Amplix represents a new type of partner roll-up

The report of another private equity-backed roll-up of technology advisory firms barely qualifies any longer as “breaking news.” It also certainly wouldn’t be the last time this year, or perhaps this quarter, we hear such a pronouncement.

In its January report on mergers and acquisitions in the tech space, for instance, Corporate Finance Associates listed more than 60 “major reseller M&A transactions” taking place in the fourth quarter of 2022 alone. Nonetheless, the recent formation of Amplix looks a bit different than the PE/partner provider activity we’ve seen so far. Rather than moving from the top down, Amplix was formed from the bottom up.

Up to this point, much of the PE-based activity in the channel has started with a private equity firm looking to purchase and pull together “complementary” channel partners to leverage their combined customer bases and the economies of scale. The individual partner and advisory firms that are interested in a transaction then vie for that PE firm’s attention.

Amplix, on the other hand, initially took form when three independent, New England-based technology advisory firms met up to collaborate over cocktail napkins at a partner holiday event in 2021. For the leadership teams of ROI Communications, Blue Front Technologies and allConnex, the writing was on the wall in a room quickly filling up with consolidating competitors. New and disruptive models were emerging within the market, while at the same time, the complex and varied IT needs of today’s customer often required a broader bench of technical experts, greater client resources and greater leverage with vendors than any of the three companies could provide on their own.

“We decided to meet up prior to the event to talk shop,” recalled Joe DeStefano, at the time serving as CEO of ROI Communications, now as CEO of Amplix. “Within a couple hours we had a plan to combine and build a platform, an org chart and a plan to go find the right advisors to take us through the process. We hit the ground running after the holidays.”

Amplix CEO Joe DeStefano

When plans were initially planted, private equity money, rather than a driving force, was just one of the options to achieving the ultimate objective of getting the best tools possible to service Amplix customer and employee populations, said DeStefano. “It wasn’t immediately saying, ‘Hey, we’re gonna go out and find private equity money.’”

The team and its advisors eventually turned to Gemspring Capital, a Westport, Conn.-based private equity firm with $3.4 billion of capital under management. The company is privately held, so the terms of the deal were not disclosed, but the owners of allConnex, Blue Front and ROI Communications remained equity participants and have assumed executive leadership roles in the new entity. Along with DeStefano, that includes Dan Passacantilli, formerly the CEO of Blue Front Technologies who will serve as Amplix chief strategy officer; Steven King, formerly a managing partner at allConnex who is now Amplix chief development officer; Jamie Kuzman, formerly a managing partner at allConnex but now Amplix’s chief administrative officer; and Dan Gill, formerly president of ROI Communications, who will hold that same role at Amplix.

According to DeStefano, this leadership’s deep background in building and running successful trusted advisory businesses sets it apart from some of the other large private equity-supported roll-ups that have dominated the headlines.

“Our big advantage is the starting point,” he said. “We’ve got four owners with 20-plus years of experience operating at the top performance level in our market – that experience is unique compared to the executive teams at most of the other roll ups.”

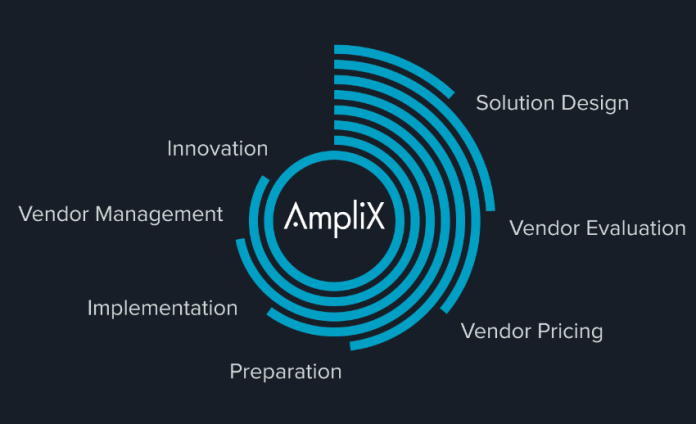

This leadership, he continued, allows the provider to focus on the elements that make the trusted advisory model work. Namely, that entails leveraging technical expertise and deep relationships throughout the technology vendor landscape to deliver optimized outcomes for customers across their entire technology infrastructures.

“In our minds, all of this change in our business is only good if it’s done with the customer in mind,” said DeStefano. “If we have not improved the ability of the advisor model to drive value to the customer and their desired outcomes, we will have failed to truly capture the opportunity. If this is just a big financial exercise, the size of its impact and its sustainability will fall short of what it could have been.”

Similarly, the complementary nature of the ROI, allConnex and Blue Front teams and internal processes was an essential component of the Amplix merger, said DeStefano, rather than a situation in which individual agencies or partner organizations are “gobbled” up for various reasons, whether that be an attractive customer base or an owner simply looking for an exit strategy.

“Each of the companies brings a unique value to the platform even though we are in the same business,” said DeStefano.

The ROI Communications team, for its part, had made a substantial investment in client success resources and a software platform to go along with significant success in core data and voice markets as well as security and managed services. Blue Front Technologies, meanwhile, brings significant business in the public sector, a virtual practitioner practice as well as success in cloud optimization to go along with the core advisor categories. Finally, allConnex brings expertise in the UCaaS realm along with a successful sub-agent model that brings a more diverse sales approach to the combined business.

“Additionally, we are starting with a truly dominant regional position,” DeStefano continued. “We’ve taken three of the four largest in New England and put them together, giving us a significant influence in market, scale of customers and spend influenced, resource advantages, data and knowledge advantages, brand recognition, sales and marketing efficiencies and much more.”

All three of the Amplix companies have operated offices in Massachusetts, and the combined entity will run its headquarters out of Norwood, Mass., with offices in Boston. Ultimately, the company plans to expand its borders, but initially the plan is to double-down on its Northeast practice with a “laser-focus” on customers in-region. Other than Bridgepoint on the West Coast, the other PE-based roll-up models, said DeStefano, are much more dispersed and less dense in regions.

Also unlike some of its contemporaries, Amplix has no plans to disintermediate the large technology solutions distributors – formerly known as master agencies – by establishing direct relationships with their suppliers. “We understand the value of large tech distributors in the ecosystem and the specialized nature of what they do,” explained DeStefano. “We plan to continue to embrace them, building off 20 years of relationships, and work together with them to drive great results.”

It’s safe to assume that as the early consolidators continue to grow and an increasing number of advisory firms and MSPs look to take advantage of the economies of scale, new and interesting roll-up models will emerge. It would seem that one based on the core elements of operating a successful trusted advisory firm is a solid alternative to consider.