For channel marketers, partner models begin to blur

All the way back to the early days of deregulation and divestiture, providers of communications and access services have enjoyed a pretty clear path for channel marketing. Back in the day, if a telecom provider wanted to ramp up partner sales, it would seek out strong sales agencies or enlist the help of one of the big agent aggregators. More recently, phone system and IT resellers emerged as logical up-sell partners due largely to the opportunity to bundle equipment with connectivity and collaboration services. And during the past several years, channel program emphasis has largely focused on signing up managed services providers (MSPs).

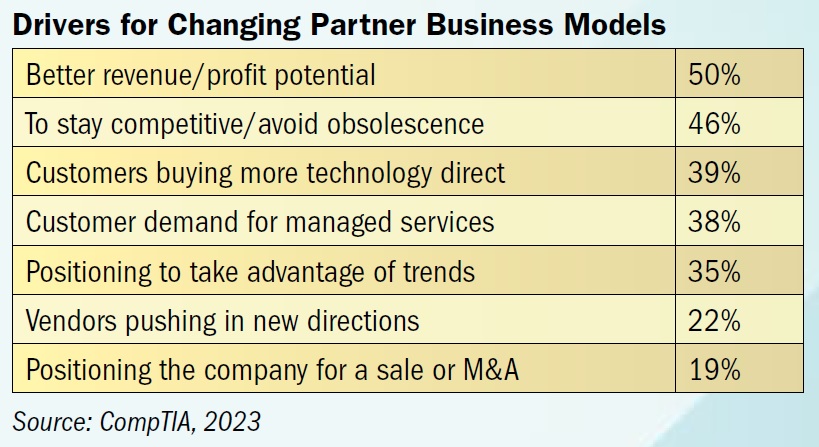

But as we move into the post-pandemic environment, after the acceleration toward digital transformation has altered buyer behavior, acronyms are becoming less and less important to providers.

Partners that can play the role of “trusted solution advisor,” make no mistake, will be the winners moving forward, as enterprise IT executives must navigate increasingly complex technology stacks that play increasingly larger roles in every part of the business, often while faced with a shortage of qualified IT personnel to hire. The required characteristics and capabilities of a trusted advisor, however, are not exclusive to any partner acronym or model. In turn, channel managers of communications and connectivity solutions face a less-defined go-to market strategy then they possibly have ever encountered, leading to the recognition of and marketing toward a more diverse set of partner business models.

Of course, the traditional telecom agents, for their part, are consolidating and retiring, and there has been virtually no injection of youth to sustain the telecom agent/sub-agent model. MSPs, meanwhile, still arguably the darlings of channel program marketers, never truly represented the opportunity that was expected from them, as many folks are finding out.

“Vendors that blindly seek MSPs because of model alignment look past their limited capabilities, lackluster sales records, subpar renewal performance and inability to evolve their models for future market conditions,” warned analyst at Channelnomics in a 2022 report on the MSP channel.

For starters, MSPs tend to prefer mature, stable technologies that can be combined with their scalable and repeatable offerings, argued Channelnomics analysts, and be delivered for a price based on the number of seats or devices. So emergent or “transformational” solutions that don’t fit into that mode of operation will be of little interest to them. Likewise, “MSPs haven’t expressed a great interest in moving up the technology stack to business applications,” said the research firm, limiting the appeal of many cloud-based or SaaS solutions.

Meanwhile, MSPs typically prefer a “sell-to” model, whereby they combine products and services into a bundle that are sold directly to the end users and billed by the MSP. Technology vendors often prefer the “sell-thru” model in which the end users are responsible for the payment.

“In a classic sell-thru model, tech vendors have a pretty clear understanding of how their products are positioned, priced and delivered,” Channelnomics researchers explained. The “sell-to” model “means tech vendors lose control over how their technologies are priced, marketed and paid for,” they continued.

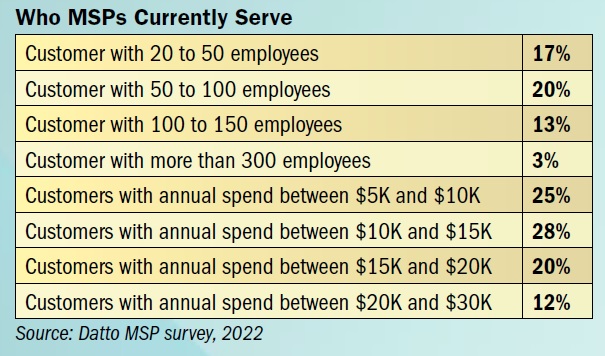

MSP also might not be the best fit for providers looking to land the proverbial “whale.” According to separate reports from CompTIA and IT solution provider Datto, MSP tends to service the smaller end of the SME (small to mid-sized enterprise) market. According to Datto’s survey of more than 1,800 MSP partner organizations, 71 percent of respondents primarily serve businesses with between 20 and 200 employees. That figure was 84 percent in the 2021 survey. Just 3 percent of MSP channel partners serve clients with more than 300 employees, and well more than a third reported to primarily serving business with 100 or less employees.

The majority of MSP clients are spending between $5,000 and $15,000 per year on managed services, showed the Datto data, while nearly seven in 10 MSP partners have revenues of less than $5 million. Perhaps this should come as little surprise, since MSPs tend to provide the greatest value to firms that lack certain internal IT resources, effectively eliminating the largest enterprises as potential prospects.

Perhaps equally important, “MSPs are typically more skilled at systems administration and troubleshooting than customer prospecting and deal closing,” Channelnomics researchers pointed out, and are underinvested in sales excellence, customer success and marketing, while playing “a limited role in the strategic mission of customers.” This despite a time when technology providers are placing increasing emphasis on customer experience, retention and enablement, while business decision making is increasingly made by “buying circles” that include line of business managers along with IT executives.

Who’s Up?

Many channel veterans we spoke to believe IT hardware and software VARs that adopt recurring revenue models are best positioned to take advantage of the current environment. That’s particularly true for the contestants willing to truly embrace telecom and related services rather than treating them as “other services.” VARs also might be a better fit for larger customers that have in-house IT, working as a supplement to internal resources rather than a replacement. They are also well-suited for the logical bundling of connectivity and communications with the growing number of devices being deployed in corporate networks.

Already, larger VARs including Peak, Barcoding and Lowry, among others, are beginning to dedicate budgets and teams to monthly recurring services.

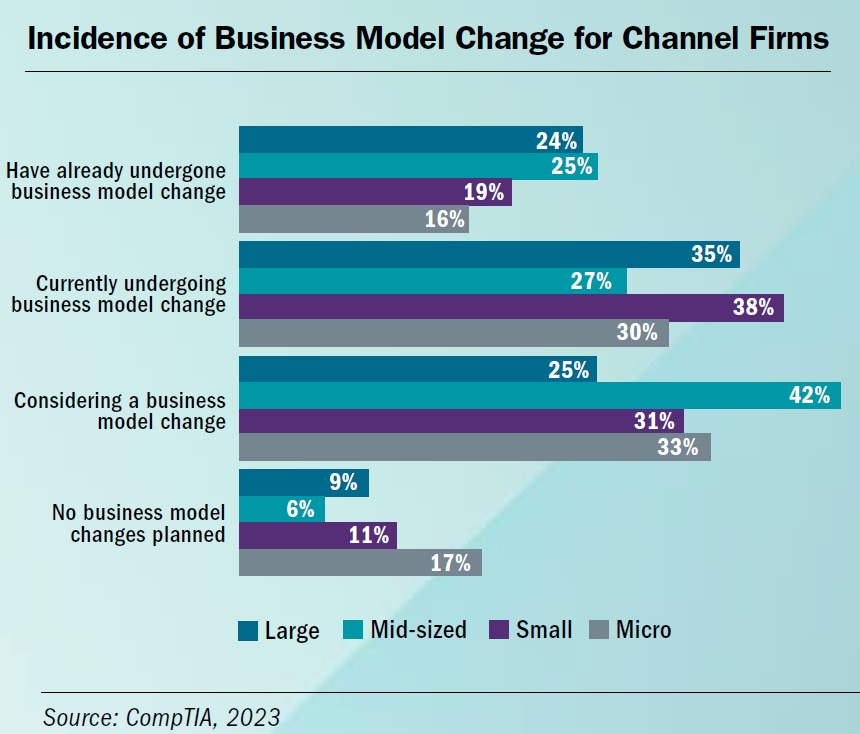

It probably won’t be that easy, however. Instead, channel marketers could face a landscape in which the next primary partner target, or “the next MSP” so to speak, is “none of the above.” Rather, channel programs will need to weave their way through a broad and varied base of potential partners, including many that have adopted practices of several types of partners and don’t neatly fit into any of the traditional categories (agent, MSP, VAR, ISV, cloud broker, integrator, etc.).

A recent slew of partner program updates coming from major tech companies, for instance, included little emphasis on the usual channel acronyms and silos and much emphasis on “flexibility” in working with “multiple types” of partner models and modes.

While certainly still focusing on its large reseller base, VMware partners now can pursue “one business model, depending on their core competency, or they can be many business models, depending on how they execute that customer lifecycle with their end users,” said Kaushik Ram, senior director of partner programs and experience at VMware, upon a program update announcement last year. Partners won’t be typecast into particular roles, he noted.

As part of the first material change to Microsoft’s program in many years, said Rodney Clark, corporate vice president of global channel sales and channel chief at Redmond, Wash., company, the updated Microsoft Cloud Partner Program “spans partners that sell services, develop software offerings or focus on devices.” Microsoft officials emphasized the goal of backing all partners regardless of business model, it was reported.

“This is a program for all partners – no matter what type of business model you have,” added Nick Parker, corporate vice president of global partner solutions at Microsoft. “There is something in there for every partner to differentiate their offerings to their customers.”

CX & Enablement

One thing seems pretty certain, “proximity to the customer” is key, said analysts at IDC. “Quality CX” is the new mantra, and for good reasons. Customers face complex problems and rapidly evolving environments. And prospects usually have done the majority of their discovery research before they are even touched. Getting those customers is tough. Not keeping them eliminates any real value.

In comes the “trusted advisor” that can address their important questions, understand the triggers and business needs of the customer and stick through beyond implementation to help drive the intended outcomes. It’s certainly not an easy role to play, but it’s not one that’s particular to any partner model.

It’s also why we are seeing channel reward programs starting to shift from sales- and transaction-based tiers to points-based system that reward partners for customer experience achievements such as product and customer enablement training, post-sales activity, and willingness to share and integrate customer data.

When announcing the latest retooling to Microsoft’s partner program, Clark pointed to research showing how a group of partners that invested in Microsoft’s advanced specializations, which let channel companies differentiate across a range of technical fields, grew twice as fast as a group not participating in that program. A group that in addition to pursuing specializations also invested in digital sales via cloud marketplaces, emphasis on partner-to-partner engagement and participated in Microsoft’s co-selling programs grew at 140 percent.

Not surprisingly, Microsoft seeks to “get all the partners to participate in that 140 percent growth,” Clark told TechTarget’s MicroScope.

As cheesy as it may sound, finding productive channel partners within the current and coming ecosystem could be less about partner business models and the “what” that is being delivered and more about developing true partnerships. Certainly, serving and retaining customers will require partners and providers that are willing to deeply cooperate, share and integrate throughout the entire customer lifecycle.

On one hand, cloud and digital transformation have greatly expanded the potential base of viable partner-vendor relationships. On the other hand, channel program marketers and partners have a less clear and defined path to finding ideal partners.