2025 was a year of continued transformation, within both the channel and the c-suites that channel partners advise. Technology advisers and MSPs across the IT and communications landscape are being charged with selling and supporting what could be considered increasingly technical and layered solutions. And those solutions are more connected to customers’ overall survival and success than ever before, despite the fact that IT budget growth remains fairly consistent.

This rewind through some of the data sets representing key trends in 2025 reflects the reality of transformation currently facing the channel with an eye toward what we expect for 2026.

‘C’ is for ‘Change’

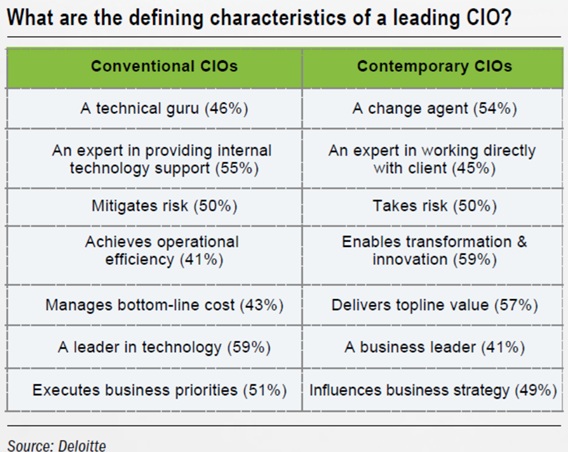

We started the year discussing how the role of the corporate CIO is transforming. And that is not just an outside observation. According to a Deloitte survey of CEOs, the change is being witnessed, and even desired, by top executives in the c-suite.

And when partners and provides engage with c-suites that are undergoing transformation, we found that sometimes the reasons a company doesn’t utilize a technology advisor can be as instructive as the reasons they do.

Security Redux

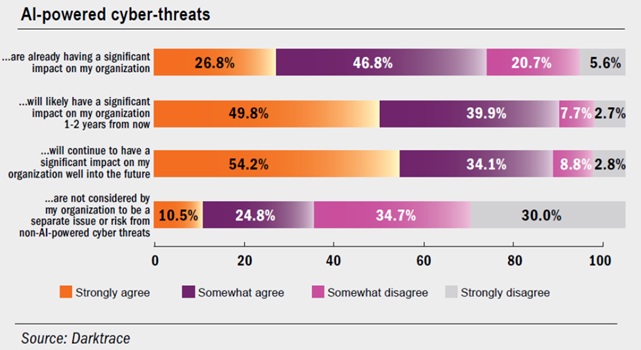

Clearly, across the board AI was the top topic of the year 2025, effectively usurping the importance of just about every other technology category. For 2026, we expect a lot of discussion to turn back to cybersecurity. In part because of the impact AI will have on bad actors’ ability to attack. This reality was already on decision-makers’ radar in early 2025, showed this DarkTrace data set.

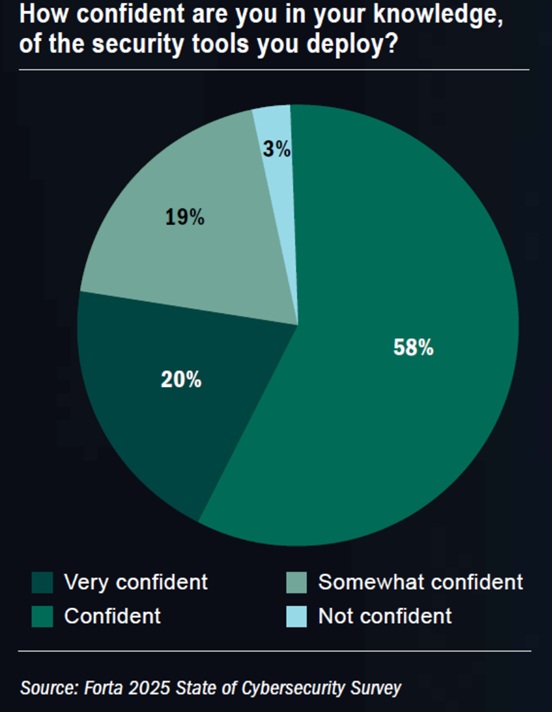

And cybersecurity is an area where business certainly need help from technology advisors, as just one-fifth of companies have high levels of confidence in their knowledge of the security tools they deploy, according to a Forta 2025 survey of IT administrators. Specialist advisors in cybersecurity will be especially welcomed by IT administrators who increasingly are being asked to serve as IT generalists.

AI to Z

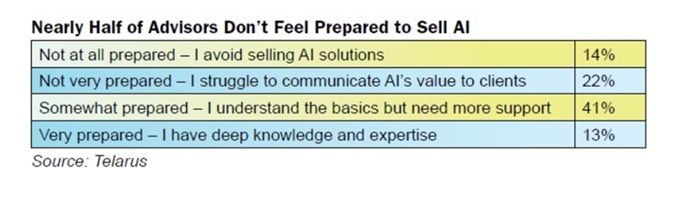

When it comes to AI specifically, perhaps the biggest story within the channel in 2025 was the lack of confidence, even trepidation, that technology advisor experienced when it came to discussing AI with customers. A mere 13 percent of TAs surveyed by Telarus said they feel very prepared to sell AI solutions. Nearly half (48 percent) admitted to either struggling to communicate AI’s value to clients or avoiding the selling AI solutions altogether. Nearly one-third (32 percent) said they are not discussing AI with customers or offering AI solutions at all at the time of the 2025 survey.

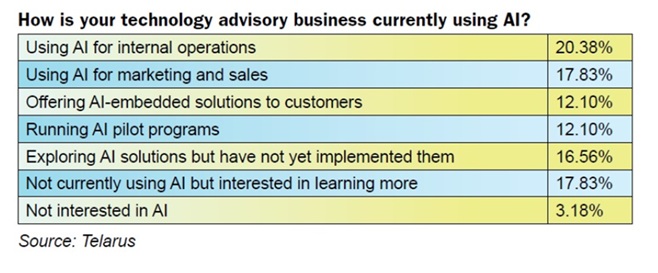

The good news is Telarus data also showed that TAs that use AI tools within their own operations were substantially more confident and successful in selling AI technologies, and good percentages of TAs were using AI tools in 2025, suggesting higher levels of confidence moving forward.

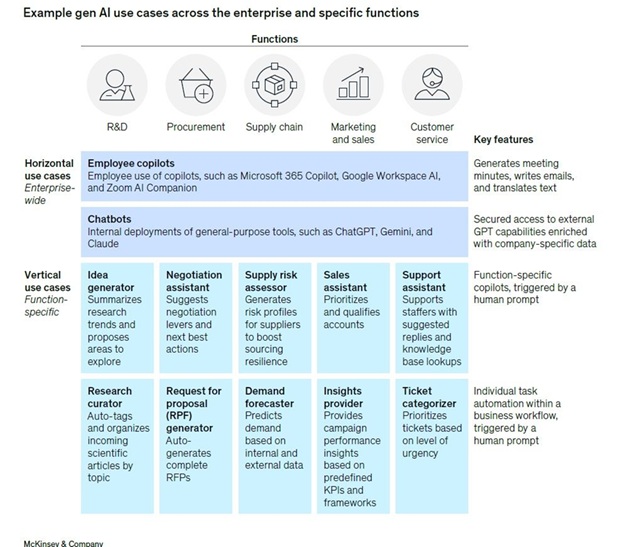

As businesses grow increasingly confident with AI, we can expect to see a shift from horizontal to vertical AI deployments, argue analysts at McKinsey. Horizontal use cases, McKinsey explained, are the easier, enterprise-wide deployments, such as copilots and chatbots, whereas vertical deployments are those embedded into specific business functions and processes. These are more difficult to pull through the pilot stage but tend to offer better returns.

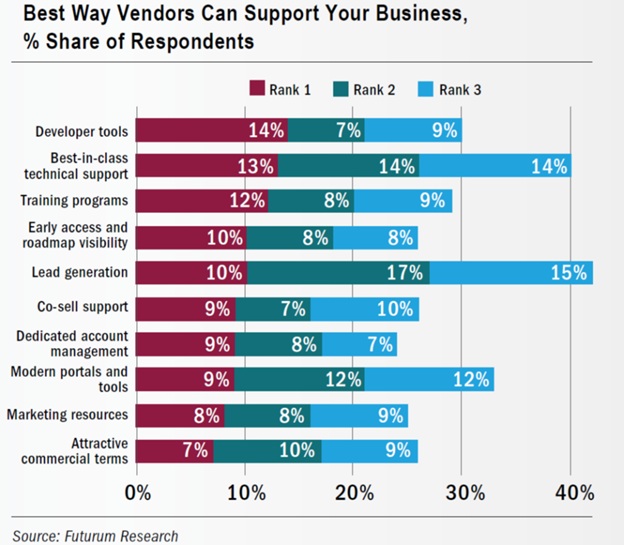

Not surprisingly, throughout the aforementioned transformations, there coincides an increasing demand for technical enablement within partner organizations. While many of the long-standing partner support mechanisms are still very important to channel partners, shifts in the marketplace and new service opportunities have created a shift in how vendors and TSDs must support their partners and sub-agents.

Intelligent Enablement

When Futurum Research asked IT partner professionals to rank the top ways vendors can support their businesses, the expected sales-oriented responses – attractive terms, co-sell support, marketing resources, lead generation and robust portals – certainly remained on the list. But more than anything, partners today are looking for technical enablement, argued analysts at Futurum Research. Mechanisms including developer tools (such as API libraries and documentation), best-in-class technical support and training programs were listed as the top three ways vendors could support their partners’ businesses.

Good Time for Telecom

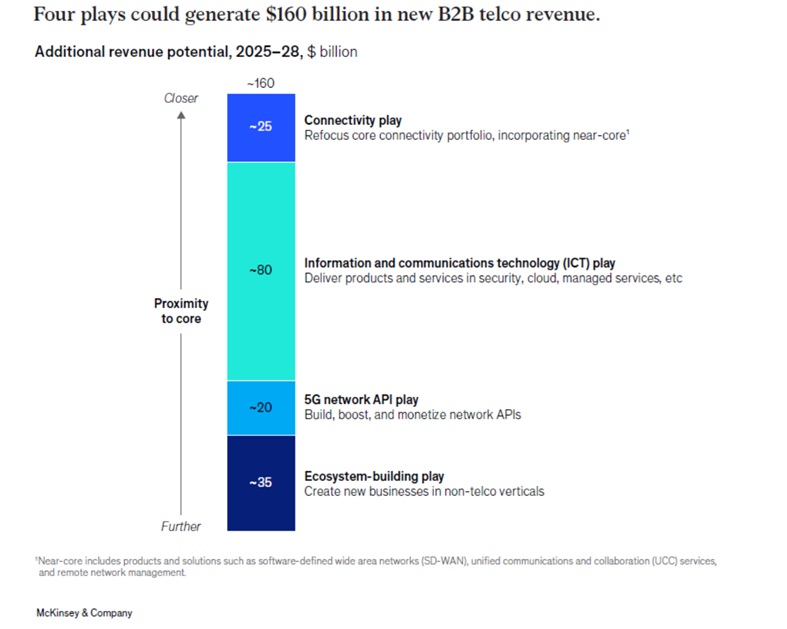

Through it all, McKinsey analysts offer reasons for telecom-based providers to be positive. “After a prolonged period of disruption spurred by new technologies, new competitors, rapidly evolving customer demands and dwindling opportunities in the B2C space, the telecom industry is now in a position to catalyze rapid B2B growth,” said the research firm.

This is partly due to the key role connectivity plays in bringing transformation plans to life. Aggregated global bandwidth demand tripled between 2019 and 2023, said McKinsey, and is expected to continue growing. As organizations venture further into AI adoption, McKinsey surveys show that respondents expect to spend 2.5 to 3.5 percent more this year than last year on legacy connectivity services and 6 percent more year-over-year on “next-gen” connectivity services such as 5G and SD-WAN.

Also at issue is the even larger opportunity around “accessorizing access sales,” or what McKinsey calls the “information and communications technology” (ICT) play, whereby operators leverage their customer relationships by coupling connectivity with value-added products and services in areas such as cloud infrastructure, IT managed services and cybersecurity. According to McKinsey’s recent survey of IT decision makers, more than half of companies planned to increase telecommunications and technology spending this year, and 80 percent of these decision makers see telecom operators as viable partners for products and services beyond core connectivity.

And while ICT already is driving growth for some telcos, the telecom industry overall accounts for just 12 percent of the ICT market.

And while ICT already is driving growth for some telcos, the telecom industry overall accounts for just 12 percent of the ICT market.

“As organizations demand faster connections, lower latency, more comprehensive security and a deeper understanding of the benefits that advanced connectivity can bring, telcos can lead B2B customers into the future while reducing their own reliance on legacy revenue streams,” said McKinsey.