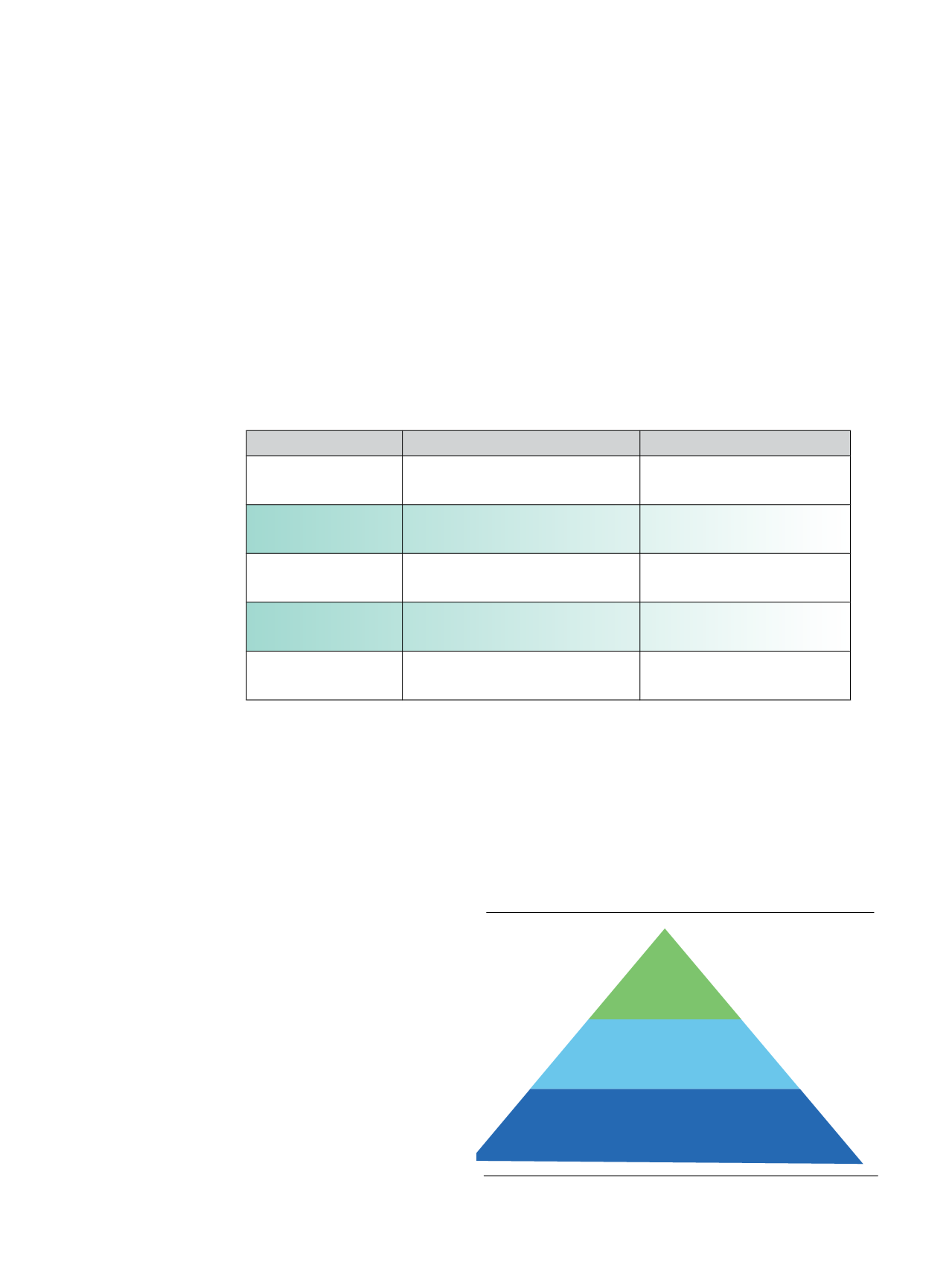

MSO Commercial Market Opportunity

MSO

Number of Firms in Region

Market Opportunity

Comcast

5.2M – very small (<20 emp)

5.6M – total

$11.5B – very small

$49.8B – total

Time Warner Cable

2.3M - 2.7M – very small

2.5M - 3.0M – all SMBs

3.0M – total

$6.3B – very small

$17B - $21B – all SMBs

$21B - $25B – total

Cox Communications

820,000 – very small

1.3M – total

$6.2B – wireline

$4B – wireless

Charter Communications

1M – total

$5.5B – total

Cablevision Systems

685,000 – very small & small (<100 emp)

50,000 - 60,000 – midsized & larger firms

$3.0B – very small & small firms

$3.0B - $3.5B – mid-sized & larger firms

Source: Heavy Reading, 2012

Source: Accenture

Source: Accent re

Consumers who intend to buy these

device in the next year (2016)

% point movement over last year (201

Smartphone

TV

Laptop computer

Tablet

Smartwatch

Wearable fitness monitor

Wearable health device

Home conn cted surveillance camera

In Vehicle automation system

In vehicle entertainment system

Smarthom thermostat

Home 3D printer

Personal drone

48%

30%

30%

29%

13%

13%

11%

11%

10%

10%

9%

8%

7%

-6%

-8%

-6%

-9%

1%

1%

1%

1%

0%

0%

0%

1%

1%

Source: Center for Disease Control; U.S. Cen us; Market Realists

Market hare in Fixed Segment, 2013

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

Cable

Wireline

Others

Fixed broadband

Residential fixed voice

41%

56%

58%

37%

Source: Excelacom

SoHo

(micro) Business

1-4 Emplyed; $0.2

Trillion in Revenue

SMB Business

5-499 Employed;

$1.9 Trillion in Revenue

Large Enterprises

2,500+ Employed;

Over $3 Trillion in Revenue

Global Wireline and Wireless Revenues,

38

Channel

Vision

|

January - February 2016