Helping partners speak AI with customers

For the second year in a row in the annual Telarus technology trends report, released at the technology solution distributor’s 2025 partner summit in Anaheim in August, artificial intelligence (AI) once again ranked as the leading driver of IT investment. And this time it’s with increasing momentum, as 58 percent of IT buyers surveyed identified AI as their top priority for 2025, compared to 53 percent in 2024 and a mere 13 percent in 2023. At the same time, a full 71 percent of technology advisors surveyed by Telarus believe AI will be a source of revenue growth in the next 12 to 24 months, up from the 65 percent who said the same in 2024.

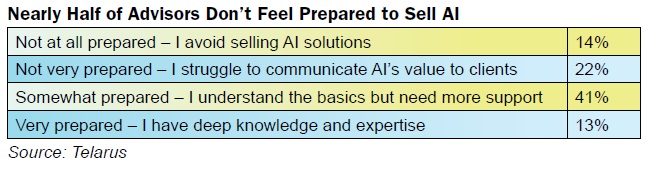

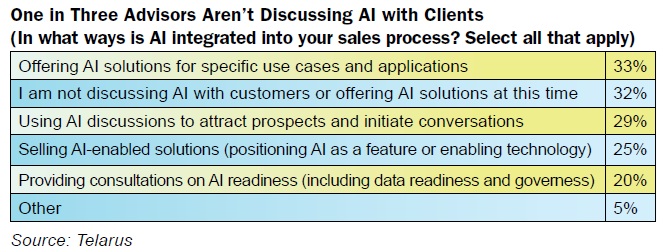

Despite the clear importance for both buyers and sellers, many technology advisors simply are not ready to advise on AI. A mere 13 percent said they feel very prepared to sell AI solutions. Nearly half (48 percent) admitted to either struggling to communicate AI’s value to clients or avoiding the selling AI solutions altogether. Nearly one-third (32 percent) said they are not discussing AI with customers or offering AI solutions at this time at all. Advisors we spoke to at the recent Telarus partner summit spoke to a lack of confidence, even trepidation, when it came to talking to customers about AI solutions and value propositions.

So perhaps it’s no surprise that much of the conversations at the partner summit centered around what advisors can do to gain confidence and competencies when it comes to leading customers on the AI journey and selling AI solutions. And while, as Telarus chief revenue officer Dan Foster said, “there is no playbook for AI deployment,” findings in the technology distributor’s latest tech trends report provide partners with a strategy of attack, as well as a window into what buyers want to hear and the outcomes they want to see.

Indeed, the importance of AI competency can’t be overstated. “Buyers aren’t just looking for access to technology; they’re seeking strategic advisors who can guide them through AI adoption, implementation and impact,” said the Telarus report. For example, 96 percent of mid-market firms are open to support from a new advisor, while three quarters said they were most interested in meeting a new advisor for help with AI.

“Buyers are ready,” said Foster. “The question is, are you ready?”

Not that anyone can blame advisors for being a bit intimidated. Few technology areas in the history of the network services channel, including VoIP and broadband access, have been as disruptive or moved as rapidly as AI and automation. The good news is, advisors don’t need to get a Ph.D. in machine learning to play in the AI space. A common piece of advice is that it’s okay to start small.

That can mean putting parameters around on what an agency needs to be an expert on, focusing on a subset of AI or the AI being used only within one core category of services that a firm already represents.

“We’ve seen advisors win big (with AI deals) just by being the first one there to have that conversation,” said Josh Lupresto, senior vice president of sales engineering at Telarus, “because customer need help and they don’t know where to lean.”

Advisors also can start with systems and parts of a business in which “it’s okay to be a little wrong,” many experts suggest. While that may be limiting within verticals such as healthcare or financial services, there are usually places within most businesses that are not mission critical where AI-enabled solutions can have a positive impact.

“Organizations don’t need massive rollouts to generate meaningful insights,” said analysts at McKinsey, in its report on how to accelerate AI adoption. “Some of the most valuable organizational experiments involve five to ten people over two to four weeks.”

Dog Eat Dog Food

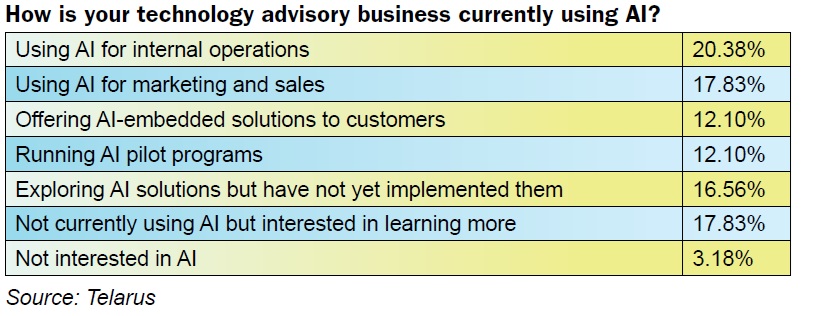

Perhaps even before starting any conversations, many of the presenters at the Telarus partner summit suggested advisors heed the old axiom regarding “eating your own dog food.” In this instance, however, they don’t necessarily mean a provider using the AI solutions that it provides customers. Rather, they suggested agencies and advisors use any AI technologies within their internal operations and process. That could include tools such as marketing automation, quoting tools, basic office productivity and organization, social media moderation and even text generation and summarization. The logic here is that using even simple AI tools will provide advisors with a better understanding of the outcomes that can be delivered, providing them more confidence and credibility when leading conversations with clients.

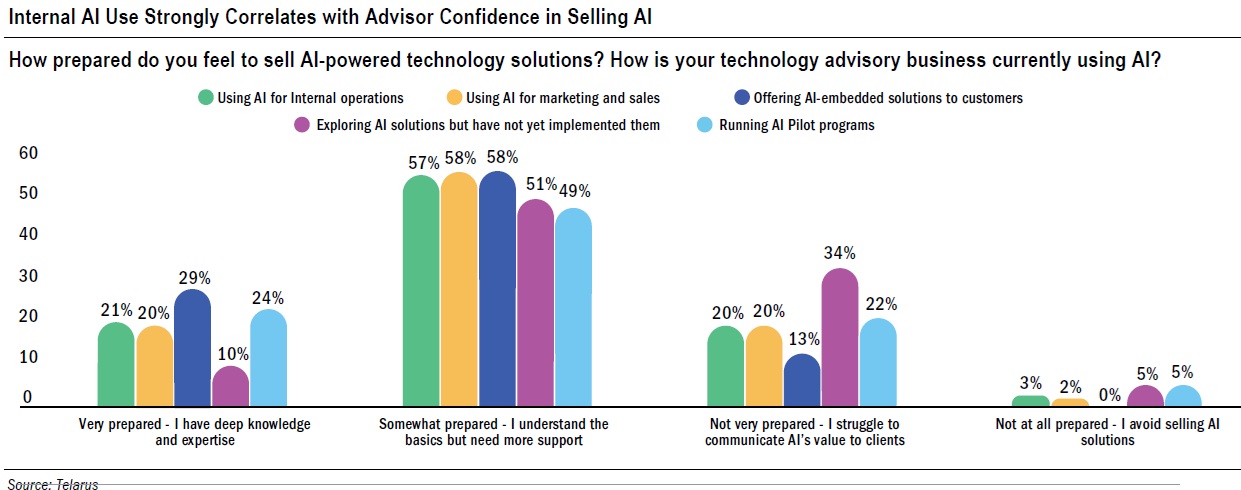

Findings from Telarus seem to support this notion, as advisors who actively use AI within their own operations report significantly greater confidence in selling AI solutions.

“Whether deploying AI for internal workflows or marketing, or running solution pilots, these advisors are more likely to understand real-world challenges and demonstrate what’s possible,” said the research report.

Compared to the 13 percent of all advisors who feel very prepared to discuss AI with customers, 21 percent of those who use AI for internal operations feel the same way. Nearly eight in 10 of the advisors that use AI in internal operations are very or somewhat prepared. Very similar percentages were seen among technology advisors who are using AI for marketing and sales, as well as running AI pilots. Advisors using AI internally are also more optimistic. These partners are more likely to believe AI will drive more business and revenue in the next 12 to 24 months, showed the Telarus survey.

“This suggests that hands-on experience not only builds credibility but also translates into stronger client conversations and more consultative selling,” said the report.

Better Outcomes

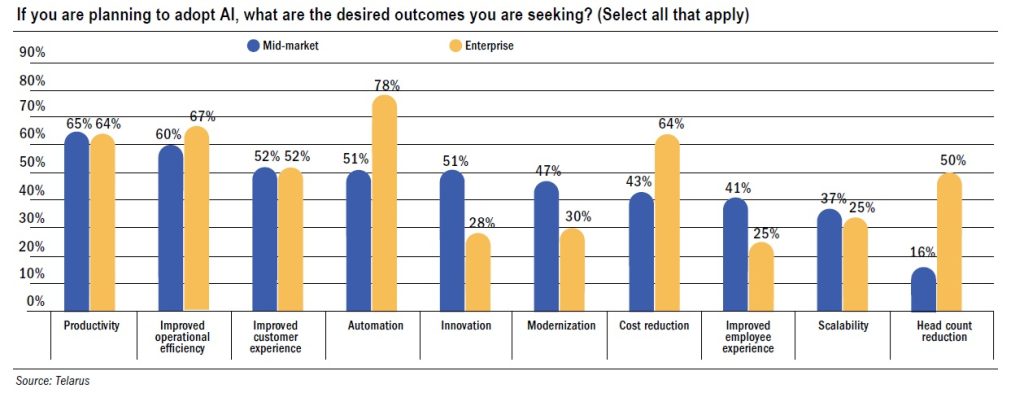

Once AI conversations are initiated, advisors must be careful not to get tied down in technical capabilities and general infrastructure modernization. Similar to other areas of technology being sold nowadays, advisors are recommended to anchor their AI messaging in specific business outcomes. And across both mid-sized firms (50 to 500 employees) and large enterprises (500+), decision-makers for the most part are looking to AI to boost productivity and operational efficiency and improve customer experience.

Telarus findings, however, did point to some clear distinctions between the desired outcomes of mid-market firms and large enterprises. Mid-market organizations, for example, are far more likely to emphasize innovation, modernization and improved employee experience, while large enterprise buyers a particularly focused on cost reduction and the headcount control provided by tools such as automation. Indeed, large enterprises are greater than 4x more likely to have investment decisions influenced by cost-cutting than mid-market organizations, showed the survey. Mid-market, meanwhile, tends to prioritize AI investments that deliver immediate operational improvements and measurable revenue impact.

In general, the mid-market is outpacing large enterprise peers when it comes to AI adoption. These organizations tend to be more agile, more open to experimentation and more likely to embed AI across departments, often coupling AI investments with cloud modernization, cybersecurity upgrades and CX platform overhaul, said Telarus researchers.

“While enterprises are tightening their belts, mid-market is not holding back with investment and experimentation as AI provides them a route to catch up in scale with their enterprise counterparts,” said the report.

Mid-market firms also are 3x more likely to engage external advisors.

“Identification of project motive early in a sales cycle will enable advisors to properly guide selling conversations based on desired outcomes,” advised the report.

McKinsey & Co. analysts Bob Sternfels and Yuval Atsmon, for their part, recommend that participants focus on clear and specific goals and outcomes instead of vague hypothesis. Rather than “improve productivity with AI,” for example, begin with specific, testable predictions such as, “Using AI to automate your monthly reporting process will reduce the time spent by 50 percent while maintaining accuracy above 95 percent,” they continued.

This becomes even more important as businesses shift their attention away from “horizontal uses cases,” such as enterprise-wide copilots and chatbots, and toward more challenging “vertical uses cases,” or those embedded into specific business functions and processes, suggest McKinsey findings.

Data Sets Apart

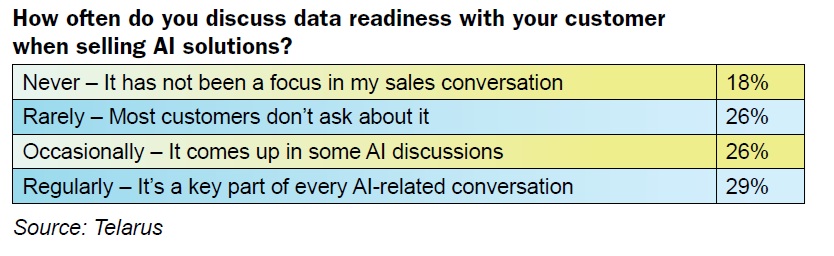

One way for an advisor to stand out is a willingness to dive into the tough but important questions around data readiness. In other words, is data available, high enough quality, properly structured and aligned with AI use cases.

According to a recent report from MIT and Snowflake, more than three quarters of businesses lack a very ready data foundation to support generative AI. In a recent Salesforce study, 52 percent of CIOs cited untrustworthy data (poor accuracy, recency) among their top AI fears. And while one third of buyers ranked data readiness as a top IT buying driver, only a small share of channel partners has stepped into the role of data readiness advisor, showed the Telarus findings. More than four in 10 (44 percent) said they rarely or never discuss data readiness with clients. An additional one quarter of respondents admitted data readiness comes up only occasionally during AI discussions.

Telarus executives recommend advisors walk their customers and prospects through these “building blocks of data readiness.”

- Data hygiene – Is your data clean, current and error-free?

- Data accessibility – Can the right users and systems securely access it?

- Data quality – Is it consistent, accurate and complete?

- Context – Is it labeled and structured so AI models can interpret it?

From here, a conversation can move to some key general topics surrounding existing infrastructure, skills gaps and eventual implementations goals, suggested Koby Phillips, vice president of cloud strategy at Telarus.

For infrastructure and architecture, begin by mapping out the customer’s existing compute, storage and networking capabilities, as well as their cloud and edge deployments, to help assess whether current systems support AI readiness, said Phillips. Are AI workloads running on dedicated AI infrastructure? What types of storage solutions is the company using, and what connections are in place?

The IT skills gap, meanwhile, is expected to impact as many as 90 percent of global organization by 2026, according to IDC, so for customers looking to implement AI, “it’s worth asking if they are comfortable with their current teams, or if they may need advanced guidance and manpower,” advised Phillips. Question here can center around how taxing AI implementations will be on IT teams and whether they will cause delays in other projects.

With the emergence of agentic AI and the constant flow of new productivity tools, most companies will be looking to build upon AI pilots and initial deployments in order to take advantage of emerging capabilities. In turn, technology advisors would be wise to discuss near-term and longer-term AI investment priorities and how data readiness can help customers achieve those goals. Questions here can start with the more immediate concerns around how many streams of data are coming in, where they are landing and how they are connected, and turn to bigger picture discussions around the core business challenges hopefully being solved with AI and how the company sees AI being used a year to two down the road.

Make no mistake, AI is no longer confined to the domains of pilots, innovation labs and exploratory meetings. It’s being rapidly deployed across most departments and is having a major influence within the spending on cybersecurity, cloud and CX, among other areas, the Telarus data showed.

Solution distributors such as Telarus, vendors, publishers and research firms all are rushing to market with whitepapers, e-guides and training tools to help technology advisors build AI fluency. But until those materials can be absorbed and processed, it’s possible that channel partners will be compelled to start AI conversations with their customers and simply trust that their vendor and distributor partners will help close the deal and deliver the goods.

It may not be an ideal scenario, but it’s much better than your customers having AI conversations with a competitor.