By Martin Vilaboy

Whether or not online marketplaces have become more important to any given provider or partner go-to-market strategy, it’s highly likely that the marketplace model, among other digital distribution strategies, has become more important to their customers’ technology acquisition strategies. And moving forward, marketplaces are only going to be more important to both the buying and selling process.

Nearly three-quarters of IT channel firms surveyed by CompTIA, for instance, acknowledged that more customers today are using marketplaces for their initial purchases. “To deny the impact of marketplaces would be folly,” said researchers at CompTIA in its recently released annual IT industry outlook.

“Today, online marketplaces, such as those from Amazon and Google to Microsoft and Salesforce, have become the direct, go-to option for many tech purchases in today’s cloud era,” said the report. “Everything from hardware devices to SaaS applications and beyond is available at the click of button for customers today.”

The good news is, despite notions that online channels can lead to a sense of “displacement from the sale” for channel firms, research suggests a marketplace strategy can be beneficial to both solution vendors and their partners.

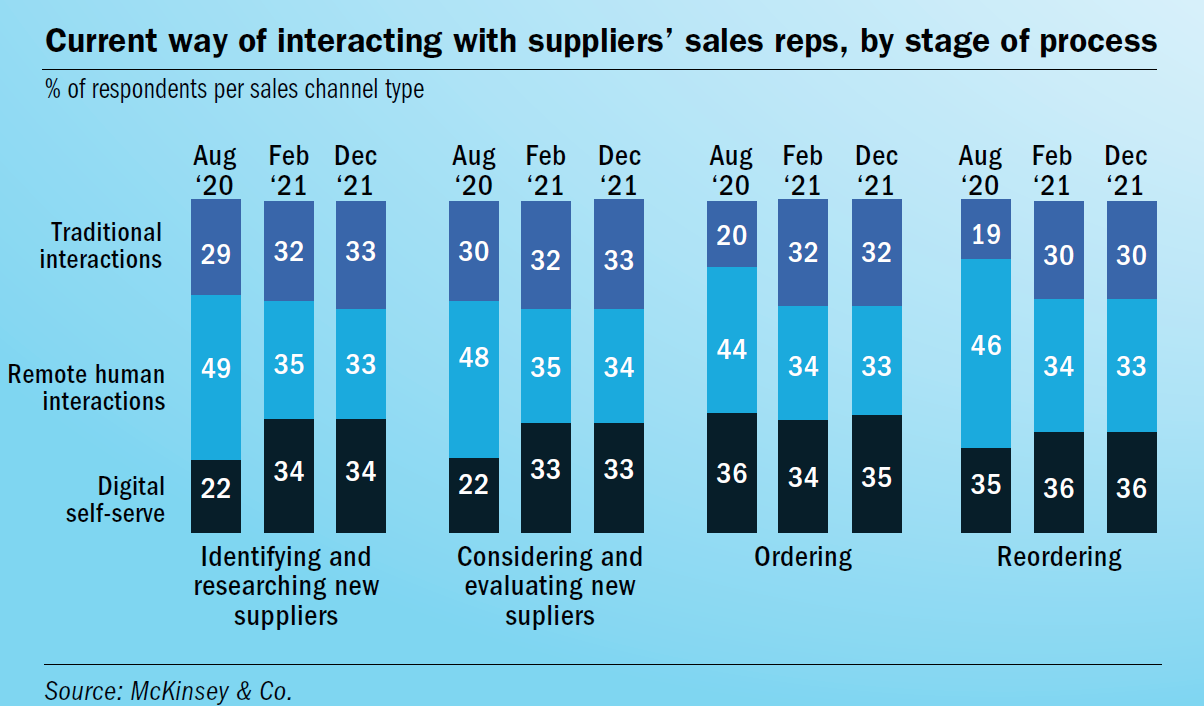

Coming out of the pandemic, which unilaterally accelerated digital transformation plans and the adoption of digital technologies, B2B buyers have settled into an evenly divided mix of sales channel, show surveys from McKinsey & Co.

“[T]he ‘rule of thirds’ has become entrenched,” said McKinsey & Co. analysts.

“Given the choice of traditional human, remote human and digital/self-serve channels, buyers globally have shown they want them all – and in equal measures throughout the purchasing journey,” they continued.

And albeit just slightly, digital and self-serve options now account for the largest share of ordering (35 percent) and re-ordering (36 percent) activity.

Not surprisingly, the higher the value or complexity of the transaction, the more likely buyers prefer traditional human interaction, show McKinsey figures, but 31 percent of respondents still preferred digital/self-serve channels for “high value” deals, and 29 percent preferred digital sourcing during “more complex” purchasing situations. B2B buyers also show a willingness to transact larger order values through digital/self service and remote human interactions. The percentage willing to spend between $500,000 to $5 million through these channels grew from 16 percent in February of last year to 20 percent by December 2021. A solid majority are willing to spend $50,000 or more through digital or remotely served channels.

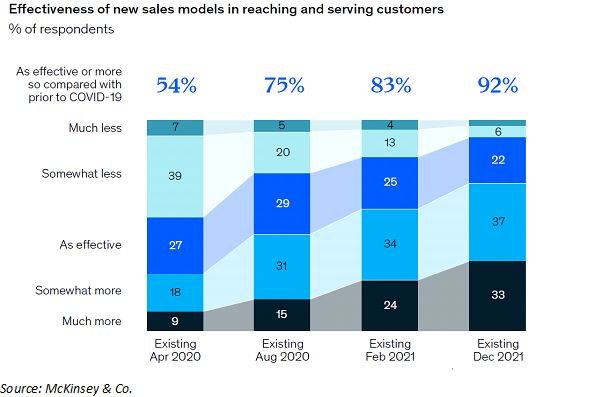

Providers likewise appear to be more comfortable with the post-pandemic omni-channel balance. Companies are nearly unanimous that their current sales model is more effective than their pre-pandemic model, showed McKinsey’s latest figures (see table), and optimism has grown substantially since early 2020. About a third said their new normal version was “much more” effective.

In general, the more channels an omni-channel seller utilized, the more likely they were to be market share gainers, suggest McKinsey surveys, and marketplaces in particular appear to have a positive impact on customer acquisition efforts. Nearly three-quarters (72 percent) of companies that built their own marketplace experienced market-share growth during the past two years. “Among those that did not build a marketplace, only 42 percent of companies saw share growth – a difference of 1.7x,” said McKinsey.

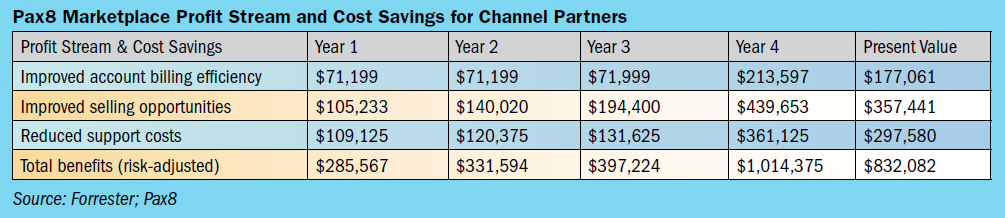

Further down the channel, an analysis by Forrester on behalf of marketplace provider Pax8 found that the marketplace model benefits partner MSPs by simplifying billing and support and improving selling opportunities. Forrester composite organization, built from interviews of nine current partners with experience building, selling and scaling through the Pax8 marketplace and platform, experienced “a total present value of profits and cost savings of $832,082 over three years versus investments and overhead expenses of $238,675, adding up to a net present value (NPV) of $593,407 and an ROI of 249 percent.

For starters, Pax8 marketplace partner were able to move away from outdated, manual billing processes and simplify billing by leveraging a single platform and automation features. Outside of the Pax8 marketplace, the interviewees utilized spreadsheets from distributors and direct vendors for client billing, said Forrester researchers. Using spreadsheets meant that it took account managers two full days each month to bill for most cloud services, and these processes could consume as much as two weeks when billing for cloud platform usage.

“Account managers saved as much as 55 percent of their time, which was previously spent managing billing,” said Forrester analysts.

Manual methods are also susceptible to human error and make it difficult to audit and unify billing practices. “A billing error in any one month could wipe out the margin available for an MSP,” warned Forrester. With the marketplace’s billing integrations, manual processes became digitized, automated and consolidated.

“Account managers could now capture changes in licensing costs or tiers in an automated way, creating efficiencies. It also helped organizations to consolidate account billing for customers across all services managed via Pax8,” said Forrester in its total economic impact analysis.

The platform also allowed some organizations to capture revenues of as much as $1,500 a month that previously went unbilled due to missed account updates caused by disorganized, spreadsheet-based processes. All told, the improved account billing efficiency generated benefits of $177,000 over three years for the composite partner sales organization.

The interviewed Pax8 partners also shared savings related to support costs, both for direct client support and for getting support from Pax8, as compared with previous distributors, show the impact analysis.

“The MSPs noted that user onboardings and cloud product provisioning were significantly more efficient for their technicians when using Pax8, and ticketing was also easier,” continued the report. Indeed, the automation of technicians’ work in ticket creation led to a 15 percent increase in their efficiency.

Along with improving technician productivity related to ticket creation, Pax8 also served as a unified platform to manage client requests across the breadth of cloud services offered on the marketplace. “Previously, MSPs’ prior processes relied on getting support from several different distributors or vendors to solve specific support issues,” said the report.

“Improved ticketing efficiency led to improved resolution times, benefitting MSPs’ relationships with end clients,” it continued. “Furthermore, Pax8 saved vendor support costs for the interviewees’ organizations, as Pax8 would handle issue support free of charge.”

At the same time, it provided support for all products across its platform, reducing the time required previously to generate requests for individual vendors. Pax8 also displaced costs required for vendor-provided support. For its composite organization, Forrester projected reduced support costs of $297,580 over three years.

The partner interviewees also reported increased their sales opportunities. On the one hand, the Pax8 marketplace made it easier for end customers to purchase core cloud services, bringing MSP partners more revenues by enabling the easier sale of add-on services related to integration, security and backup.

What’s more, the marketplace model enabled firms to increase sales at both the low and high ends, show the findings.

“At the low end, interviewees shared that their firms were not targeting the long tail of smaller deals as their relatively high cost of sales made them uneconomical,” said the report. “Self-service for end clients via Pax8’s platform lowered sales costs and enabled MSPs to book more small-deal revenue. At the high end, Pax8’s managed services supported MSPs on larger migrations that would otherwise be beyond their internal capabilities, enabling them to close larger deals as well.”

Lastly, Pax8’s marketplace platform brought in further revenues to MSPs by connecting them to vendor market development fund programs that they were either unaware of or too busy to manage.

B2B decisions makers are regularly using more channel than ever before to interact with suppliers, McKinsey’s annual surveys make clear, up from five channels on average used during the decision journey in 2018 to as much as 10 by December 2021. Online marketplaces, along with remote human interaction, has been a significant factor in this share shift.

To meet the expectations of and provide value to an increasingly omni-channel-inclined customers, sales professionals need to act as “journey orchestrators,” argued McKinsey analysts, “guiding customers to the channels that, according to their buyer intelligence, are most helpful to specific audiences and purchasing stages.”

Suppliers also may need to shift their online product mix and launch new pricing processes to streamline quoting and approvals for large-value purchases, said McKinsey analysts.

As with most shifts to the cloud computing and digital, value propositions once again lean more toward customer experience and support, specialization, service integration and personalization, as well as after-market services, and less upon onsite infrastructure and servicing dollars.

“This could deflate channel firms that now feel displaced from the sale,” admitted CompTIA in its annual IT industry outlook, “but marketplaces don’t necessarily have to do so. A synergy exists for those channel firms that adjust in their business model to be more consultative and specialized, while emphasizing the after-market services that customers will very much need after initial tech purchase.”