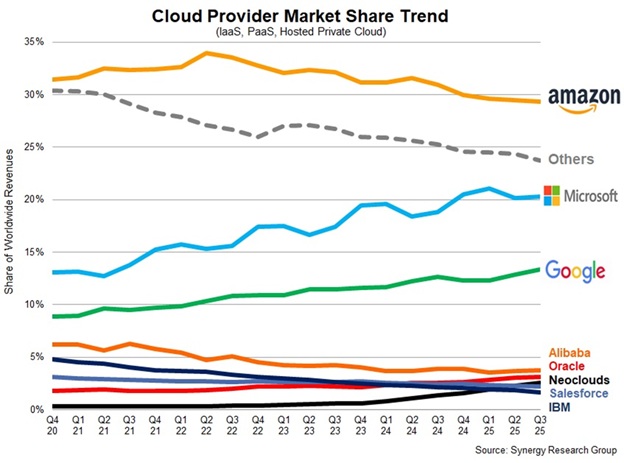

Amazon, Microsoft and Google continue to control an overwhelming share of enterprise spending on cloud infrastructure services. According to the latest data from Synergy Research Group, the big three hyperscalers accounted for 63% of that market in the third quarter of 2025. And while that’s just a tick up from the 62% the trio controlled four quarters ago, and the 61% four quarters before that, the gradual increase comes as the worldwide market value of cloud infrastructure spending exploded from $68 billion to $107 billion during the last two years.

The substantially smaller pack of attackers in Synergy’s “other” category, meanwhile, continue to make up a shrinking portion of the market, but that decline appears to be less about the big three hyperscalers’ gains and more connected to the rise during the past year of neoclouds (along with Oracle’s gains), suggest the findings from Synergy.

Neoclouds, or independent GPU-as-a-service (GPUaaS) providers, came about as a way to address a GPU shortage largely driven by the emergence of generative AI. Evolving from their bare-metal-as-a-service (BMaaS) offerings, neoclouds offer flexible contracts, faster provisioning and specialized infrastructure configurations compared to the hyperscalers, along with GPU prices that are as much as 85 percent less, explained McKinsey & Co. analysts.

“Neoclouds present lower barriers to entry than traditional cloud providers—standing up a compute cluster does not require building a full tech stack, as a hyperscale platform does,” they continued, “so new entrants can move quickly to capture unmet demand.”

Between ten and 15 neoclouds are operating at meaningful scale in the U.S., McKinsey & Co. estimated, with more than 100 operating globally. Among them, CoreWeave is “by far the largest player in this market,” reported Synergy, while other substantial neoclouds that are growing rapidly include Crusoe, Nebius and Lambda.

Moving forward, the future for neoclouds likely lies not in rivaling hyperscalers but in securing positions in enduring niche markets, such as sovereign compute and specialized workloads, while also compounding the early footholds they’ve built with AI start-ups, McKinsey analysts argued. At the same time, their long-term viability “hinges on their ability to move up the stack into AI-native services, which puts them in direct competition with hyperscalers,” said the research firm.