CMR estimates the business voice market at $31

billion annually and business data at $86 billion a year.

Mobility services purchased by businesses represent $21

billion a year, but cable companies have not yet entered

that segment.

A TNR study of 6,500 businesses in 2015 found cable

TV small business market share as high as 17 percent.

Also, fixed network voice and data product spending at-

tributable to cable providers rose more than 38 percent,

climbing from 12.2 percent to 16.9 percent during a

two-year period. TNS attributed the gains to a heavier

small business reliance on Internet access and the need

for greater bandwidth; two areas where larger cable pro-

viders excel, TNS said.

If one assumes the U.S. small office and

home office segment represents $200 mil-

lion in addressable revenue, while the SMB

segment represents $1.9 trillion in annual

addressable revenue, while the enterprise seg-

ment is a $3 billion opportunity, it is clear why

cable operators always have expected to move

up the value chain from the consumer and

SMB segments to the enterprise segment.

Up to this point, cable-provided backhaul

for mobile operator tower sites has been a

prime example of successful pursuit of enter-

prise opportunities. But we can expect more-

extensive federation deals between cable TV

operators that will allow a better pursuit of

enterprise multi-location data services op-

portunities, in particular. Comcast’s ability, in

2016, to supply a symmetric 2-Gbps service

to about 85 percent of its total U.S. locations will underpin

part of the effort. Wholesale agreements with other out-of-

region cable operators will provide the other element.

U.S. cable operators now are readying a bigger as-

sault in the enterprise services segment, something many

skeptics believed would be difficult. But cable operators

likely are going to begin taking more market share in the

enterprise segment.

Mobility is Next

It also is virtually certain that cable operators are going

to enter the mobility business. It is the last remaining big

telco revenue driver where cable has no presence. And cable

executives clearly believe mobile will allow them to build

successful quadruple-play offers.

Broadly speaking, cable TV operators believe in the value

of the “quadruple play,” where fixed network voice, video

entertainment and Internet access are bundled with mobility

services. Just as broadly speaking, telcos are more skeptical

about the value of the quad play. Liberty Global, for example,

is absolutely convinced the quad play is a winner. Verizon says

its has not seen evidence of the demand in its U.S. markets.

Source: Excelacom

Source: Insight Research

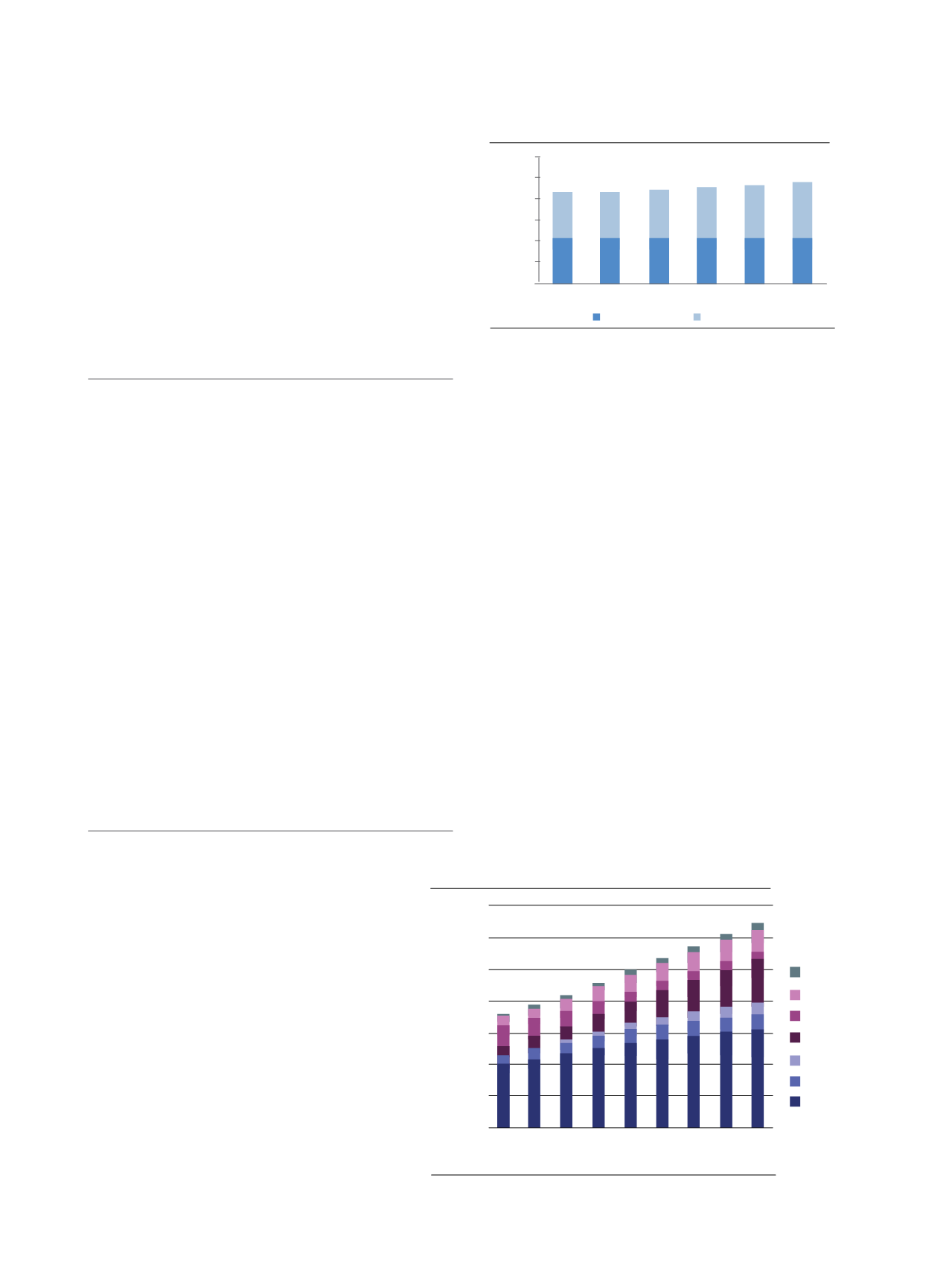

Global Wireline and Wireless Revenues,

2014-2019 ($Billions)

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0

2014 2015 2016 2017 2018 2019

Wireline

Wireless

$Billions

Source: Analysys Mason

Emerging Asia Fixed and Mobile Revenue

350

300

250

200

150

100

2008

2009

2010

2011

2012

2013

2014

2015

2016

50

0

Retail revenue (USD billion)

Business network s

Fixed braodband

Fixed voice

Handset data

Mobile broadband

Mobile messaging

Mobile voice

Source: Deloitte University Press; company reports

2002 and 2013 U.S. Telecommunications and Content Distribution

Revenues, $ Billions

2002 2013

Consumer

2002 2013

Consumer net

2002 2013

Business

2002 2013

Business net

350

300

250

200

150

100

50

0

Cable and other

DBS

Wireless

Wireless

222

316

185

226

163

139 130

107

Source: Center for Disease Control; U.S. Census; Market Realists

30%

20%

10%

0%

Fixed broadband

Residential fixed voice

37%

Source: Excelacom

SoHo

(micro) Business

- Emplyed; $0.

Trillion in Revenue

SMB Business

5-499 Employed;

$1.9 Trillion in Revenue

Large Enterp i es

2,500+ Employed;

Over $3 Trillion in Revenue

Source: Insight Research

Global Wireline and Wireless Revenues,

2014-2019 ($Billions)

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0

2014 2015 2016 2017 2018 2019

Wireline

Wireless

$Billions

Source: Analysys Mason

Emerging Asia Fixed and Mobile Revenue

350

300

250

200

150

100

2008

2009

2010

2011

2012

2013

2014

2015

2016

50

0

Retail revenue (USD billion)

Business network services

Fixed braodband

Fixed voice

Handset data

Mobile broadband

Mobile messaging

Mobile voice

2002 and 2013 U.S. Telecommunications and Content Distribution

-

The point is that cable TV

operators have become

the primary market

share beneficiaries of

the deregulation of local

telephone services in the

U.S. market, and likely

will develop in that same

way in European and other

fixed network markets

they might enter.

40

Channel

Vision

|

January - February 2016