Driven by competitive demands and largely enabled by the rise of software defined networking, enterprise WAN (wide area network) configurations have undergone a significant shift the last few years. The corporate WAN, suggest separate findings from TeleGeography and Gartner, is officially going “Internet-first.”

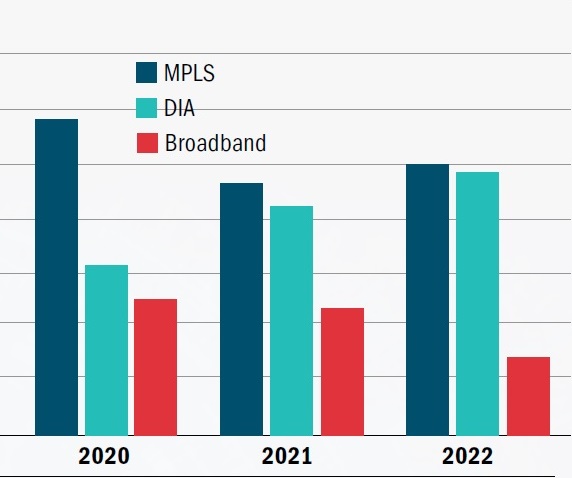

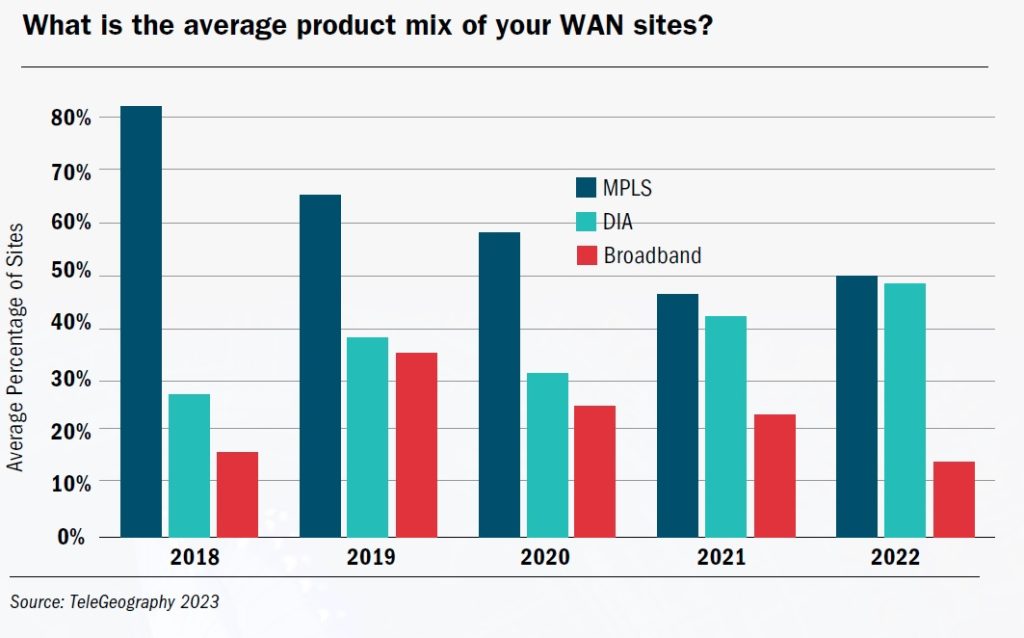

Among global enterprises, for example, the rapid decrease in MPLS usage seems to have slowed a bit in 2022, shows TeleGeography data, but the average percentage of WAN sites using MPLS has dipped from more than 80 percent in 2018 to less than half the past two years. At the same time, dedicated internet access (DIA) has climbed from just more than a quarter of WAN sites in 2018 to around half by 2022. DIA and broadband links combine to deliver connectivity to about 60 percent of global enterprise WAN sites.

Gartner, for its part, expects that by 2026, a full 45 percent of enterprise locations will use internet services exclusively for their WAN connectivity. “Growing interest in services like managed SD-WAN and SASE are transforming the enterprise networking market,” said the research firm.

This shift is particularly notable when considering that configurations of enterprise networks typically don’t change very quickly. Contract lengths can be long, as can the time it takes to go from RFP to installed network, TeleGeography analysts pointed out, “but our time series clearly indicates that WAN configurations are undergoing a shift.”

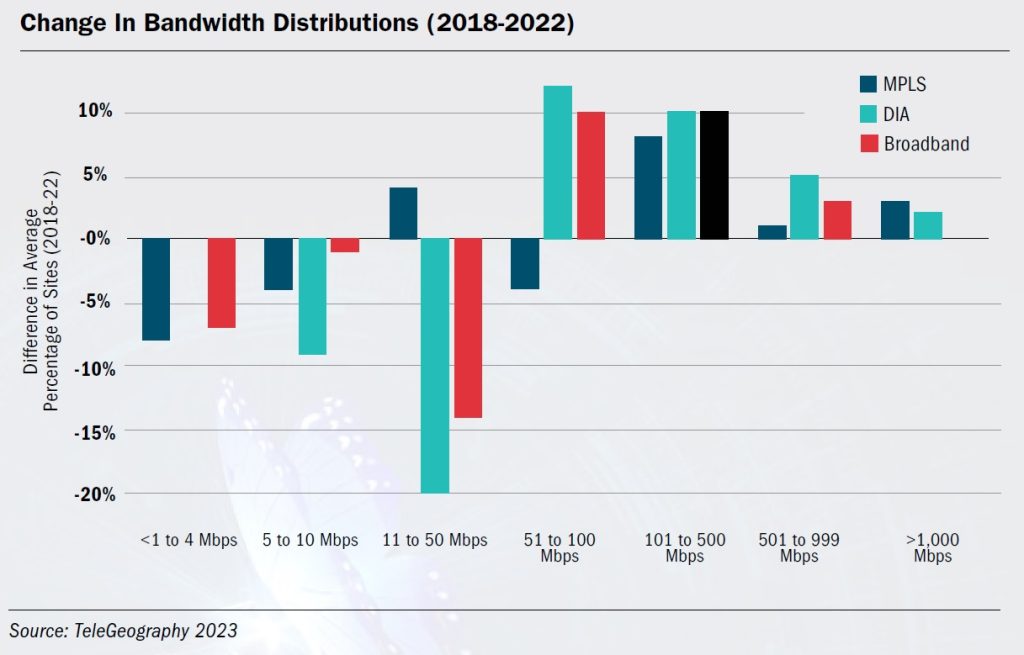

Much the same can be seen when looking at where bandwidth is being deployed.

“With the evolution of SD-WAN, WAN managers have begun to shrink port sizes for MPLS while increasing DIA and business broadband bandwidths,” said TeleGeography analysts. “Altering these port sizes often lowers the total cost of ownership.”

In 2022, for example, MPLS usage peaked at 11 to 50 Mbps with 27 percent of enterprise WAN sites falling in that range, show TeleGeography figures. DIA was a more common product in the top four bandwidth ranges, peaking at 31 percent for the 51 to 100 Mbps range, while business broadband also peaked at 29 percent in the 51 to 100 Mbps range. Meanwhile, DIA saw increases in all port sizes above 50 Mbps, with the largest increase of 12 points in the 51 to 100 Mbps range. Business broadband increased 10 points in the 51 to 100 Mbps range during the past four years, while MPLS saw that percentage drop by about 5 points.

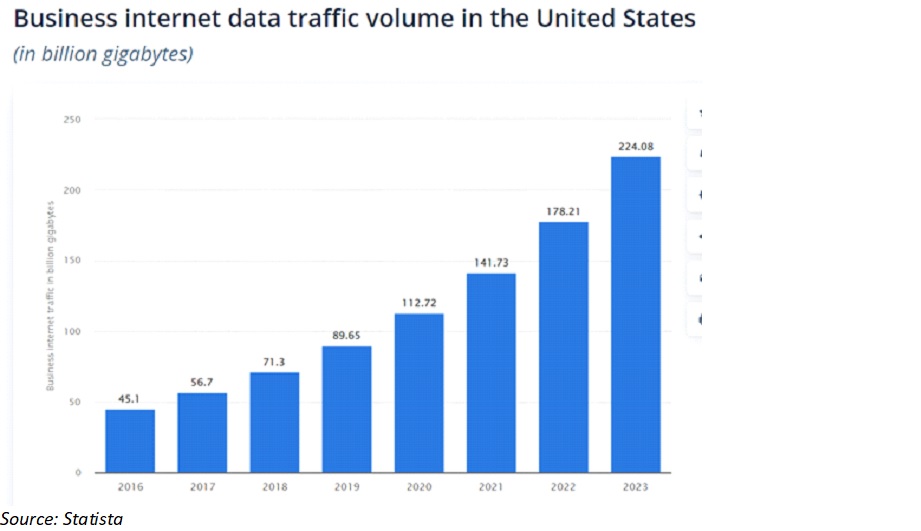

Indeed, it’s enough of a transformation to expect some direct impacts in the way business connectivity is bought and sold. After all, while SD-WAN’s traffic-shaping capabilities allow for the trade-in of more-expensive and stable MPLS links for more-agile and cheaper – but often less-reliable – local loops, those lines still must deliver on the promises of smart, fast, secured, work-from-anywhere networks. In other words, the exploding number of business internet and broadband links still must be deployed, packaged, managed, supported and secured. SD-WAN technology, at least currently, can only do so much to address this growing and complex opportunity.

Among global and the largest enterprises, MPLS lines largely are being replaced by DIAs, most notable Ethernet and wavelength services, show findings from TeleGeography and Gartner. Among mid-sized and smaller enterprises that don’t operate locations across multiple countries or in global regions where fixed broadband access can be less reliable and more regulated, one can assume broadband lines are playing a much larger role in the transitions from private to public access. For small, remote workers and less-critical locations, in particular, that includes cable modem and VDSL connections with little or no SLAs, said Gartner researchers. Gartner noted the recent emergence of access options labeled “business broadband” but warned they only offer incremental SLA improvements compared with consumer offerings.

Surveys from Aryaka likewise found that while 50 percent of responding enterprises consume what they consider managed or premium internet service, a total of 60 percent leverage non-managed business or consumer internet within their WANs. Many providers now even support “bring your own broadband,” said Gartner, referring to a service provider delivering managed services over broadband sourced by the enterprise.

Despite its Wild West nature, the use of unmanaged lines in the last mile comes as little surprise. If the idea is to provide a secondary or “back-up” link that’s readily available, competitively priced, mostly reliable and relatively easy to locally deploy, procuring local site-by-site internet underlay from the lowest-cost service provider – be it cable, LTE or DSL – often will make the most sense. On the other hand, each location still often must handle critical business applications, provides access to cloud services, manage common web browsing and receive internet traffic from visitors, Gartner analysts pointed out, and each of these traffic flows has different security needs. So perhaps it’s also not so surprising that survey respondents cited “slow application performance leading to poor user experiences” for remote workers and at branch offices as the biggest resource-consuming/time-consuming issues facing their IT help desk or support teams, showed Aryaka’s findings.

There’s little doubt SD networking can attack many of the issues that might be created by a bring your own access option, but in the meantime, both providers and enterprises are suddenly faced with an increasing number and assortment of connections they now must fully rely upon. In many cases, it’s one MPLS link being replaced by two internet lines compounded over and over again across multiples of locations. The challenge only grows larger as WANs continue to grow more dispersed and remote work enabled. And one has to wonder how long “good enough” is really good enough when a diverse, dispersed, agile network is mission critical.

No doubt enterprises will be looking for help managing this shift in connectivity, with emphasis moving toward overlay services that pull together and protect WANs whatever the choice in local underlay access. SD-WAN providers, as they incorporate more solutions and integrate capabilities into their platforms, certainly will play a key role here.

“The large percentage of unmanaged internet connectivity paves a path forward for managed offerings delivering more predictable application performance,” said Aryaka executives.

For providers, the growing use of internet services for WAN transport has led to a reevaluation of their internet service offerings, said Gartner, as well as the extent they partner to peer with local ISPs for greater geographic reach and differentiation. The research firm also expects more reliance on broadband aggregators, federations of ISPs that offer controlled routing among their members, and enhanced internet services that control routing in a way that is agnostic to ISPs and specific SD-WAN technology.

“Traditional MPLS network operations centers are known for their focus and troubleshooting ability, providing end-to-end management of both the WAN edge and circuit,” said Gartner, in its most recent Magic Quadrant for network services. “Generally, ISPs aren’t as focused, which means the onus is on the vendor to troubleshoot and manage connectivity issues. Depending on an IT team’s management choice – adopting DIY SD-WAN versus managed SD-WAN – it is essential for them to understand how prospective vendors will provide a service-level agreement to monitor and troubleshoot connectivity.”

Certainly, the forces pushing the transformations of WANs from private to public underlay services remain present and powerful.

“Enterprises remain challenged to design and operate their networks to support dynamic requirements, including changing working practices, accelerated digital and cloud transformations, and rapidly changing business environments,” said Gartner analysts. “As a result, they increasingly see the value of improving the agility of their enterprise networks, both in terms of new technologies and new sourcing approaches.”

Already, SD-WAN is the default offering for new network deployments and major refreshes, said Gartner, which expects 70 percent of enterprises to have implemented SD-WAN by 2026, up from approximately 45 percent in 2021.

“New global network proposals are almost exclusively based on managed SD-WAN services with either a hybrid mix on MPLS and internet or all-internet-based underlay links,” the research firm continued.

It would seem to suggest a boom in “second-line” Internet access for small to mid-sized enteprises, as the assumption with SD-WAN is that one private line can be replaced by two presumably more flexible, more dispersed and ideally less expensive public lines – without risking dips in performance. So, each location that was once served by one private line now requires at least two internet lines (excluding the emerging cases of single-line SD-WAN).

For the customer, any extra effort to adopt and manage two lines is rewarded with a savings in recurring cost. For WAN providers, it can mean providing twice as many internet lines for presumably less money than they made on one MPLS link.

It won’t be easy.