Although MSP interest in mergers and acquisitions had already been declining before 2020, the pandemic marked the most profound shift in M&A sentiment in recent years, according to the latest findings from IT Glue.

In a February survey prior to most of the lockdowns brought on by the pandemic, more than half (52 percent) of MSPs professionals surveyed by IT Glue indicated they were at least somewhat interested in acquiring or merging with another MSP, which was down from 62 percent in IT Glue’s 2018 survey. Fast forward to IT Glue’s May 2020 follow-up survey, and only 37 percent said they were considering M&A activity following the move to remote work under quarantine. Though M&As are likely to slow down as a result of the pandemic, IT Glue said, market consolidation will continue, but the pace of which remains to be seen.

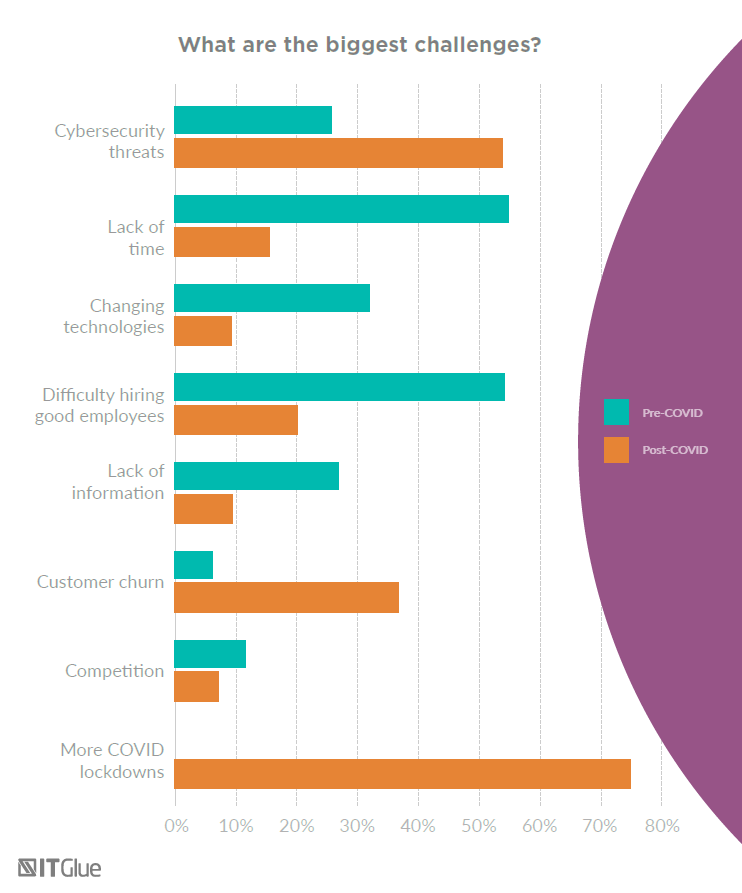

IT Glue noted other significant shifts since the onslaught of shutdowns. In the initial February survey, the top concerns of MSPs were a lack of adequate time to complete work (54 percent) and an inability to find good technical employees (53 percent), followed closely by changing technologies (32 percent) and a lack of information sharing (27 percent). Yet, less than 20 percent of respondents to the May follow-up survey marked these as top concerns following the start of the pandemic, replacing them instead with concerns for cybersecurity threats, customer churn, price pressure and a second lockdown. Concern for cybersecurity saw the greatest change, jumping from 27 percent in the February survey to more than 50 percent in May, likely fueled by an unparalleled increase in cyberattacks during the pandemic. Customer churn concerns also took a notable leap.

The May 2020 data also found that three-quarters of MSPs are concerned about the impact of a potential second quarantine in Fall 2020. Overall, a full half of MSPs saw monthly revenue decreases as a result of the coronavirus shutdown. Additionally, more than a quarter (29 percent) saw their accounts receivable increase.