SD-WAN Opportunities Shine in 2017

by: Tara Seals

Software-defined wide area network are perhaps the hottest market buzzwords at the moment, and no wonder: SD-WAN offers multi-location companies a way to connect their disparate offices via the cloud, over simple broadband connections.

Applications and network resources can be accessed on-demand, and performance management, security and routing combine to make it an effective way to address WAN needs while harnessing the scalability and cost-effectiveness of the cloud.

According to research firm MarketsandMarkets, the SD-WAN market size is estimated to grow from $738.9 million in 2016 to $9.1 billion by 2021, at an expected compound annual growth rate of 65.11 percent during the forecast period. A rising need for effective management of networks and the need for better security are increasing the demand for SD-WAN. North America held the largest market share in 2016. And, since enterprises are focusing on improving products and solutions, the managed services segment is expected to witness a substantial growth rate during the forecast period.

“The cloud breaks MPLS,” explained Kevin Suitor, chief marketing officer at TeloIP, which offers SD-WAN on a wholesale basis. “You have a massive cloud market out there – by 2020, it will be worth $190 billion – plus there’s a second massive mega-market behind it in the Internet of Things. Billions of devices coming online will require a different type of network than what we’ve had for the last 20 years.”

RELATED: California, TELoIP Partner on SD-WAN

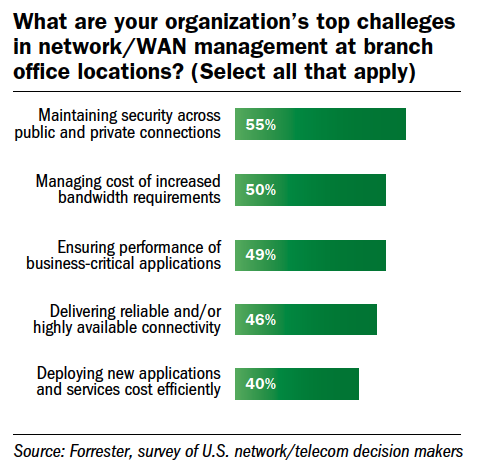

There’s a bit of a perfect storm happening when it comes to enterprise realities. CFOs are cutting IT budgets and staff, while deploying and managing broadband, MPLS and cloud links remains a complex enterprise. Meanwhile, emerging unified communications and collaboration apps need voice and video quality control so that calls don’t drop out and so video doesn’t become pixelated.

“If I wrap all of this up, it’s a massive opportunity for channel partners looking to get into a managed service opportunity or to move away from selling boxes,” Suitor said.

Target verticals include retail, financial and insurance, and hospitality – segments where companies tend to have many small sites, including in fairly rural markets where it’s possible to get broadband inexpensively.

“Take a money mart type company with storefronts across the country,” Suitor said. “If they had MPLS, you pay through the nose. They don’t all have the same data comm environment either. It’s so much easier to build a standing SD-WAN that they can just link into. Channel partners that previously sold hardware can now provide managed services on the back of our network.”

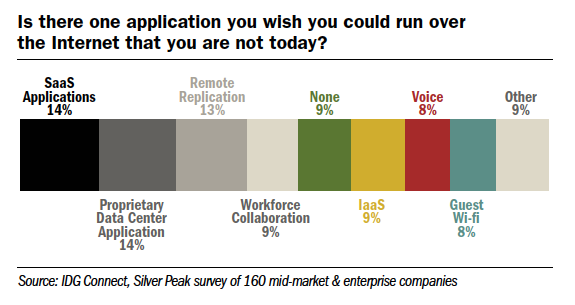

Most of the channel sales fall into two categories – MPLS replacement and the ability to address issues with hosted PBX, VoIP or unified communications installations.

Most of the channel sales fall into two categories – MPLS replacement and the ability to address issues with hosted PBX, VoIP or unified communications installations.

“All the providers have a different version of the MPLS replacement story to tell,” said Brent Baker, network services manager at Powernet. “Cloud-based services are driving the need for bandwidth through the roof, but it’s not practical for most businesses to put in 50Mpbs connections everywhere. SD-WAN allows them to make use of performance-based routing with low-cost broadband to achieve the same connectivity goals at very close to the same quality as MPLS, and it creates a financial incentive that they can’t ignore.” Baker said that moving to SD-WAN can save a customer with 12 locations $12,000 to $20,000 every month.

“It doesn’t matter if people think SD-WAN is a good idea or not; those savings are impossible to ignore,” he said.

RELATED: CV Report: Separating the Layers

The second scenario makes use of forward error correction. “For people that already have broadband but are having problems with hosted PBX, implementing SD-WAN can go a long way to fix quality issues because of the performance routing,” Baker explained. “It makes everything run better.”

Anton Loon, vice president of sales at Powernet, added, “People with hosted VoIP and real-time apps see the value in this. Some of our agents won’t sell hosted anymore unless the customer goes with SD-WAN as well. This gets rid of organizational headaches and saves people’s organizational time.”

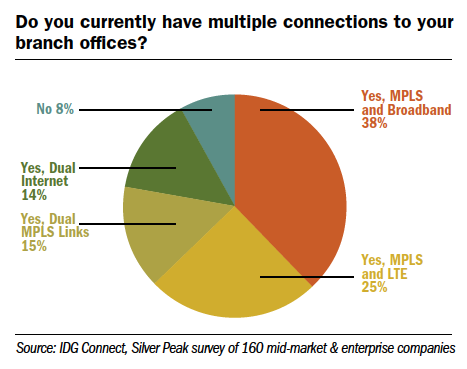

The obvious sweet spot for SD-WAN is multi-location businesses with multiple applications running on the network. But another market approach is for businesses to use SD-WAN for secure best-efforts traffic, in order to free up MPLS for video and voice.

“SD-WAN is seen as an MPLS replacement product, but the concern is that it sends traffic over the best available connection,” said John Cunningham, founder and co-CEO at BCM One. “If there’s latency on all the connections, you end up with a not-great experience. If the broadband connections aren’t up to the task, SD-WAN can’t help with that. So a hybrid approach where some applications are still on MPLS makes sense for a lot of companies.”

Having a hybrid option is also necessary if customers have contracts with varying termination dates, requiring integrated MPLS and SD-WAN support. “You have to be looking to make sure the network has proper routing support and devices that interoperate with both,” said Baker.

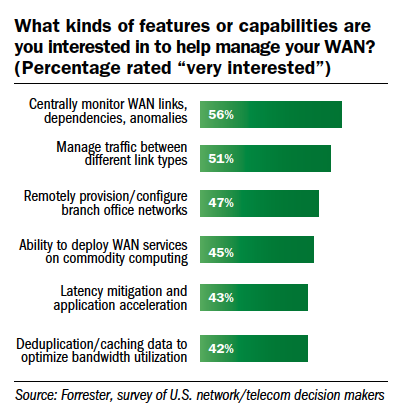

SD-WAN also brings everything under one roof from a management perspective – the SD-WAN itself along with any cloud applications can be managed from one point.

“Moving into the software-defined realm makes provisioning easier and also easier to support and do everything we need to do through the lifecycle,” Loon said. “We can pretty much do everything remotely except plug cables in, and customers like that.”

SD-WAN sales aren’t automatic, however. Loon explained that getting decision makers to make the jump from dedicated circuits to running things over public broadband can be a bit of a challenge.

“It’s not fully understood by your average network manager or IT person, so everyone wants a referral for their exact use case,” he said. “This is very similar to the early days of VoIP – people were worried about quality. But eventually everyone got the idea.”

RELATED: BCM One to Acquire CloudStrategies

There’s also market confusion about what SD-WAN actually offers.

“Anytime you have a disruptive tech, there’s a certain degree of end user and partner education, and with this, everything around orchestration seems to mean different things to different people,” Suitor said. “You can say, here’s how to get the most utilization I can out of the links, and you can optimize the performance on the up and downlink; you can have voice and video guarantees; you can do this at distances because there are offices spread out; it integrates with legacy MPLS; and you can do all of this with much simpler provisioning, supporting multicast over a fundamentally unicast environment like the Internet. Oh, and it’s secure. It all sounds great, but from a marketing perspective, it’s a huge challenge to explain how that works in practice.”

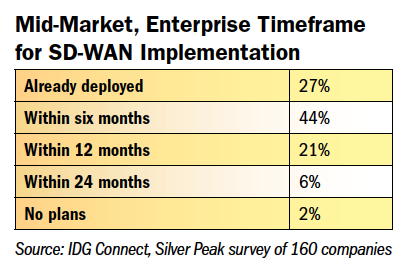

With all of the excitement over SD-WAN, one caveat is to be aware that the market is in its heady early days, and that consolidation will be inevitable.

“Not one company we speak to isn’t interested in it, and it’s a great conversation for channel partners to have in order to be relevant in the WAN spaces,” Cunningham said. “But channel partners should understand that the market is going to change.

“Gartner said there are now about 40+ companies offering SD-WAN. Remember when the automobile came along, there was a time when there were a hundred car companies,” continued Cunningham. “We ended up with just three. That doesn’t mean the other 97 didn’t have good cars.”

Rather, “the market can’t support all of these companies indefinitely, so that’s something that CPs should be aware of,” he said.

That caveat can also be an opportunity. “Any channel partner with a multi-site customer base should get in now,” Baker said. “And you should go after every big chain in your market. There’s a lot of money to make, and there’s no one established as a dominant player in this yet, so treat it as a land grab and get as much as you can.”

VIEW ARTICLE

SUBSCRIBE TO MAGAZINE

About ChannelVision Magazine:

ChannelVision is a bi-monthly digital and print magazine, read by channel partners selling all manner of voice, data, access, managed and business services (both on premise and “in the cloud”), as well as, technology, gear, and equipment. ChannelVision is a highly focused and efficient way for service providers, hardware, and software companies to reach experienced channel partners targeting the small/medium business space. Serving a controlled circulation of providers and indirect distributors of communications, network, IT and cloud-based business services, ChannelVision is telecom’s gateway to perspective on how to adapt, what to sell, and how to sell it.